Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Eidesvik Offshore ASA (OB:EIOF) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Eidesvik Offshore

What Is Eidesvik Offshore's Debt?

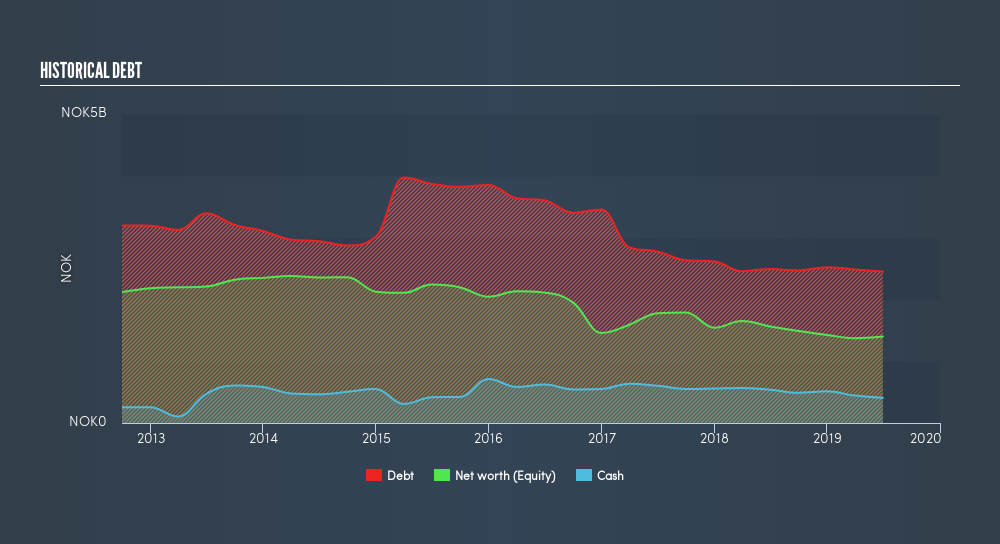

As you can see below, Eidesvik Offshore had kr2.45b of debt, at June 2019, which is about the same the year before. You can click the chart for greater detail. However, it also had kr409.8m in cash, and so its net debt is kr2.04b.

How Strong Is Eidesvik Offshore's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Eidesvik Offshore had liabilities of kr225.6m due within 12 months and liabilities of kr2.43b due beyond that. On the other hand, it had cash of kr409.8m and kr290.5m worth of receivables due within a year. So its liabilities total kr1.95b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the kr359.2m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Eidesvik Offshore would probably need a major re-capitalization if its creditors were to demand repayment. When analysing debt levels, the balance sheet is the obvious place to start. But it is Eidesvik Offshore's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Eidesvik Offshore reported revenue of kr573m, which is a gain of 11%. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Importantly, Eidesvik Offshore had negative earnings before interest and tax (EBIT), over the last year. Indeed, it lost a very considerable kr60m at the EBIT level. Combining this information with the significant liabilities we already touched on makes us very hesitant about this stock, to say the least. That said, it is possible that the company will turn its fortunes around. Nevertheless, we would not bet on it given that it lost kr151m in just last twelve months, and it doesn't have much by way of liquid assets. So while it will probably survive, we think it's risky; we'd treat it like chicken pox and try to avoid it. For riskier companies like Eidesvik Offshore I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OB:EIOF

Eidesvik Offshore

Provides services to the offshore supply, subsea, and offshore wind market in Norway.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives