- Norway

- /

- Oil and Gas

- /

- OB:GEOS

Golden Energy Offshore Services ASA (OB:GEOS) Might Not Be As Mispriced As It Looks After Plunging 36%

Golden Energy Offshore Services ASA (OB:GEOS) shareholders that were waiting for something to happen have been dealt a blow with a 36% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 32% in that time.

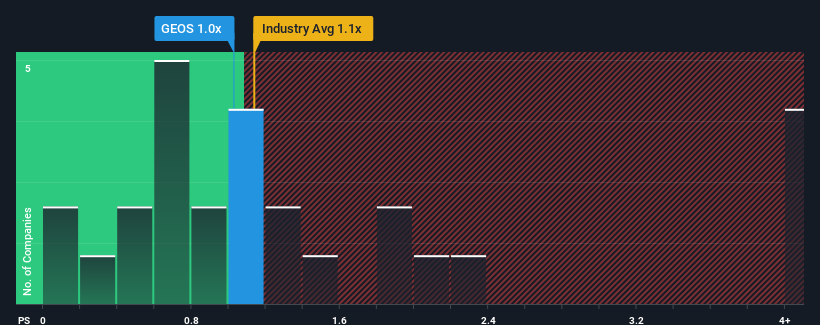

Although its price has dipped substantially, there still wouldn't be many who think Golden Energy Offshore Services' price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S in Norway's Oil and Gas industry is similar at about 1.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Golden Energy Offshore Services

How Golden Energy Offshore Services Has Been Performing

Recent times have been quite advantageous for Golden Energy Offshore Services as its revenue has been rising very briskly. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Golden Energy Offshore Services will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Golden Energy Offshore Services will help you shine a light on its historical performance.How Is Golden Energy Offshore Services' Revenue Growth Trending?

Golden Energy Offshore Services' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 164%. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is predicted to shrink 5.4% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

With this information, we find it odd that Golden Energy Offshore Services is trading at a fairly similar P/S to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What Does Golden Energy Offshore Services' P/S Mean For Investors?

Golden Energy Offshore Services' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Golden Energy Offshore Services revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. The fact that the company's relative performance has not provided a kick to the share price suggests that some investors are anticipating revenue instability.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Golden Energy Offshore Services (2 are potentially serious) you should be aware of.

If these risks are making you reconsider your opinion on Golden Energy Offshore Services, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:GEOS

Golden Energy Offshore Services

Owns and operates offshore service vessels for the oil and gas service industry in the North Sea and the Caribbean.

Low and overvalued.