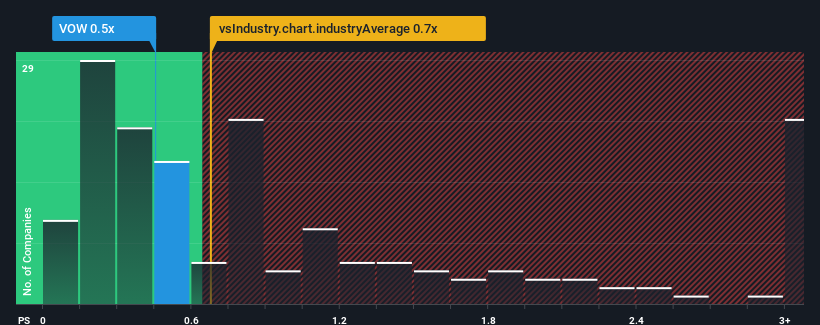

You may think that with a price-to-sales (or "P/S") ratio of 0.5x Vow ASA (OB:VOW) is definitely a stock worth checking out, seeing as almost half of all the Commercial Services companies in Norway have P/S ratios greater than 10.7x and even P/S above 191x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Vow

How Has Vow Performed Recently?

Vow certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Vow's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Vow?

The only time you'd be truly comfortable seeing a P/S as depressed as Vow's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. Pleasingly, revenue has also lifted 124% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 35% per year during the coming three years according to the dual analysts following the company. With the industry predicted to deliver 38% growth per year, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Vow's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Vow's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Vow's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You need to take note of risks, for example - Vow has 3 warning signs (and 2 which are potentially serious) we think you should know about.

If these risks are making you reconsider your opinion on Vow, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:VOW

Vow

Produces, delivers, and maintains systems for processing and purifying wastewater, food waste, solid waste, and bio sludge in Norway, France, Poland, the United States, and Italy.

High growth potential and good value.

Market Insights

Community Narratives