- Norway

- /

- Energy Services

- /

- OB:EIOF

The Eidesvik Offshore (OB:EIOF) Share Price Is Down 79% So Some Shareholders Are Rather Upset

It is a pleasure to report that the Eidesvik Offshore ASA (OB:EIOF) is up 44% in the last quarter. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. Indeed, the share price is down a whopping 79% in that time. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The million dollar question is whether the company can justify a long term recovery.

Check out our latest analysis for Eidesvik Offshore

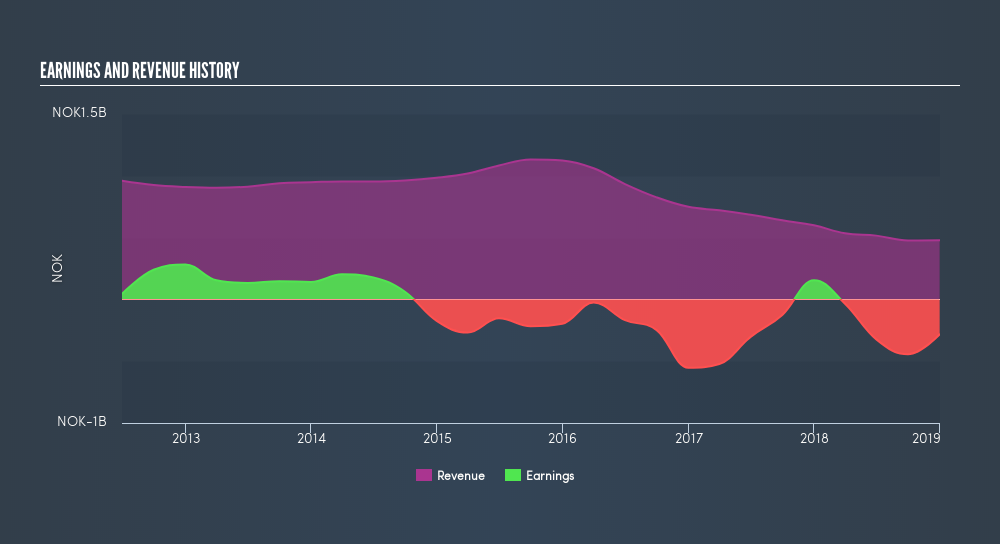

Given that Eidesvik Offshore didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last five years Eidesvik Offshore saw its revenue shrink by 15% per year. That puts it in an unattractive cohort, to put it mildly. So it's not altogether surprising to see the share price down 27% per year in the same time period. This kind of price performance makes us very wary, especially when combined with falling revenue. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

You can see how its balance sheet has strengthened (or weakened) over time in this freeinteractive graphic.

A Different Perspective

Eidesvik Offshore shareholders are up 1.2% for the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 27% endured over half a decade. It could well be that the business is stabilizing. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this freelist of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OB:EIOF

Eidesvik Offshore

Provides services to the offshore supply, subsea, and offshore wind market in Norway.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives