- Norway

- /

- Construction

- /

- OB:VEI

A Look at Veidekke (OB:VEI) Valuation Following Key Win on Gothenburg West Link Rail Project

Reviewed by Simply Wall St

Veidekke (OB:VEI) has just been tapped by the Swedish Transport Administration to take over pivotal works on the Korsvagen stretch of Gothenburg’s West Link rail project. This follows the sudden end of the prior contractor’s agreement and puts Veidekke into a demanding, evolving contract.

See our latest analysis for Veidekke.

Veidekke’s selection for this critical infrastructure project comes soon after its recent contract win to build a new cultural centre near Stockholm, further lifting its profile in Sweden. Despite short-term share price softening, Veidekke’s one-year total shareholder return of nearly 34% and three-year return above 130% highlight strong long-term momentum and renewed optimism about its growth potential.

If contracts like these spark your curiosity, now is the perfect moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

But with shares already rallying over the past year, is Veidekke currently undervalued given its project wins and growth? Or is the future already fully reflected in the price, leaving limited upside for new investors?

Price-to-Earnings of 16.7x: Is it justified?

Veidekke currently trades at a price-to-earnings (P/E) ratio of 16.7x, noticeably above both its peer average of 15.5x and the European Construction industry’s average of 14.6x. Despite the rally in its share price, the market assigns Veidekke a premium multiple versus competitors.

The price-to-earnings ratio measures how much investors are willing to pay for each unit of a company's earnings, offering a snapshot of sentiment and perceived growth prospects in the sector. For construction firms like Veidekke, the P/E highlights how the market values future profit sustainability amid heavy project pipelines and operational risks.

Looking closer, Veidekke’s P/E suggests that investors expect more robust earnings growth and potentially superior returns compared to its peers. However, when compared to the estimated fair P/E of 13.5x, Veidekke still appears somewhat overvalued by traditional benchmarks. This indicates the current price reflects high optimism or embeds expectations of continued project wins and execution.

Against the industry’s and estimated fair benchmarks, Veidekke’s premium multiple may be tough to justify unless profitability improves meaningfully or project momentum accelerates from this point.

Explore the SWS fair ratio for Veidekke

Result: Price-to-Earnings of 16.7x (OVERVALUED)

However, persistent share price weakness or project execution setbacks could quickly challenge the positive growth narrative that supports Veidekke’s current market valuation.

Find out about the key risks to this Veidekke narrative.

Another View: Discounted Cash Flow Says Shares May Be Cheap

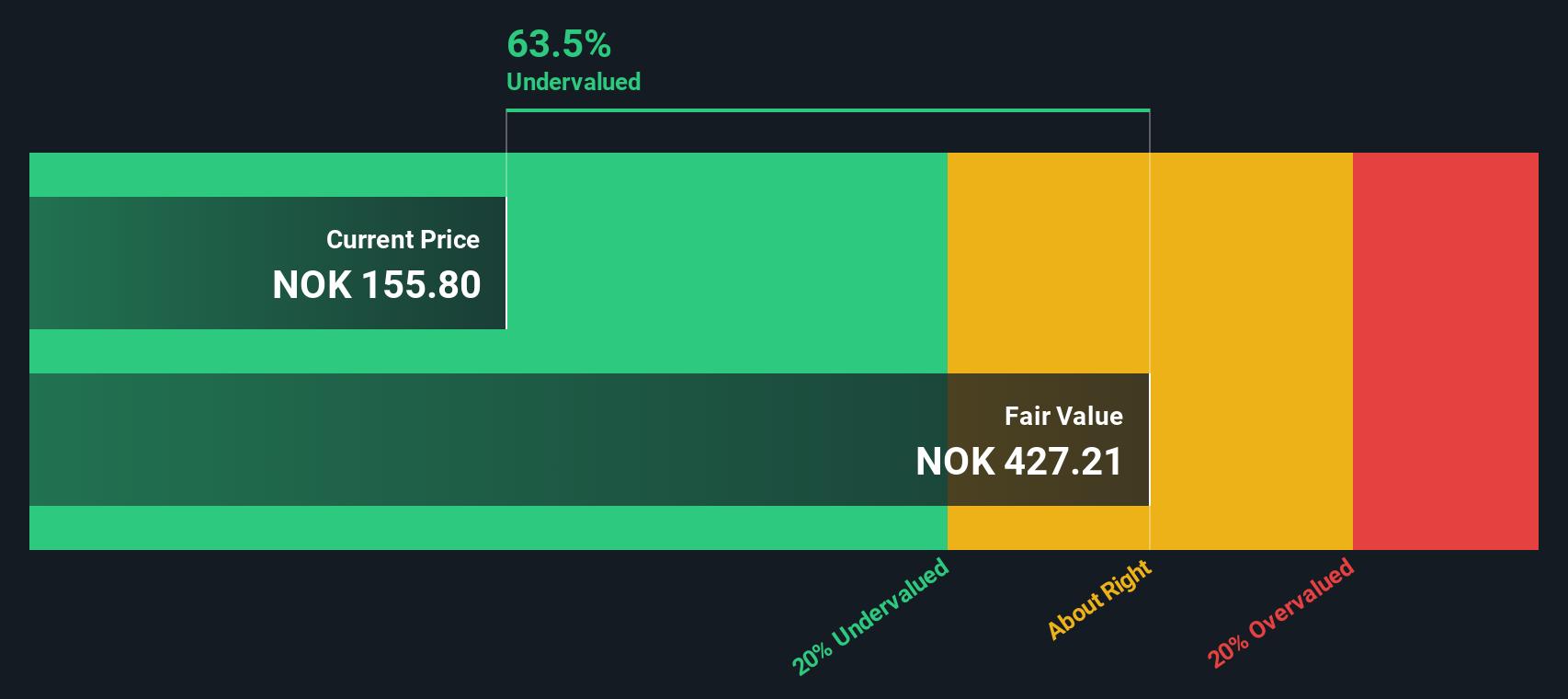

While the price-to-earnings multiple suggests Veidekke might be expensive compared with peers, our DCF model offers a much more optimistic picture. According to the SWS DCF model, Veidekke is trading at a significant 63% discount to its estimated fair value, signaling that the market may be overlooking something.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Veidekke for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Veidekke Narrative

If you want to dig into the numbers, challenge these conclusions, or simply see the story from your perspective, you can craft your own case for Veidekke in just a few minutes with Do it your way.

A great starting point for your Veidekke research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let new opportunities slip through your fingers. Move quickly and widen your investment radar. Smart investors are always scouting the next breakout trend.

- Capitalize on the future of healthcare innovation by tapping into these 33 healthcare AI stocks, making headlines with life-changing technology and growing demand.

- Boost your income potential and spot reliable picks with these 17 dividend stocks with yields > 3%, which consistently deliver yields above 3% and support your long-term goals.

- Position yourself for the next big leap in technology by acting on these 26 quantum computing stocks, transforming industries with revolutionary computing advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:VEI

Veidekke

Operates as a construction and property development company in Norway, Sweden, and Denmark.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives