- Norway

- /

- Consumer Finance

- /

- OB:ACR

Axactor (OB:ACR) shareholders have endured a 79% loss from investing in the stock five years ago

Axactor ASA (OB:ACR) shareholders should be happy to see the share price up 11% in the last month. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. In fact, the share price has tumbled down a mountain to land 80% lower after that period. So we don't gain too much confidence from the recent recovery. The million dollar question is whether the company can justify a long term recovery.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

Check out our latest analysis for Axactor

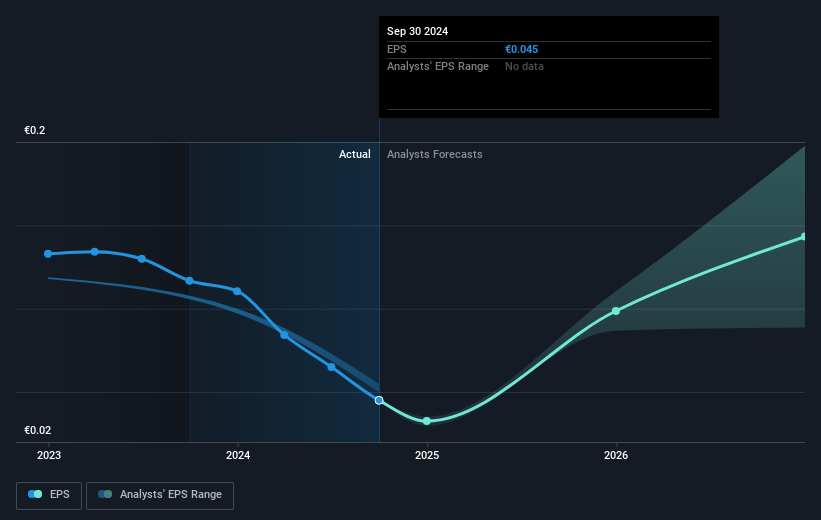

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years over which the share price declined, Axactor's earnings per share (EPS) dropped by 15% each year. This reduction in EPS is less than the 27% annual reduction in the share price. This implies that the market was previously too optimistic about the stock. The low P/E ratio of 7.14 further reflects this reticence.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Axactor's key metrics by checking this interactive graph of Axactor's earnings, revenue and cash flow.

A Different Perspective

Investors in Axactor had a tough year, with a total loss of 19%, against a market gain of about 7.7%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 12% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Axactor better, we need to consider many other factors. For example, we've discovered 2 warning signs for Axactor (1 shouldn't be ignored!) that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Norwegian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:ACR

Axactor

Through its subsidiaries, operates as a debt management and collection company in Sweden, Finland, Germany, Italy, Norway, and Spain.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives