- Norway

- /

- Aerospace & Defense

- /

- OB:KOG

How Investors May Respond To Kongsberg Gruppen (OB:KOG) Expanding Drone Defense and Global Production Capacity

Reviewed by Sasha Jovanovic

- Norwegian defense company Kongsberg Gruppen recently announced the expansion of its air defense offerings to include advanced drone detection and control, highlighted by rapid deployment in Ukraine and new missile production facilities under development in Australia and the US.

- This expansion underscores Kongsberg's response to increasing drone threats across Europe and its efforts to strengthen supply chain resilience and address surging global defense demand.

- We'll explore how the rollout of advanced drone capabilities and international factory investments could reshape Kongsberg Gruppen's investment outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Kongsberg Gruppen Investment Narrative Recap

To be a Kongsberg Gruppen shareholder, you likely see value in the company’s role as a supplier to allied governments amid persistently high global defense spending and rising security threats in Europe. The news of expanded drone defense in Ukraine and new missile factories supports the short-term growth story, but does not eliminate the risk that elevated order backlogs may eventually peak if government procurement priorities change.

Of the latest announcements, the NOK 6.5 billion agreement with Germany for Joint Strike Missiles aligns closely with the company’s increased focus on advanced defense products. This contract highlights both surging demand and the challenge of translating large, complex agreements into recurring high-margin revenue, making it central to the current investment debate.

Yet, in contrast to accelerating defense orders and growing revenues, investors need to be aware of the possibility that shifting political priorities could...

Read the full narrative on Kongsberg Gruppen (it's free!)

Kongsberg Gruppen's outlook points to NOK83.8 billion in revenue and NOK9.2 billion in earnings by 2028. This implies annual revenue growth of 16.4% and a NOK2.5 billion increase in earnings from the current NOK6.7 billion.

Uncover how Kongsberg Gruppen's forecasts yield a NOK325.17 fair value, a 3% downside to its current price.

Exploring Other Perspectives

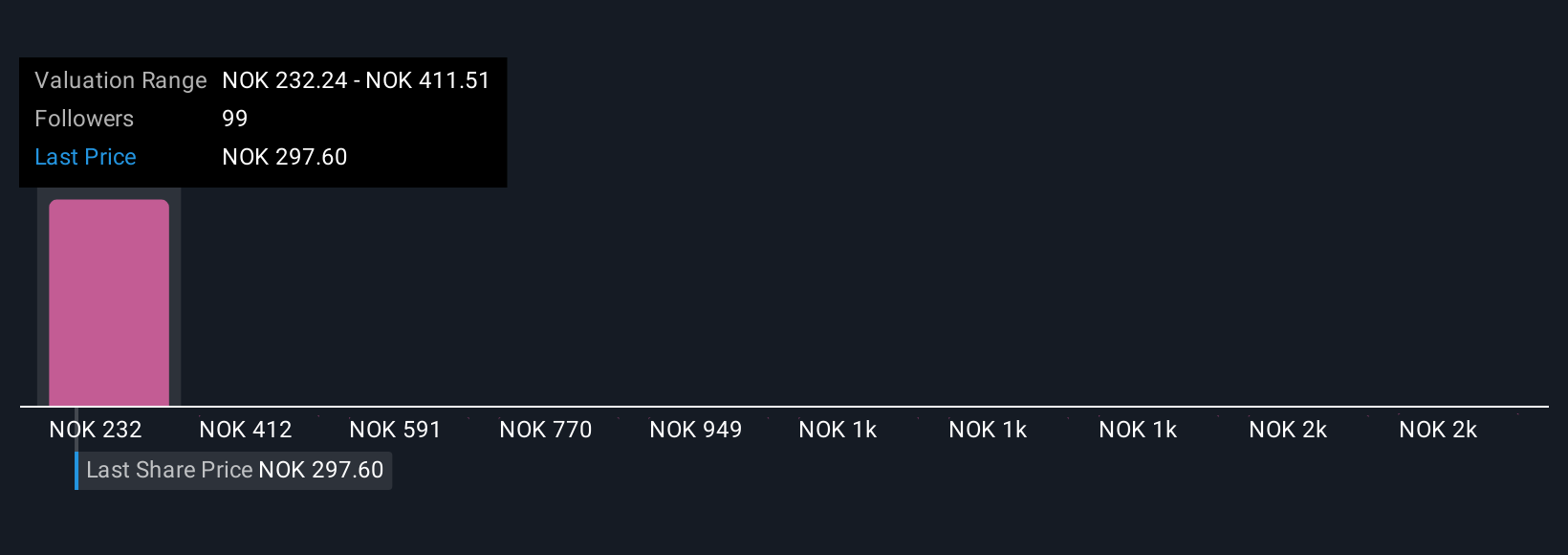

Eleven unique fair value estimates from the Simply Wall St Community for Kongsberg Gruppen span from NOK237 to over NOK2,000 per share, with sharply contrasting views. Rapid order intake and expanded global defense capabilities may please optimists, but the persistence of these trends remains uncertain so consider a variety of perspectives before forming your own view.

Explore 11 other fair value estimates on Kongsberg Gruppen - why the stock might be worth 29% less than the current price!

Build Your Own Kongsberg Gruppen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kongsberg Gruppen research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Kongsberg Gruppen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kongsberg Gruppen's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kongsberg Gruppen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:KOG

Kongsberg Gruppen

Provides high-tech systems and solutions primarily to customers in the maritime and defense markets.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives