Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Hexagon Composites ASA (OB:HEX) does use debt in its business. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Hexagon Composites

What Is Hexagon Composites's Debt?

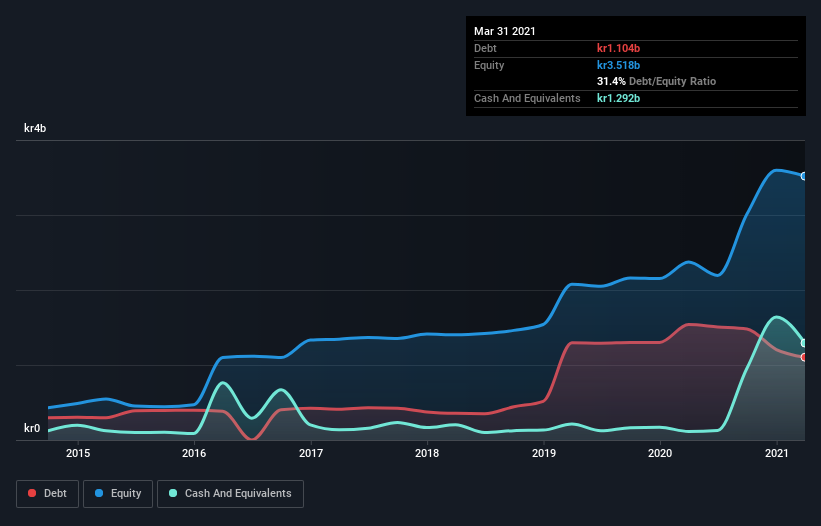

As you can see below, Hexagon Composites had kr1.10b of debt at March 2021, down from kr1.54b a year prior. But on the other hand it also has kr1.29b in cash, leading to a kr188.2m net cash position.

How Healthy Is Hexagon Composites' Balance Sheet?

The latest balance sheet data shows that Hexagon Composites had liabilities of kr881.2m due within a year, and liabilities of kr1.52b falling due after that. On the other hand, it had cash of kr1.29b and kr679.7m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by kr432.6m.

Given Hexagon Composites has a market capitalization of kr7.25b, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. While it does have liabilities worth noting, Hexagon Composites also has more cash than debt, so we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Hexagon Composites's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Hexagon Composites had a loss before interest and tax, and actually shrunk its revenue by 14%, to kr2.9b. That's not what we would hope to see.

So How Risky Is Hexagon Composites?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And the fact is that over the last twelve months Hexagon Composites lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of kr77m and booked a kr296m accounting loss. Given it only has net cash of kr188.2m, the company may need to raise more capital if it doesn't reach break-even soon. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with Hexagon Composites , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Hexagon Composites, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hexagon Composites might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:HEX

Hexagon Composites

Provides alternative fuel systems and solutions to commercial vehicles and gas distribution companies worldwide.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives