- Norway

- /

- Capital Markets

- /

- OB:ABG

ABG Sundal Collier (OB:ABG) Net Margin Improves, Challenging Narrative of Low Quality Earnings

Reviewed by Simply Wall St

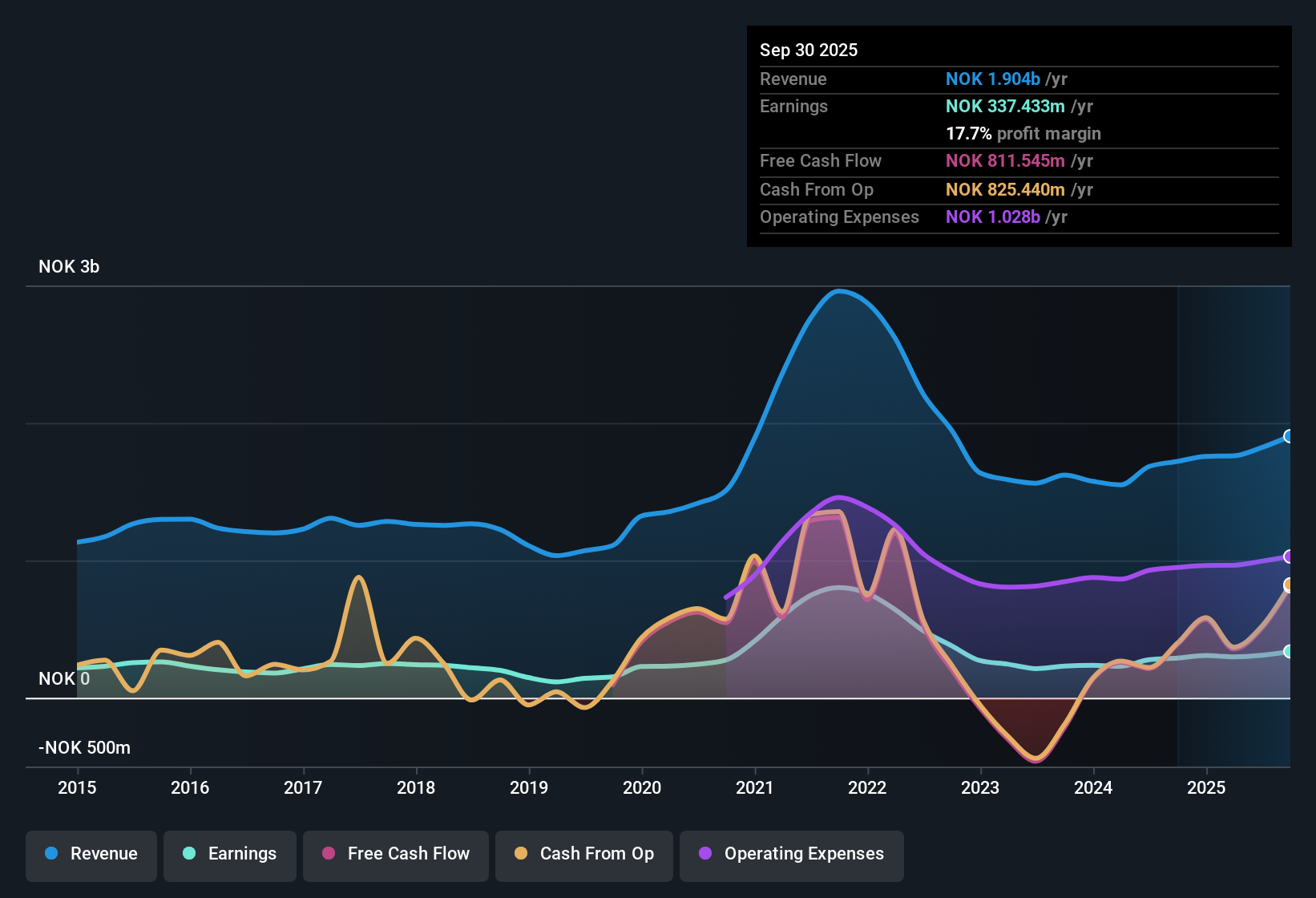

ABG Sundal Collier Holding (OB:ABG) posted a 16.8% increase in earnings over the past year, bucking a five-year trend of declining earnings at an average rate of 18.3% per year. The company improved its net profit margin to 17.7% from 16.8% in the prior year, signaling stronger profitability on the back of high-quality earnings. With a share price of NOK7.02 still trading below the estimated fair value of NOK8.7 and a price-to-earnings ratio of 10.7x that sits well below both peer and industry averages, value-focused investors may find the setup compelling, even as some risks linger around growth and income reliability.

See our full analysis for ABG Sundal Collier Holding.Up next, we will see how these numbers stack up against the narratives that investors and analysts have built around ABG Sundal Collier Holding. We will also explore which perspectives might need a rethink after these results.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Rises to 17.7%

- Profitability moved up as ABG Sundal Collier Holding’s net profit margin increased to 17.7% from 16.8% last year, outpacing many peers and signaling a greater share of revenue is now reaching the bottom line.

- What is surprising is how the increase in margin coincides with a shift in earnings quality, which the prevailing analysis credits as “high,” not typical for a firm known for cyclical swings.

- This margin improvement supports views that ABG is operating more efficiently than before, marked by both the step up in profit margin and the 16.8% earnings growth, which is a sharp reversal from recent annual declines.

- Even so, the new margin figure is noted as potentially vulnerable if deal flow or market activity drops. This underlines a focus on whether this level can be sustained in a more challenging environment.

P/E Ratio Undercuts Peer Group

- ABG’s price-to-earnings (P/E) ratio sits at 10.7x, far below both the peer average of 25x and the industry average of 16.2x. This makes it stand out on value drills.

- The prevailing take highlights that this discount strengthens the value-oriented case even as some investors raise doubts.

- The broad gap between ABG’s P/E and its peer group means investors pay less for each unit of earnings than market norms, which typically appeals to bargain hunters.

- This supports the idea that upside potential exists if sentiment or sector returns improve. However, it leaves open the question of whether the low multiple fairly prices in risk around future growth.

Fair Value Gap Suggests Upside

- The current share price of NOK7.02 is materially below its DCF fair value estimate of NOK8.70, placing ABG at roughly a 19% discount on a cash flow basis.

- The prevailing analysis calls out this valuation gap as a potential catalyst for re-rating, especially as recent profit improvement may not be fully priced in.

- With the reported earnings growth of 16.8% following years of declines, the fair value disconnect could draw attention if operational momentum continues into the next period.

- Still, risks flagged around future revenue growth and dividend reliability prompt caution for those weighing whether the discount is a genuine bargain or simply a reflection of embedded uncertainty in ABG’s outlook.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on ABG Sundal Collier Holding's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While ABG Sundal Collier Holding’s recent profit rebound is notable, ongoing concerns over future revenue growth and dividend reliability highlight potential volatility ahead.

If you prefer stocks with more consistent expansion and income dependability, use stable growth stocks screener (2096 results) to discover companies known for delivering steady earnings and revenue, even when the cycle shifts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ABG

ABG Sundal Collier Holding

Provides investment banking, stock broking, and corporate advisory services in Norway, Sweden, Denmark, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives