- Norway

- /

- Oil and Gas

- /

- OB:EQNR

How Equinor’s (OB:EQNR) Renewed Oil and Gas Focus and Leadership Shift Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Equinor announced that Camilla Salthe will become executive vice president for Safety, Security, and Sustainability effective January 1, 2026, following her leadership role in UK and Ireland exploration and production.

- Alongside this leadership change, Equinor plans to drill 250 oil and gas exploration wells in Norwegian waters over the next decade, supported by annual investments of about NOK60 billion and a recalibration of its renewable energy commitments.

- We’ll examine how Equinor’s renewed focus on oil and gas exploration and investment reshapes its investment narrative and future outlook.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Equinor Investment Narrative Recap

To be a shareholder in Equinor today, one needs to believe in the company’s ability to generate cash flow from oil and gas production in Norway while managing the risks of shifting energy policy and emerging sustainability pressures. The recent appointment of Camilla Salthe as Executive Vice President for Safety, Security, and Sustainability, alongside ambitious drilling plans, does not materially alter the most immediate catalyst, maintaining production levels, but the biggest risk remains regulatory shifts impacting future upstream revenue potential.

The announcement of Equinor’s plan to drill 250 oil and gas exploration wells in Norwegian waters is closely linked to its focus on sustaining cash flows from mature fields, which is a central catalyst for near-term investor confidence. This move is especially relevant amid concerns that renewables growth and policy changes could quickly erode the value of traditional assets, making the company’s commitment to upstream production a significant factor for its outlook.

Yet, investors should be aware that if decarbonization policies accelerate faster than anticipated…

Read the full narrative on Equinor (it's free!)

Equinor's outlook anticipates $90.2 billion in revenue and $7.6 billion in earnings by 2028. This scenario assumes a 5.4% annual revenue decline and a $0.6 billion decrease in earnings from the current $8.2 billion.

Uncover how Equinor's forecasts yield a NOK245.80 fair value, a 7% upside to its current price.

Exploring Other Perspectives

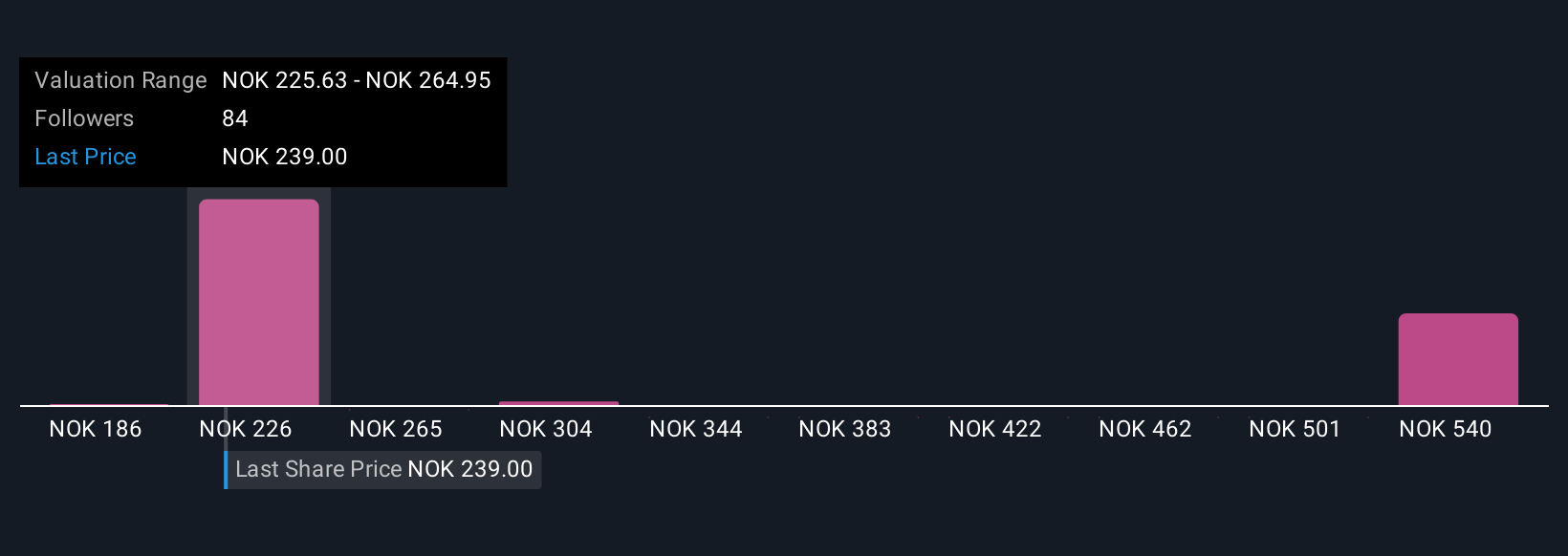

Simply Wall St Community members assigned fair values for Equinor from NOK186 to NOK624 across 16 separate views. With policy risk to long-term oil and gas earnings top of mind, investor conclusions diverge, explore these perspectives for a rounded outlook.

Explore 16 other fair value estimates on Equinor - why the stock might be worth over 2x more than the current price!

Build Your Own Equinor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Equinor research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Equinor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Equinor's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:EQNR

Equinor

An energy company, engages in the exploration, production, transportation, refining, and marketing of petroleum and other forms of energy in Norway and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success