- Norway

- /

- Commercial Services

- /

- OB:ACC

Not Many Are Piling Into Aker Carbon Capture ASA (OB:ACC) Stock Yet As It Plummets 28%

The Aker Carbon Capture ASA (OB:ACC) share price has fared very poorly over the last month, falling by a substantial 28%. For any long-term shareholders, the last month ends a year to forget by locking in a 50% share price decline.

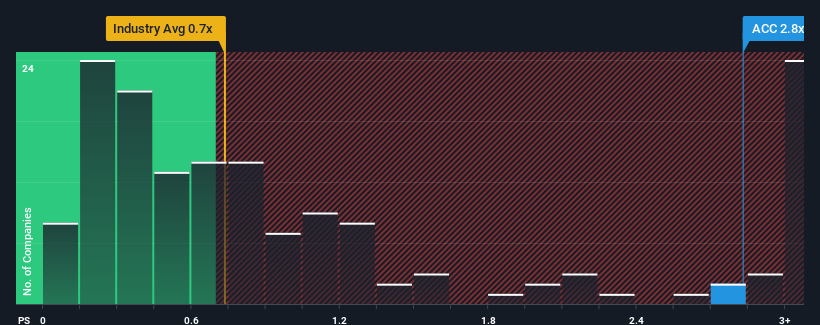

In spite of the heavy fall in price, there still wouldn't be many who think Aker Carbon Capture's price-to-sales (or "P/S") ratio of 2.8x is worth a mention when it essentially matches the median P/S in Norway's Commercial Services industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Aker Carbon Capture

What Does Aker Carbon Capture's P/S Mean For Shareholders?

Aker Carbon Capture certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Aker Carbon Capture's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Aker Carbon Capture would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 106% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 40% per year as estimated by the nine analysts watching the company. With the industry only predicted to deliver 7.3% per annum, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Aker Carbon Capture's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

With its share price dropping off a cliff, the P/S for Aker Carbon Capture looks to be in line with the rest of the Commercial Services industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at Aker Carbon Capture's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about this 1 warning sign we've spotted with Aker Carbon Capture.

If these risks are making you reconsider your opinion on Aker Carbon Capture, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:ACC

Aker Carbon Capture

Provides products, technology, and solutions within the field of carbon capture technologies, utilization, and storage in Norway and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives