- Norway

- /

- Aerospace & Defense

- /

- OB:KOG

Kongsberg Gruppen ASA (OB:KOG) Just Released Its Third-Quarter Results And Analysts Are Updating Their Estimates

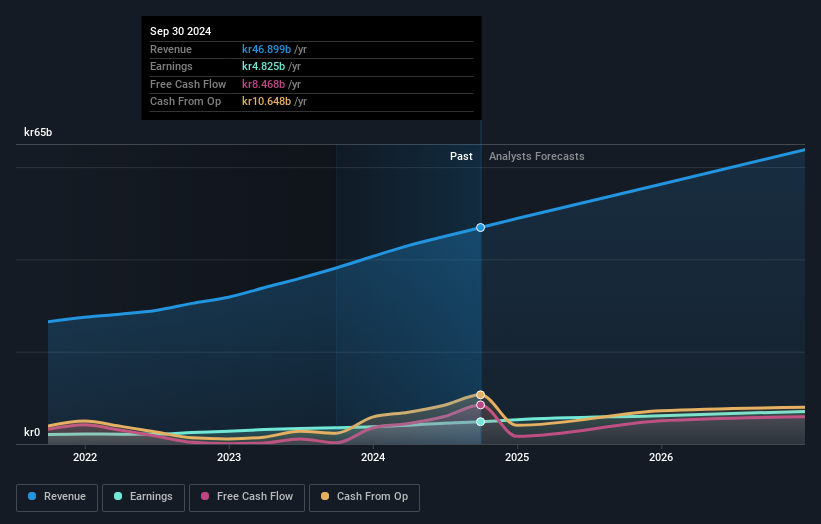

Investors in Kongsberg Gruppen ASA (OB:KOG) had a good week, as its shares rose 2.1% to close at kr1,143 following the release of its quarterly results. Kongsberg Gruppen reported kr12b in revenue, roughly in line with analyst forecasts, although statutory earnings per share (EPS) of kr7.72 beat expectations, being 3.1% higher than what the analysts expected. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

See our latest analysis for Kongsberg Gruppen

Taking into account the latest results, the most recent consensus for Kongsberg Gruppen from seven analysts is for revenues of kr56.3b in 2025. If met, it would imply a sizeable 20% increase on its revenue over the past 12 months. Per-share earnings are expected to bounce 27% to kr34.96. Before this earnings report, the analysts had been forecasting revenues of kr55.4b and earnings per share (EPS) of kr33.90 in 2025. So the consensus seems to have become somewhat more optimistic on Kongsberg Gruppen's earnings potential following these results.

There's been no major changes to the consensus price target of kr1,145, suggesting that the improved earnings per share outlook is not enough to have a long-term positive impact on the stock's valuation. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values Kongsberg Gruppen at kr1,500 per share, while the most bearish prices it at kr806. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We can infer from the latest estimates that forecasts expect a continuation of Kongsberg Gruppen'shistorical trends, as the 16% annualised revenue growth to the end of 2025 is roughly in line with the 15% annual growth over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 10% per year. So it's pretty clear that Kongsberg Gruppen is forecast to grow substantially faster than its industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Kongsberg Gruppen following these results. Fortunately, they also reconfirmed their revenue numbers, suggesting that it's tracking in line with expectations. Additionally, our data suggests that revenue is expected to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that in mind, we wouldn't be too quick to come to a conclusion on Kongsberg Gruppen. Long-term earnings power is much more important than next year's profits. We have forecasts for Kongsberg Gruppen going out to 2026, and you can see them free on our platform here.

We also provide an overview of the Kongsberg Gruppen Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

Valuation is complex, but we're here to simplify it.

Discover if Kongsberg Gruppen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:KOG

Kongsberg Gruppen

Provides high-tech systems and solutions primarily to customers in the maritime and defense markets.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives