- Norway

- /

- Hospitality

- /

- OB:G2MNO

If You Had Bought Gaming Innovation Group (OB:GIG) Stock Three Years Ago, You'd Be Sitting On A 91% Loss, Today

As an investor, mistakes are inevitable. But you have a problem if you face massive losses more than once in a while. So take a moment to sympathize with the long term shareholders of Gaming Innovation Group Inc. (OB:GIG), who have seen the share price tank a massive 91% over a three year period. That would be a disturbing experience. And over the last year the share price fell 65%, so we doubt many shareholders are delighted. The falls have accelerated recently, with the share price down 22% in the last three months. But this could be related to the weak market, which is down 19% in the same period.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for Gaming Innovation Group

Given that Gaming Innovation Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, Gaming Innovation Group grew revenue at 10% per year. That's a pretty good rate of top-line growth. So it's hard to believe the share price decline of 55% per year is due to the revenue. More likely, the market was spooked by the cost of that revenue. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

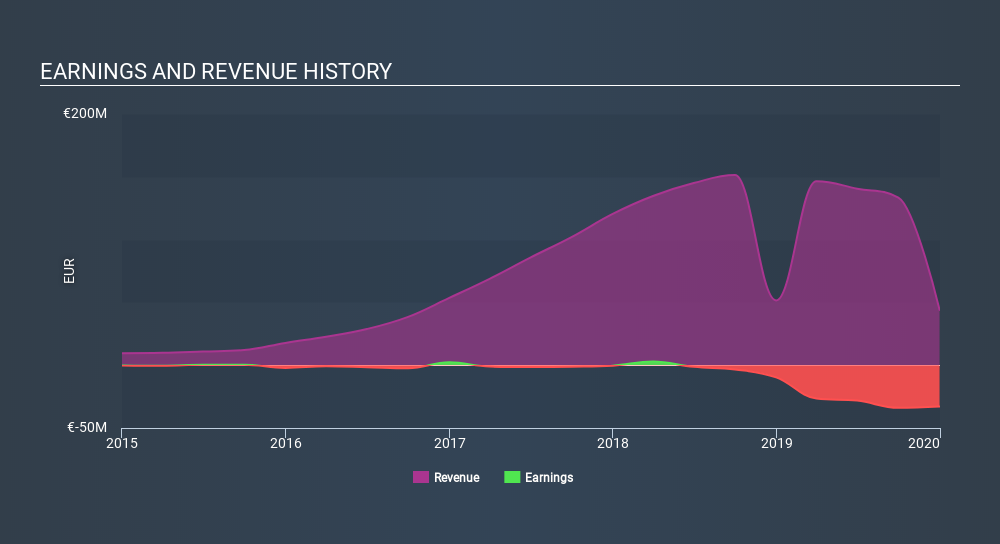

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. If you are thinking of buying or selling Gaming Innovation Group stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Gaming Innovation Group shareholders are down 65% for the year, falling short of the market return. The market shed around 15%, no doubt weighing on the stock price. Shareholders have lost 55% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Gaming Innovation Group better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Gaming Innovation Group you should know about.

Gaming Innovation Group is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OB:G2MNO

Gentoo Media

An iGaming technology company, together with its subsidiaries, provides solutions, products, and services to iGaming operators in Nordic countries, other European countries, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)