- Norway

- /

- Oil and Gas

- /

- OB:EQNR

How Will Equinor’s (OB:EQNR) Recent Debt Issuance Influence Its Long-Term Financial Strategy?

Reviewed by Sasha Jovanovic

- Equinor recently completed substantial debt capital market transactions in the US, issuing US$250 million of 4.25% notes due 2028, US$250 million of 4.50% notes due 2030, and US$1 billion of 4.75% notes due 2035 under its US Shelf Registration Statement.

- The proceeds, intended for general corporate purposes such as debt repayment and liquidity enhancement, highlight Equinor’s focus on maintaining financial flexibility in a shifting energy landscape.

- We'll examine how this move to bolster liquidity with new long-term debt may shape Equinor's investment outlook and risk profile.

Find companies with promising cash flow potential yet trading below their fair value.

Equinor Investment Narrative Recap

To be an Equinor shareholder, you typically have to believe in the company's ability to balance steady oil and gas cash flows with the ambitious transition into renewables, all while navigating earnings pressure and valuation risks. Equinor’s recent US$1.5 billion debt issuance could help support near-term liquidity and debt management but does not materially change the most important short term catalyst, energy demand from Europe, or the risk from renewables project headwinds and asset impairments.

Among recent announcements, the Q3 earnings release stands out: Equinor posted a net loss of US$210 million versus strong results the prior year, underscoring margin pressure and continued exposure to volatility in both legacy and renewables segments. The company’s efforts to enhance liquidity in the wake of these results are timely given that market expectations remain elevated for stable shareholder returns despite swings in earnings and cash flows.

By contrast, investors should be aware that ongoing regulatory changes and rapid renewables adoption may...

Read the full narrative on Equinor (it's free!)

Equinor's outlook anticipates $90.2 billion in revenue and $7.6 billion in earnings by 2028. This reflects a 5.4% annual revenue decline and a decrease of $0.6 billion in earnings from the current $8.2 billion level.

Uncover how Equinor's forecasts yield a NOK245.80 fair value, in line with its current price.

Exploring Other Perspectives

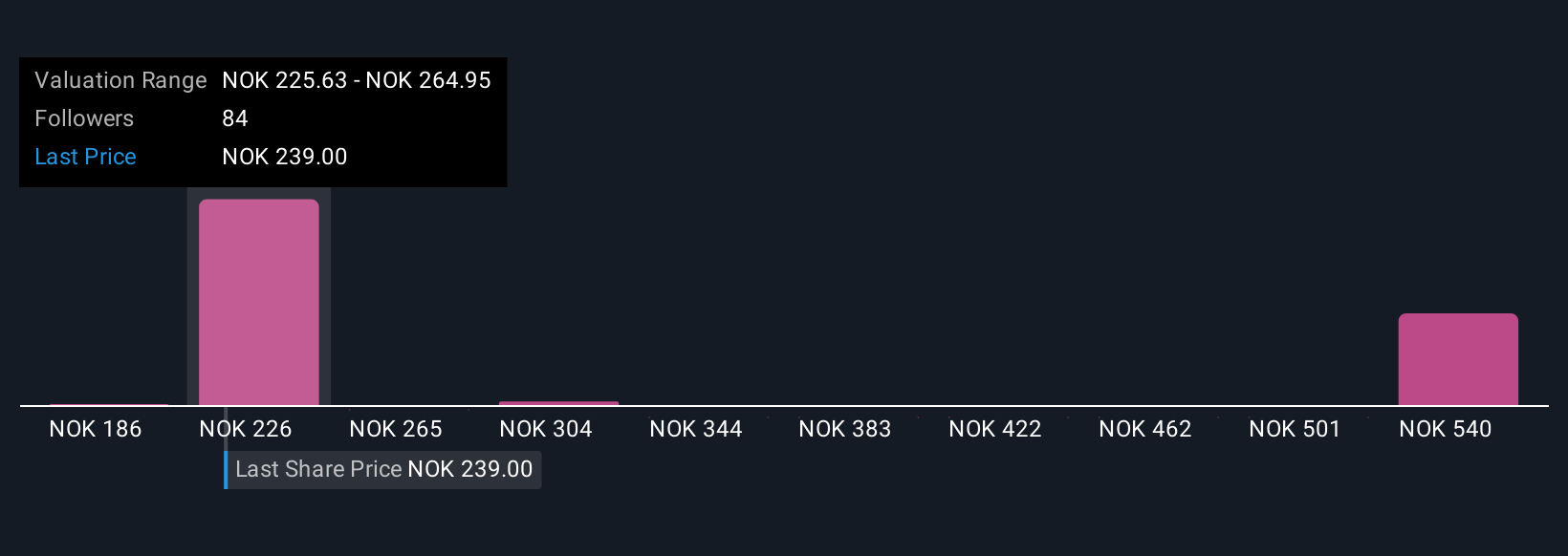

Sixteen members of the Simply Wall St Community peg Equinor’s fair value anywhere from NOK186.31 to NOK621.12 per share. With current valuations still reflecting optimistic assumptions about oil and gas demand, consider how evolving energy policy could challenge this consensus and broaden the debate on Equinor’s outlook.

Explore 16 other fair value estimates on Equinor - why the stock might be worth over 2x more than the current price!

Build Your Own Equinor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Equinor research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Equinor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Equinor's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:EQNR

Equinor

An energy company, engages in the exploration, production, transportation, refining, and marketing of petroleum and other forms of energy in Norway and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives