- Norway

- /

- Aerospace & Defense

- /

- OB:KOG

Should You Be Adding Kongsberg Gruppen (OB:KOG) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Kongsberg Gruppen (OB:KOG). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Quickly Is Kongsberg Gruppen Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, Kongsberg Gruppen has grown EPS by 34% per year, compound, in the last three years. So it's not surprising to see the company trades on a very high multiple of (past) earnings.

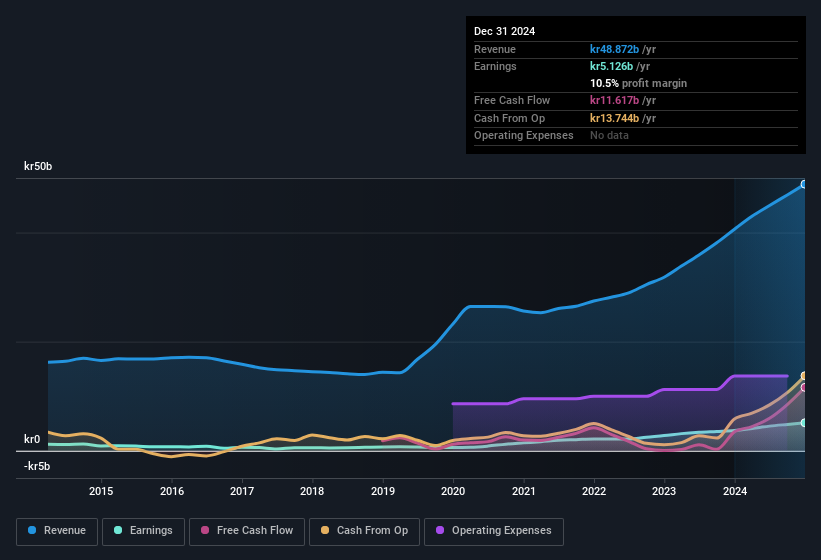

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Kongsberg Gruppen maintained stable EBIT margins over the last year, all while growing revenue 20% to kr49b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

See our latest analysis for Kongsberg Gruppen

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Kongsberg Gruppen.

Are Kongsberg Gruppen Insiders Aligned With All Shareholders?

Owing to the size of Kongsberg Gruppen, we wouldn't expect insiders to hold a significant proportion of the company. But we do take comfort from the fact that they are investors in the company. We note that their impressive stake in the company is worth kr3.4b. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Should You Add Kongsberg Gruppen To Your Watchlist?

For growth investors, Kongsberg Gruppen's raw rate of earnings growth is a beacon in the night. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. Of course, profit growth is one thing but it's even better if Kongsberg Gruppen is receiving high returns on equity, since that should imply it can keep growing without much need for capital. Click on this link to see how it is faring against the average in its industry.

Although Kongsberg Gruppen certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Norwegian companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kongsberg Gruppen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:KOG

Kongsberg Gruppen

Provides high-tech systems and solutions primarily to customers in the maritime and defense markets.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives