- Norway

- /

- Construction

- /

- OB:VEI

Here's Why Shareholders May Consider Paying Veidekke ASA's (OB:VEI) CEO A Little More

Key Insights

- Veidekke to hold its Annual General Meeting on 7th of May

- Total pay for CEO Jimmy Bengtsson includes kr4.71m salary

- The overall pay is 68% below the industry average

- Over the past three years, Veidekke's EPS grew by 8.3% and over the past three years, the total shareholder return was 8.8%

Shareholders will probably not be disappointed by the robust results at Veidekke ASA (OB:VEI) recently and they will be keeping this in mind as they go into the AGM on 7th of May. They will probably be more interested in hearing the board discuss future initiatives to further improve the business as they vote on resolutions such as executive remuneration. In our analysis below, we discuss why we think the CEO compensation looks acceptable and the case for a raise.

See our latest analysis for Veidekke

How Does Total Compensation For Jimmy Bengtsson Compare With Other Companies In The Industry?

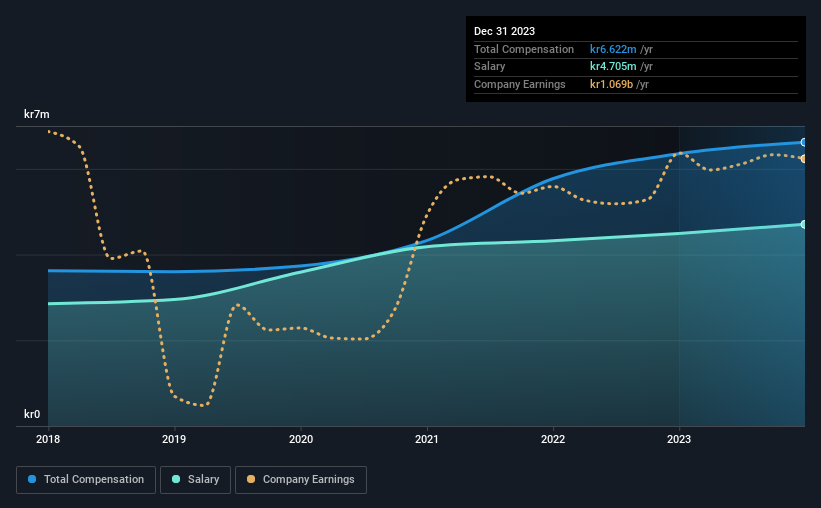

According to our data, Veidekke ASA has a market capitalization of kr16b, and paid its CEO total annual compensation worth kr6.6m over the year to December 2023. That's a modest increase of 4.3% on the prior year. Notably, the salary which is kr4.71m, represents most of the total compensation being paid.

On examining similar-sized companies in the Norwegian Construction industry with market capitalizations between kr11b and kr36b, we discovered that the median CEO total compensation of that group was kr21m. That is to say, Jimmy Bengtsson is paid under the industry median. What's more, Jimmy Bengtsson holds kr8.3m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | kr4.7m | kr4.5m | 71% |

| Other | kr1.9m | kr1.9m | 29% |

| Total Compensation | kr6.6m | kr6.4m | 100% |

Speaking on an industry level, nearly 49% of total compensation represents salary, while the remainder of 51% is other remuneration. According to our research, Veidekke has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Veidekke ASA's Growth Numbers

Veidekke ASA's earnings per share (EPS) grew 8.3% per year over the last three years. Its revenue is up 12% over the last year.

We think the revenue growth is good. And the modest growth in EPS isn't bad, either. So while we'd stop just short of calling this a top performer, but we think it is well worth watching. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Veidekke ASA Been A Good Investment?

With a total shareholder return of 8.8% over three years, Veidekke ASA has done okay by shareholders, but there's always room for improvement. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

To Conclude...

While the company seems to be headed in the right direction performance-wise, there's always room for improvement. Assuming the business continues to grow at a good clip, few shareholders would raise any objections to the CEO's remuneration. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for Veidekke that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:VEI

Veidekke

Operates as a construction and property development company in Norway, Sweden, and Denmark.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives