- Norway

- /

- Commercial Services

- /

- OB:PYRUM

Why We're Not Concerned Yet About Pyrum Innovations AG's (OB:PYRUM) 27% Share Price Plunge

Pyrum Innovations AG (OB:PYRUM) shares have retraced a considerable 27% in the last month, reversing a fair amount of their solid recent performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 36% in that time.

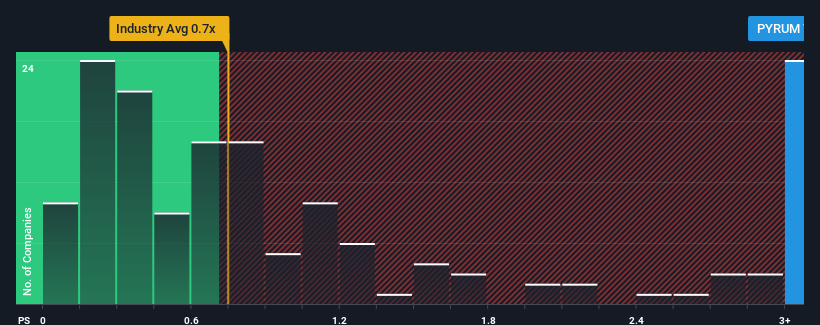

Even after such a large drop in price, when almost half of the companies in Norway's Commercial Services industry have price-to-sales ratios (or "P/S") below 2.9x, you may still consider Pyrum Innovations as a stock not worth researching with its 7.6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Pyrum Innovations

How Pyrum Innovations Has Been Performing

Pyrum Innovations could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Pyrum Innovations will help you uncover what's on the horizon.How Is Pyrum Innovations' Revenue Growth Trending?

Pyrum Innovations' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 31% decrease to the company's top line. In spite of this, the company still managed to deliver immense revenue growth over the last three years. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Looking ahead now, revenue is anticipated to climb by 37% each year during the coming three years according to the dual analysts following the company. With the industry only predicted to deliver 6.1% per annum, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Pyrum Innovations' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Pyrum Innovations' P/S?

A significant share price dive has done very little to deflate Pyrum Innovations' very lofty P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Pyrum Innovations maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Commercial Services industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Pyrum Innovations (1 doesn't sit too well with us!) that we have uncovered.

If these risks are making you reconsider your opinion on Pyrum Innovations, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:PYRUM

Pyrum Innovations

Provides patented thermolysis technology in the recycling market for used tires worldwide.

High growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026