- Norway

- /

- Commercial Services

- /

- OB:VOW

The recent kr157m market cap decrease is likely to have disappointed insiders invested in Vow ASA (OB:VOW)

Key Insights

- Vow's significant insider ownership suggests inherent interests in company's expansion

- The top 4 shareholders own 54% of the company

- Institutional ownership in Vow is 12%

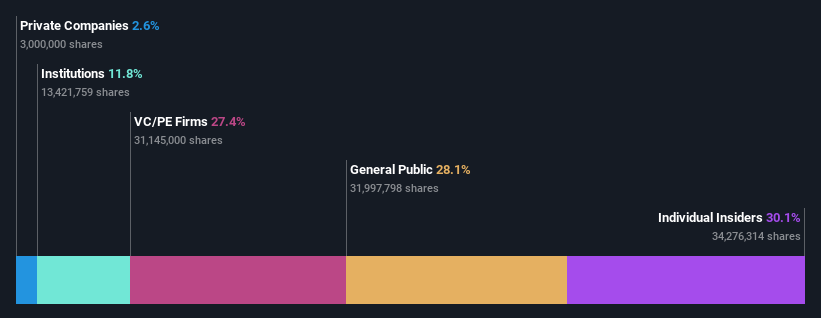

If you want to know who really controls Vow ASA (OB:VOW), then you'll have to look at the makeup of its share registry. The group holding the most number of shares in the company, around 30% to be precise, is individual insiders. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

As a result, insiders as a group endured the highest losses after market cap fell by kr157m.

In the chart below, we zoom in on the different ownership groups of Vow.

View our latest analysis for Vow

What Does The Institutional Ownership Tell Us About Vow?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

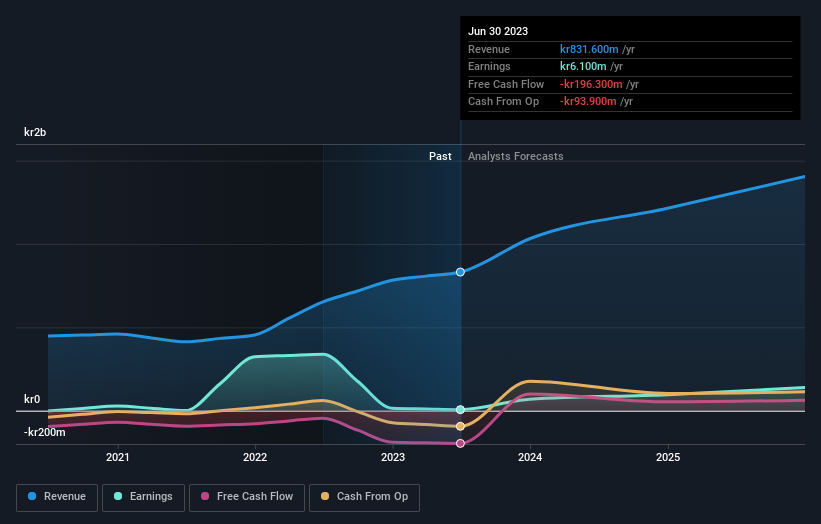

As you can see, institutional investors have a fair amount of stake in Vow. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Vow's earnings history below. Of course, the future is what really matters.

Hedge funds don't have many shares in Vow. Reiten & Co is currently the company's largest shareholder with 27% of shares outstanding. The second and third largest shareholders are Jonny Hansen and Asgeir Wien, with an equal amount of shares to their name at 8.8%. Jonny Hansen, who is the second-largest shareholder, also happens to hold the title of Chief Operating Officer. Additionally, the company's CEO Henrik Badin directly holds 8.8% of the total shares outstanding.

To make our study more interesting, we found that the top 4 shareholders control more than half of the company which implies that this group has considerable sway over the company's decision-making.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There is a little analyst coverage of the stock, but not much. So there is room for it to gain more coverage.

Insider Ownership Of Vow

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our information suggests that insiders maintain a significant holding in Vow ASA. Insiders have a kr394m stake in this kr1.3b business. We would say this shows alignment with shareholders, but it is worth noting that the company is still quite small; some insiders may have founded the business. You can click here to see if those insiders have been buying or selling.

General Public Ownership

With a 28% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Vow. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Equity Ownership

With a stake of 27%, private equity firms could influence the Vow board. Sometimes we see private equity stick around for the long term, but generally speaking they have a shorter investment horizon and -- as the name suggests -- don't invest in public companies much. After some time they may look to sell and redeploy capital elsewhere.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Vow better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for Vow you should be aware of, and 2 of them don't sit too well with us.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:VOW

Vow

Produces, delivers, and maintains systems for processing and purifying wastewater, food waste, solid waste, and bio sludge in Norway, France, Poland, the United States, and Italy.

High growth potential with low risk.

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Valuation Analysis of Palantir Technologies: Growth Assumptions and Market Expectations

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Asset-Light but Valuation-Heavy: A Fundamental Breakdown of Marriott ($MAR)

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks