- Norway

- /

- Oil and Gas

- /

- OB:ALNG

This Just In: Analysts Are Boosting Their Awilco LNG ASA (OB:ALNG) Outlook for Next Year

Awilco LNG ASA (OB:ALNG) shareholders will have a reason to smile today, with the analysts making substantial upgrades to next year's statutory forecasts. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals. Investors have been pretty optimistic on Awilco LNG too, with the stock up 31% to kr6.10 over the past week. We'll be curious to see if these new estimates convince the market to lift the stock price higher still.

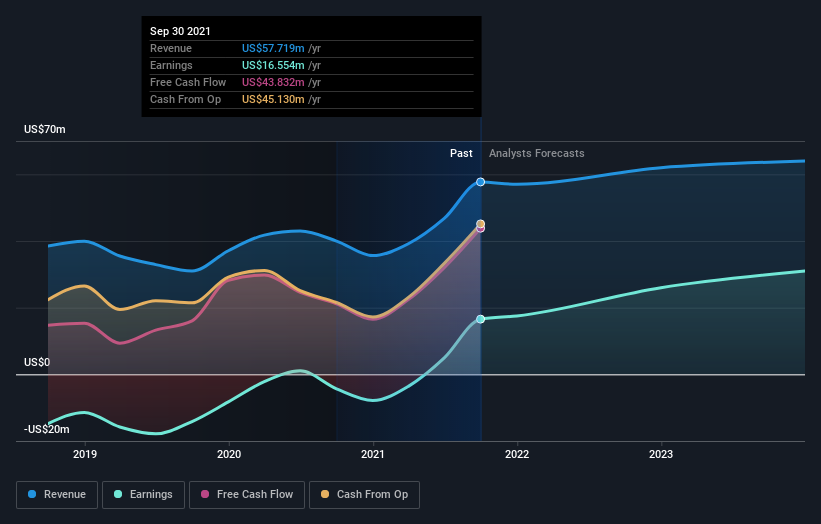

After this upgrade, Awilco LNG's dual analysts are now forecasting revenues of US$62m in 2022. This would be a modest 7.4% improvement in sales compared to the last 12 months. Statutory earnings per share are supposed to drop 20% to US$0.10 in the same period. Before this latest update, the analysts had been forecasting revenues of US$44m and earnings per share (EPS) of US$0.036 in 2022. So we can see there's been a pretty clear increase in analyst sentiment in recent times, with both revenues and earnings per share receiving a decent lift in the latest estimates.

See our latest analysis for Awilco LNG

With these upgrades, we're not surprised to see that the analysts have lifted their price target 17% to US$0.65 per share. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on Awilco LNG, with the most bullish analyst valuing it at US$6.97 and the most bearish at US$4.87 per share. With such a wide range in price targets, the analysts are almost certainly betting on widely diverse outcomes for the underlying business. As a result it might not be possible to derive much meaning from the consensus price target, which is after all just an average of this wide range of estimates.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We would highlight that Awilco LNG's revenue growth is expected to slow, with the forecast 5.9% annualised growth rate until the end of 2022 being well below the historical 11% p.a. growth over the last five years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 0.7% per year. Even after the forecast slowdown in growth, it seems obvious that Awilco LNG is also expected to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for next year. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. With a serious upgrade to expectations and a rising price target, it might be time to take another look at Awilco LNG.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. We have analyst estimates for Awilco LNG going out as far as 2023, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:ALNG

Awilco LNG

Owns and operates liquefied natural gas (LNG) vessels in Norway.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives