- Norway

- /

- Commercial Services

- /

- OB:VOW

A Piece Of The Puzzle Missing From Vow ASA's (OB:VOW) 43% Share Price Climb

Vow ASA (OB:VOW) shareholders would be excited to see that the share price has had a great month, posting a 43% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 11% in the last twelve months.

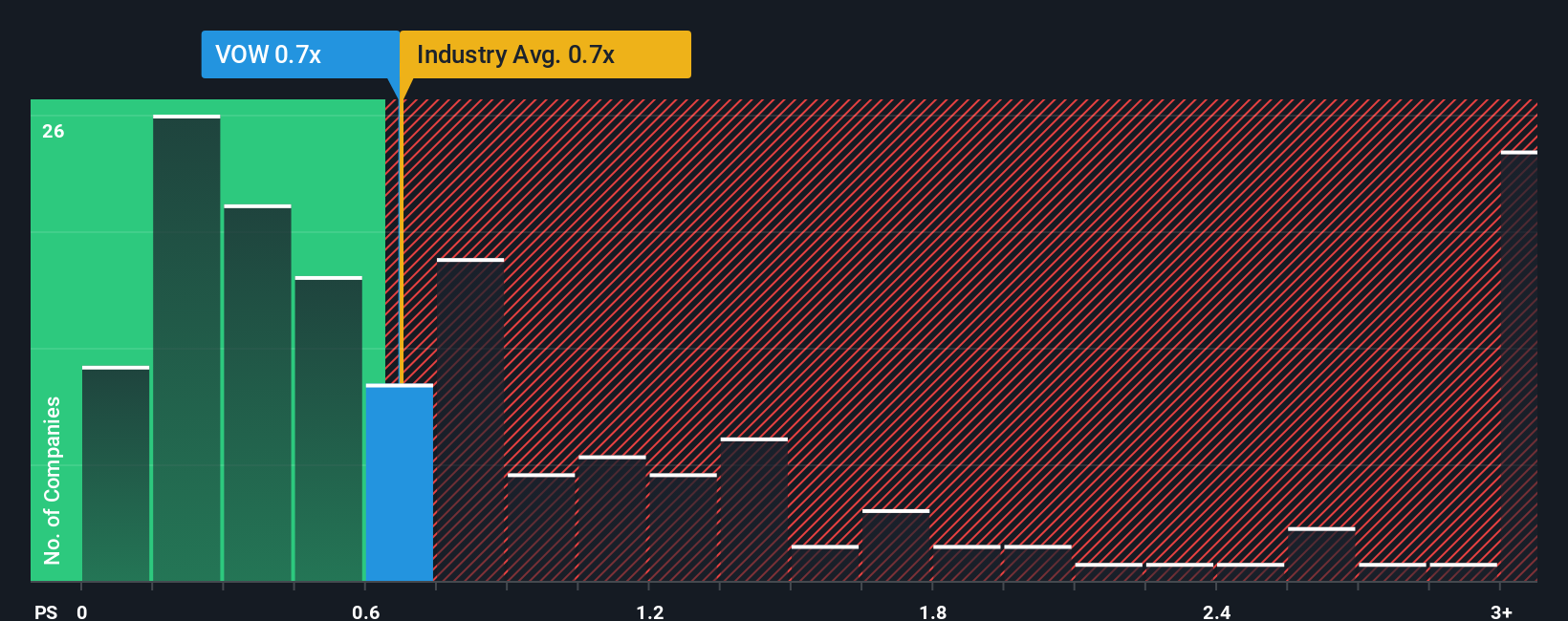

Even after such a large jump in price, Vow may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.7x, since almost half of all companies in the Commercial Services industry in Norway have P/S ratios greater than 9x and even P/S higher than 43x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Vow

How Has Vow Performed Recently?

Recent times haven't been great for Vow as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Vow will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Vow?

In order to justify its P/S ratio, Vow would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.3%. This was backed up an excellent period prior to see revenue up by 54% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next year should generate growth of 56% as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 10% growth forecast for the broader industry.

With this information, we find it odd that Vow is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Vow's P/S

Vow's recent share price jump still sees fails to bring its P/S alongside the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A look at Vow's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 4 warning signs we've spotted with Vow (including 3 which make us uncomfortable).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:VOW

Vow

Produces, delivers, and maintains systems for processing and purifying wastewater, food waste, solid waste, and bio sludge in Norway, France, Poland, the United States, and Italy.

Undervalued with high growth potential.

Market Insights

Community Narratives