- Norway

- /

- Oil and Gas

- /

- OB:BNOR

BlueNord (OB:BNOR): Assessing Valuation on Strong Earnings and Proposed 2025 Dividend

Reviewed by Simply Wall St

BlueNord (OB:BNOR) caught investors’ attention as the company announced a proposed dividend of NOK 34.75 per share for the third quarter of 2025, pending approval at its upcoming EGM. This move comes in addition to a substantial boost in earnings through September.

See our latest analysis for BlueNord.

This proposed capital return arrived following robust Q3 and year-to-date results, which marked a noticeable shift in sentiment. BlueNord’s shares have rebounded in the short term, although the year-to-date share price return sits at -31.7%. That being said, its three- and five-year total shareholder returns of 31.7% and 328% showcase impressive long-term wealth creation, and recent momentum suggests renewed investor confidence.

If this mix of dividends and momentum has you thinking about broader opportunities, now is the perfect time to broaden your investing horizons and discover fast growing stocks with high insider ownership

But with shares still down significantly for the year and analyst targets implying notable upside, the question now is whether BlueNord remains undervalued or if the market is already pricing in future growth potential.

Most Popular Narrative: 23.1% Undervalued

BlueNord's most widely followed narrative sees a fair value well above the latest close price. This highlights strong growth drivers and ambitious financial targets that set the stock apart from recent market sentiment.

The Tyra Hub is expected to more than double BlueNord's production, driving significant revenue growth as it reaches maximum capacity and maintains stable production in 2025. Exploration success with the HEMJ well has exceeded forecasts, adding substantial reserves and accelerating production, which is projected to prolong Tyra's plateau, enhancing long-term revenue potential.

Curious how such a bold fair value emerges from this outlook? A surge in production, higher margins, and an audacious earnings turnaround are at the heart of this narrative's math. Can these aggressive targets steer BlueNord to new highs? Discover the full story behind the forecast and what could make it a game changer.

Result: Fair Value of $602 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, production setbacks from operational interruptions or prolonged weakness in gas prices could quickly challenge even the most optimistic projections for BlueNord's growth and valuation.

Find out about the key risks to this BlueNord narrative.

Another View: What Do Sales Ratios Say?

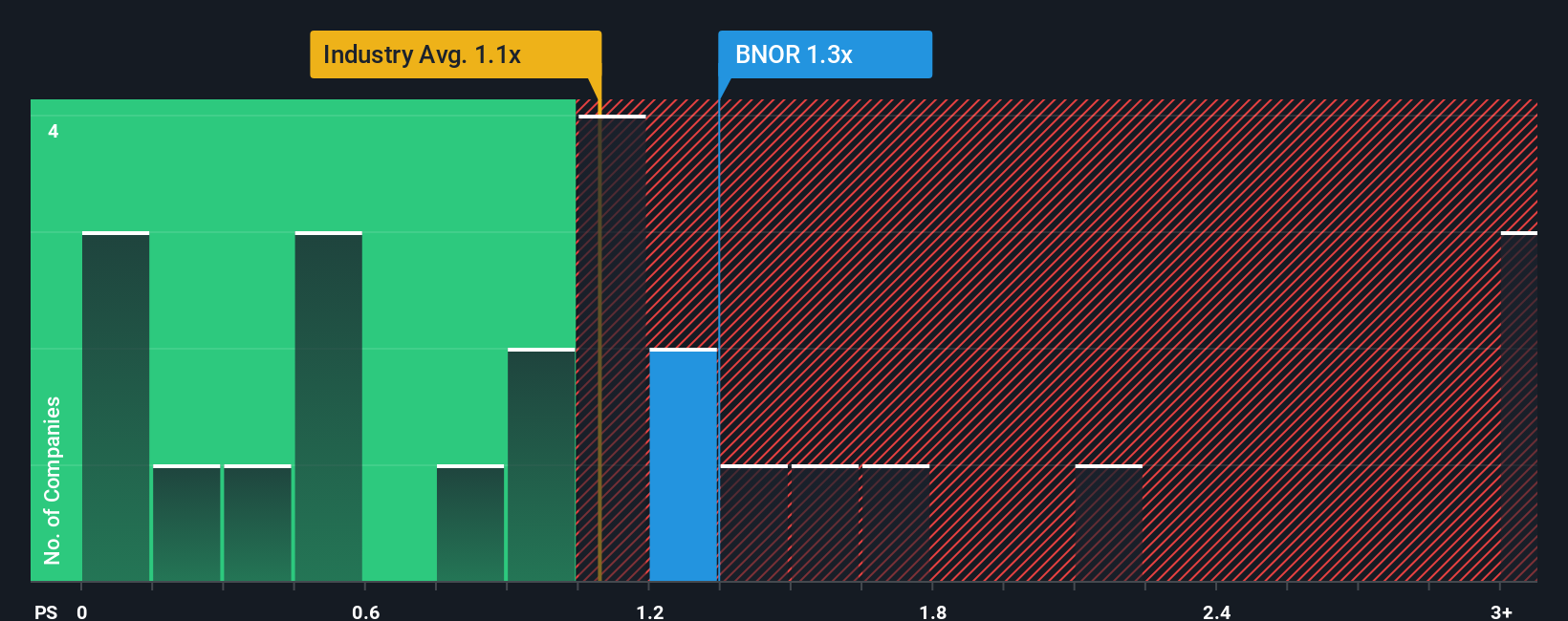

Looking beyond forecasts, BlueNord’s price-to-sales ratio stands at 1.3x. This makes it pricier than both its industry average (1.1x) and direct peers (also 1.3x). However, it remains below its fair ratio of 1.5x, which could suggest room for upside if market sentiment shifts. Does this mark a value opportunity, or signal that further risks remain?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BlueNord Narrative

If you want to approach BlueNord's story from a different angle or dive deeper into the numbers yourself, you can build your own in just minutes. Do it your way

A great starting point for your BlueNord research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Other stocks are making waves across emerging sectors as well. Stay ahead and seize your edge with these powerful strategies:

- Uncover tomorrow’s tech leaders by checking out these 27 AI penny stocks, which is packed with companies redefining innovation and artificial intelligence.

- Pounce on undervalued gems and maximize your potential gains via these 836 undervalued stocks based on cash flows, where market mispricings could become your advantage.

- Tap into fast-growing, dividend-paying opportunities with reliable income potential through these 20 dividend stocks with yields > 3%, making it easier to build a solid foundation in any portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlueNord might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:BNOR

BlueNord

An oil and gas company, engages in the production and development of resources that support the energy transition towards net zero in Norway, Denmark, the Netherlands, and the United Kingdom.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives