- Norway

- /

- Oil and Gas

- /

- OB:BWLPG

News Flash: 5 Analysts Think BW LPG Limited (OB:BWLPG) Earnings Are Under Threat

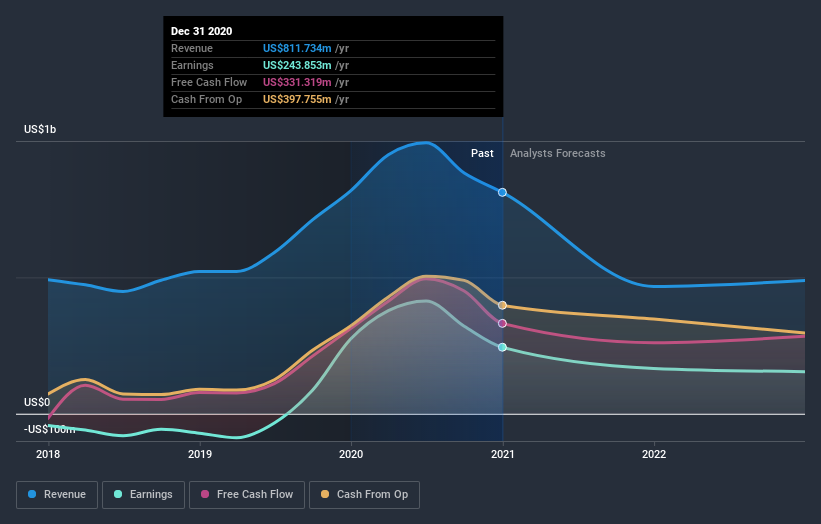

The analysts covering BW LPG Limited (OB:BWLPG) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Both revenue and earnings per share (EPS) estimates were cut sharply as the analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

Following the downgrade, the consensus from five analysts covering BWG is for revenues of US$432m in 2021, implying a stressful 47% decline in sales compared to the last 12 months. Statutory earnings per share are anticipated to crater 46% to US$0.94 in the same period. Prior to this update, the analysts had been forecasting revenues of US$509m and earnings per share (EPS) of US$1.25 in 2021. Indeed, we can see that the analysts are a lot more bearish about BWG's prospects, administering a measurable cut to revenue estimates and slashing their EPS estimates to boot.

Check out our latest analysis for BWG

It'll come as no surprise then, to learn that the analysts have cut their price target 8.4% to US$8.18. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values BWG at US$81.52 per share, while the most bearish prices it at US$53.00. With such a wide range in price targets, the analysts are almost certainly betting on widely diverse outcomes for the underlying business. With this in mind, we wouldn't rely too heavily on the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 47% by the end of 2021. This indicates a significant reduction from annual growth of 8.0% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 7.9% per year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - BWG is expected to lag the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for BWG. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that BWG's revenues are expected to grow slower than the wider market. With a serious cut to this year's expectations and a falling price target, we wouldn't be surprised if investors were becoming wary of BWG.

So things certainly aren't looking great, and you should also know that we've spotted some potential warning signs with BWG, including a weak balance sheet. Learn more, and discover the 3 other flags we've identified, for free on our platform here.

You can also see our analysis of BWG's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

If you decide to trade BWG, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade BWG, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BWG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:BWLPG

BWG

An investment holding company, engages in ship owning and chartering activities worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives