- Norway

- /

- Consumer Finance

- /

- OB:ACR

Axactor (OB:ACR): Five-Year Losses Deepen Despite Revenue Growth, Challenging Bullish Outlook

Reviewed by Simply Wall St

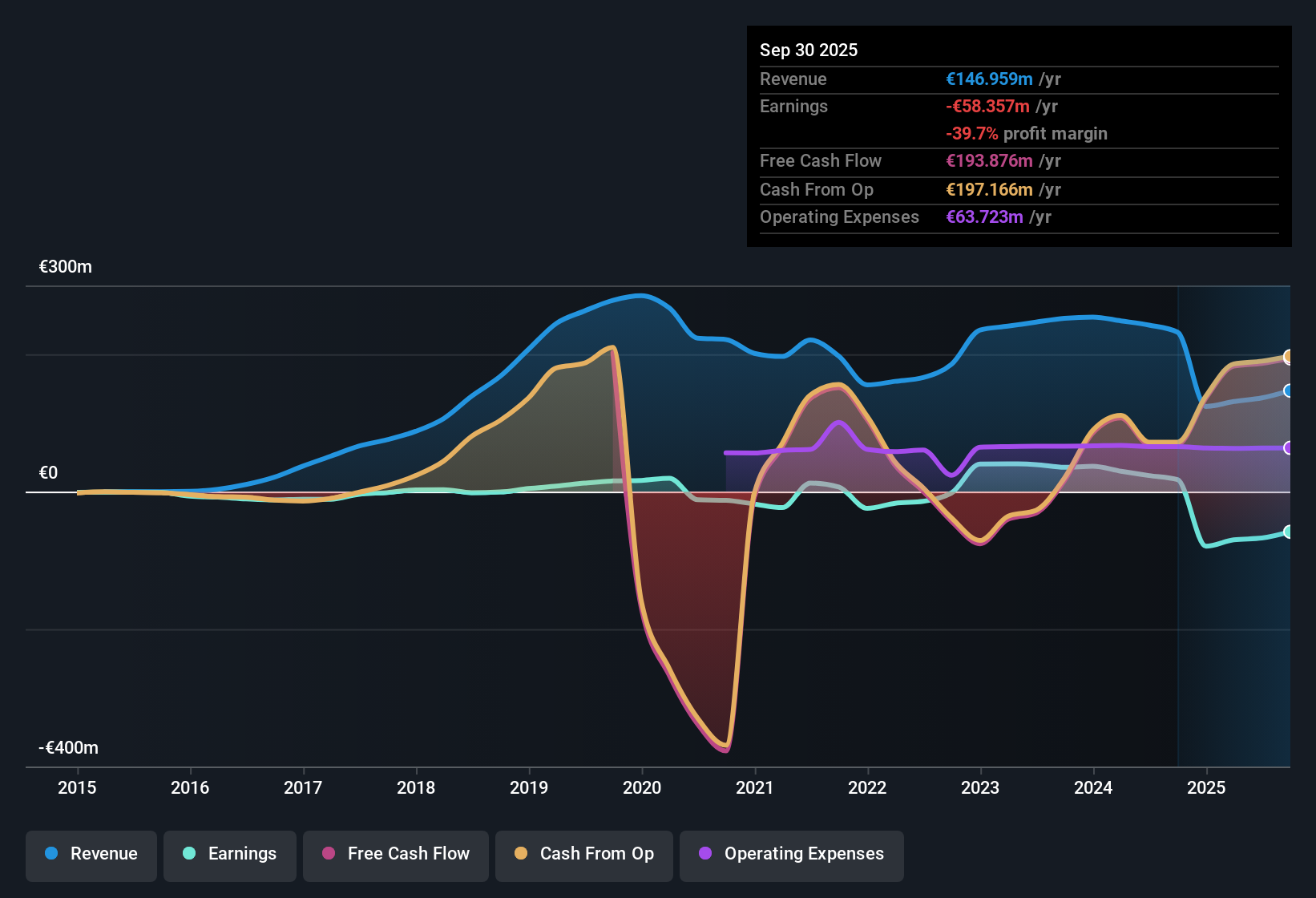

Axactor (OB:ACR) reported that losses have accelerated over the last five years, growing at an average annual rate of 19.7%. However, revenue is forecast to expand by 16.7% per year, a pace that stands out against the broader Norwegian market's 2.8% annual growth. The company's Price-To-Sales Ratio of 1.3x remains below key industry benchmarks. Investors will notice that despite sales momentum, persistent negative profitability and shares trading above the estimated fair value (NOK7.1 vs NOK4.24) frame a complex earnings picture.

See our full analysis for Axactor.Next up, we’ll see how these headlines compare to the prevailing narratives at Simply Wall St. We will also consider whether the numbers reinforce or challenge the consensus story.

See what the community is saying about Axactor

Margin Expansion Hinges on Cost Control

- Interest expenses on new bonds dropped by more than 3 percentage points due to successful refinancing, and ongoing IT-driven cost reductions (€800,000 saved per quarter) are aiming to boost Axactor's free cash flow and net profitability.

- According to the analysts' consensus view, disciplined cost management and the rollout of digital collection platforms are set to drive margin gains, with net margins forecast to climb from -49.6% to 21.9% over the next three years.

- Consensus narrative notes that new third-party collection contracts, especially in Norway, could accelerate revenue and margin growth in 2026–2027 if cost savings materialize as planned.

- What is surprising is that despite flat revenue growth in certain regions and recent margin pressure from onboarding costs, consensus expects efficiency initiatives and a larger addressable market to materially lift profitability.

See where analysts agree and disagree on whether Axactor’s efficiency push is enough to drive sustainable profit improvements. 📊 Read the full Axactor Consensus Narrative.

Market Share Upside Tied to NPL Investments

- Axactor is strategically investing in new non-performing loan (NPL) portfolios, aiming to capture a bigger share of Europe’s growing consumer debt market and capitalize on a strong NPL disposal pipeline.

- Consensus narrative highlights that management’s pivot toward acquiring new NPLs, combined with proprietary analytics and IT upgrades, positions Axactor for improved collection performance and higher future revenues.

- Consensus view emphasizes the large-scale third-party collection contracts and recently extended debt maturities into 2027–2028 as supporting longer-term growth ambitions.

- Bears argue that if flat year-over-year gross revenues (down 9% overall, down 1% excluding the Spain sale) persist due to a more “normalized” market, hoped-for NPL-related gains could fall short.

Valuation Discount Faces Profitability Hurdles

- Axactor’s Price-To-Sales Ratio of 1.3x is lower than both its peer average (3x) and the broader Consumer Finance industry (1.7x), but the current share price (NOK7.1) still trades above DCF fair value (NOK4.24) and below the analyst target (NOK10.00), revealing a tension between quantitative cheapness and earnings uncertainty.

- Consensus narrative calls out that to justify the analyst target price, Axactor needs to grow annual revenue to €317.5 million and convert losses of €-67.6 million to €69.5 million in profit within four years, a significant turnaround embedded into current forecasts.

- This expectation leans on higher margins, steady share count, and a future PE ratio of 5.1x, meaning risk remains if margin expansion or revenue targets are missed against industry headwinds and competition.

- Investors are encouraged to cross-check these optimistic forecasts against their own outlook, as the stock currently trades in the limbo between promising multiples and persistent losses.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Axactor on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the figures from another angle? In just a few minutes, you can share your own take and add it to the story. Do it your way

A great starting point for your Axactor research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Axactor’s revenue prospects have improved, ongoing losses and challenges in achieving sustainable profitability create real uncertainty around a turnaround.

If you want more reliable growth and less earnings risk, use stable growth stocks screener (2119 results) to focus on companies consistently delivering steady results year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ACR

Axactor

Through its subsidiaries, operates as a debt management and collection company in Sweden, Finland, Germany, Italy, Norway, and Spain.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives