- Norway

- /

- Aerospace & Defense

- /

- OB:NUMND

Positive Sentiment Still Eludes Nordic Unmanned ASA (OB:NUMND) Following 25% Share Price Slump

Nordic Unmanned ASA (OB:NUMND) shares have had a horrible month, losing 25% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 89% loss during that time.

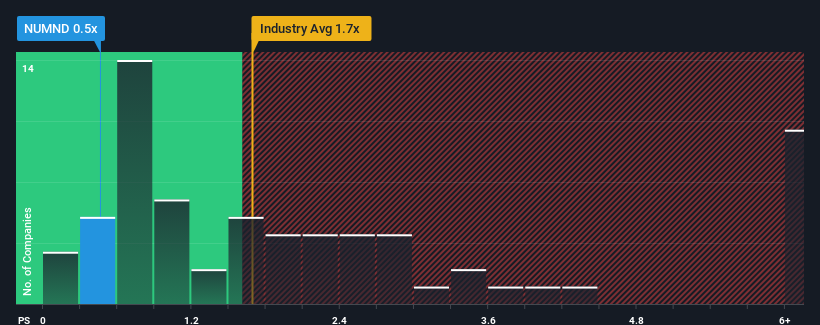

After such a large drop in price, given about half the companies operating in Norway's Aerospace & Defense industry have price-to-sales ratios (or "P/S") above 1.7x, you may consider Nordic Unmanned as an attractive investment with its 0.5x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Nordic Unmanned

What Does Nordic Unmanned's P/S Mean For Shareholders?

For example, consider that Nordic Unmanned's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Nordic Unmanned will help you shine a light on its historical performance.How Is Nordic Unmanned's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Nordic Unmanned's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.0%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 148% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 15% shows it's noticeably more attractive.

With this in mind, we find it intriguing that Nordic Unmanned's P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Nordic Unmanned's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Nordic Unmanned currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

Before you settle on your opinion, we've discovered 5 warning signs for Nordic Unmanned that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Nordic Unmanned might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:NUMND

Nordic Unmanned

Provides drones, data capture products, and flight services worldwide.

Slight and slightly overvalued.