- Romania

- /

- Electric Utilities

- /

- BVB:TEL

3 European Dividend Stocks Yielding Up To 11.3%

Reviewed by Simply Wall St

As European markets continue to show strength, with the STOXX Europe 600 Index rising by 1.68% and major indices like Germany's DAX and the UK's FTSE 100 posting gains, investors are increasingly looking at dividend stocks as a way to capitalize on stable returns amid economic growth. In this environment of robust business activity and improved consumer confidence, a good dividend stock is one that not only offers attractive yields but also demonstrates resilience in its financial performance.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.30% | ★★★★★★ |

| Sulzer (SWX:SUN) | 3.15% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.77% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.39% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.84% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.78% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 4.15% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.61% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.65% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.53% | ★★★★★★ |

Click here to see the full list of 222 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

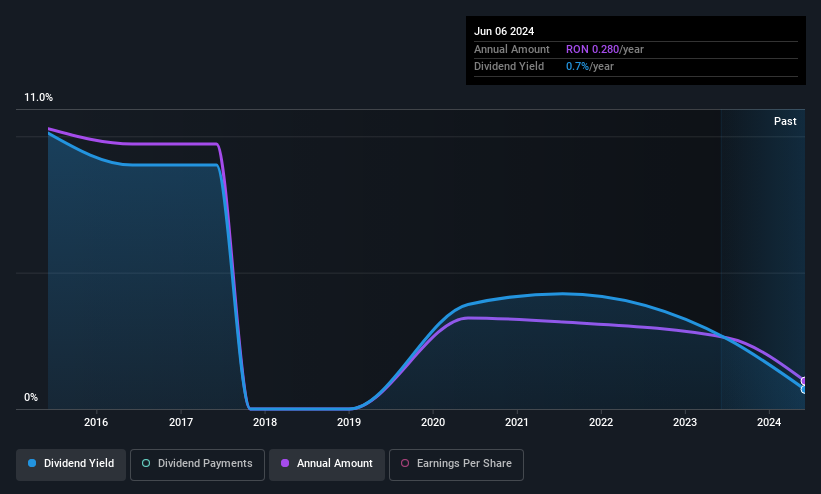

CNTEE Transelectrica (BVB:TEL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CNTEE Transelectrica SA operates as the transmission and system operator of Romania's national power system, with a market cap of RON5.11 billion.

Operations: CNTEE Transelectrica SA generates revenue primarily from its Transmission and Dispatch segment, amounting to RON6.14 billion.

Dividend Yield: 5.5%

CNTEE Transelectrica's dividend payments have been volatile over the past decade, though they are currently well covered by earnings (49% payout ratio) and cash flows (65.9% cash payout ratio). Despite a recent decline in revenue and sales, earnings grew by 77.1% last year. The dividend yield of 5.47% is below the top tier in Romania but still offers some appeal to income-focused investors given its coverage by financial metrics.

- Get an in-depth perspective on CNTEE Transelectrica's performance by reading our dividend report here.

- According our valuation report, there's an indication that CNTEE Transelectrica's share price might be on the cheaper side.

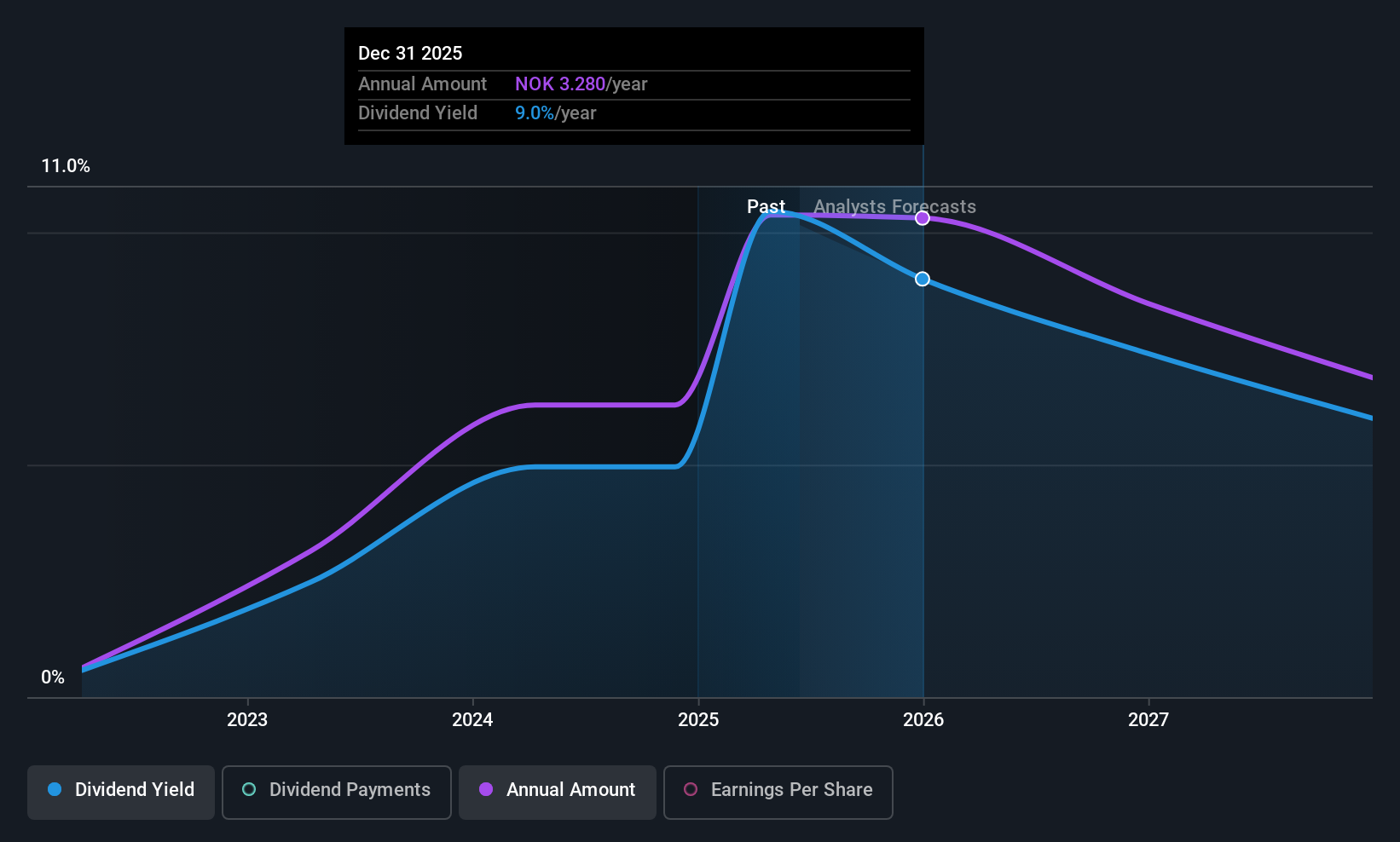

Aker Solutions (OB:AKSO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aker Solutions ASA is a company that offers solutions, products, systems, and services to the oil and gas industry across several countries including Norway, the United States, and Brazil, with a market capitalization of NOK14.02 billion.

Operations: Aker Solutions ASA's revenue segments include Life Cycle at NOK14.58 billion and Renewables and Field Development at NOK41.77 billion.

Dividend Yield: 11.4%

Aker Solutions' dividend payments have been volatile and are not well covered by cash flows, with a high cash payout ratio of 126.9%. Despite earnings growth of 48.5% last year, the dividends remain unreliable over the past decade. The current yield is among the top in Norway at 11.38%, but sustainability is questionable due to insufficient free cash flow coverage. Recent executive changes include Sigurd Mosheim Sævareid replacing Stian Pettersen Sagvold on the board.

- Delve into the full analysis dividend report here for a deeper understanding of Aker Solutions.

- Our valuation report unveils the possibility Aker Solutions' shares may be trading at a discount.

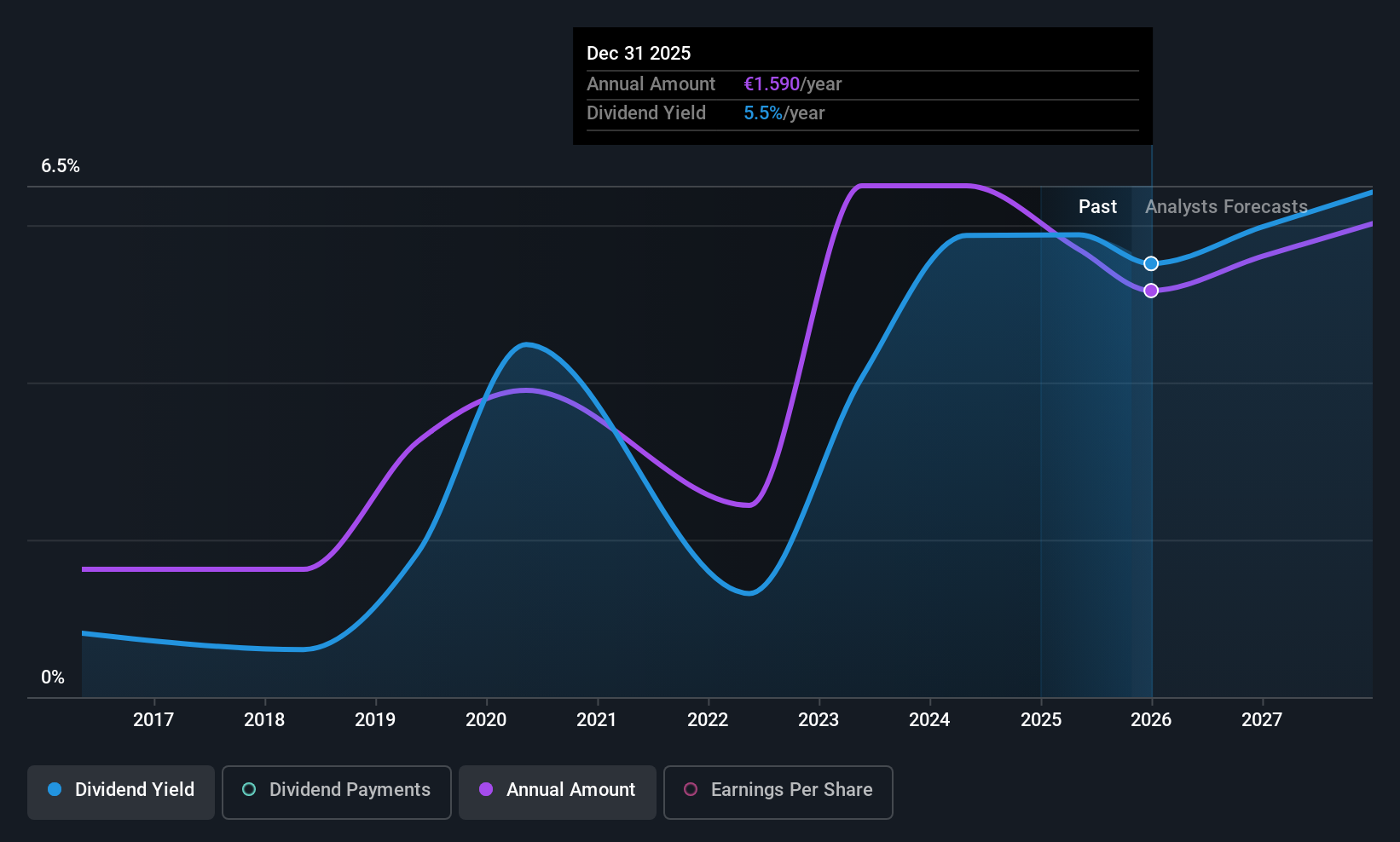

SBO (WBAG:SBO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SBO AG is a global manufacturer and seller of steel products, with a market cap of €452.29 million.

Operations: SBO AG generates its revenue primarily from Energy Equipment (€318.24 million) and Precision Technology (€320.90 million).

Dividend Yield: 6.1%

SBO's dividend yield of 6.1% ranks in the top 25% in Austria, yet its track record is unstable and payments have been volatile over the past decade. The dividends are covered by earnings (payout ratio: 70.9%) and cash flows (cash payout ratio: 49.4%), suggesting sustainability despite recent declines in sales and net income as reported for H1 2025. Trading below fair value estimates, SBO may present an opportunity for investors seeking yield with some risk tolerance.

- Navigate through the intricacies of SBO with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that SBO is trading behind its estimated value.

Next Steps

- Access the full spectrum of 222 Top European Dividend Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:TEL

CNTEE Transelectrica

CNTEE Transelectrica SA acts as a transmission and system operator of the national power system.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives