Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that FLEX LNG Ltd. (OB:FLNG) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for FLEX LNG

What Is FLEX LNG's Net Debt?

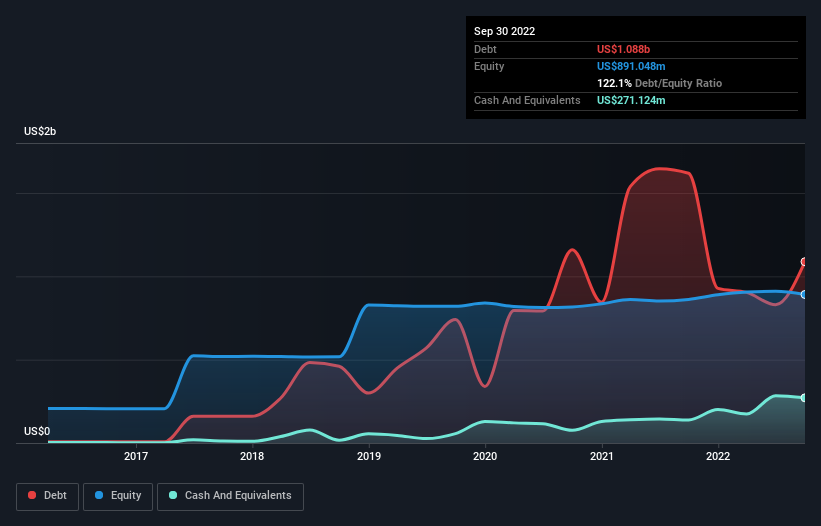

As you can see below, FLEX LNG had US$1.09b of debt at September 2022, down from US$1.62b a year prior. However, because it has a cash reserve of US$271.1m, its net debt is less, at about US$816.6m.

How Healthy Is FLEX LNG's Balance Sheet?

According to the last reported balance sheet, FLEX LNG had liabilities of US$152.3m due within 12 months, and liabilities of US$1.60b due beyond 12 months. On the other hand, it had cash of US$271.1m and US$4.55m worth of receivables due within a year. So it has liabilities totalling US$1.48b more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of US$1.73b. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

FLEX LNG has a debt to EBITDA ratio of 2.9, which signals significant debt, but is still pretty reasonable for most types of business. However, its interest coverage of 1k is very high, suggesting that the interest expense on the debt is currently quite low. It is well worth noting that FLEX LNG's EBIT shot up like bamboo after rain, gaining 35% in the last twelve months. That'll make it easier to manage its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if FLEX LNG can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. During the last three years, FLEX LNG burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

We feel some trepidation about FLEX LNG's difficulty conversion of EBIT to free cash flow, but we've got positives to focus on, too. For example, its interest cover and EBIT growth rate give us some confidence in its ability to manage its debt. Looking at all the angles mentioned above, it does seem to us that FLEX LNG is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 3 warning signs for FLEX LNG (1 is significant) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:FLNG

FLEX LNG

Engages in the seaborne transportation of liquefied natural gas (LNG) worldwide.

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Community Narratives