- Norway

- /

- Construction

- /

- OB:CADLR

Could Cadeler’s New UK Hub Reveal a Shift in Its Growth Strategy (OB:CADLR)?

Reviewed by Sasha Jovanovic

- Cadeler has opened a new and significantly larger UK office in Norwich, relocating its team from Great Yarmouth to better support its growing offshore wind project portfolio across the UK and Europe.

- This move not only reflects Cadeler's commitment to the UK renewable energy sector but also establishes Norwich as a central hub for engineering, project management, and commercial collaboration.

- We'll examine how Cadeler's expanded office space in Norwich could shape the company's investment narrative and operational growth outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Cadeler Investment Narrative Recap

The investment case for Cadeler centers on its ability to capitalize on a forecasted global shortfall of advanced wind installation vessels and the rising demand for offshore wind infrastructure. While opening a larger UK office in Norwich signals a commitment to the region and operational growth, the move is unlikely to materially change the short term catalysts or address the biggest risk: reliance on project pipeline stability amid shifting auction timelines. The most closely related recent announcement is Cadeler's relocation and expansion in Asia with a new Taipei office, reflecting ongoing efforts to diversify beyond Europe. This ties in with catalysts around global expansion, but also highlights the importance of mitigating geographic concentration risk as government policies and project delays remain key challenges. However, investors should also be aware that in contrast to long term growth drivers, recurring project delays and cancellations...

Read the full narrative on Cadeler (it's free!)

Cadeler's narrative projects €1.0 billion revenue and €406.3 million earnings by 2028. This requires 30.6% yearly revenue growth and a €173.7 million earnings increase from €232.6 million today.

Uncover how Cadeler's forecasts yield a NOK83.62 fair value, a 86% upside to its current price.

Exploring Other Perspectives

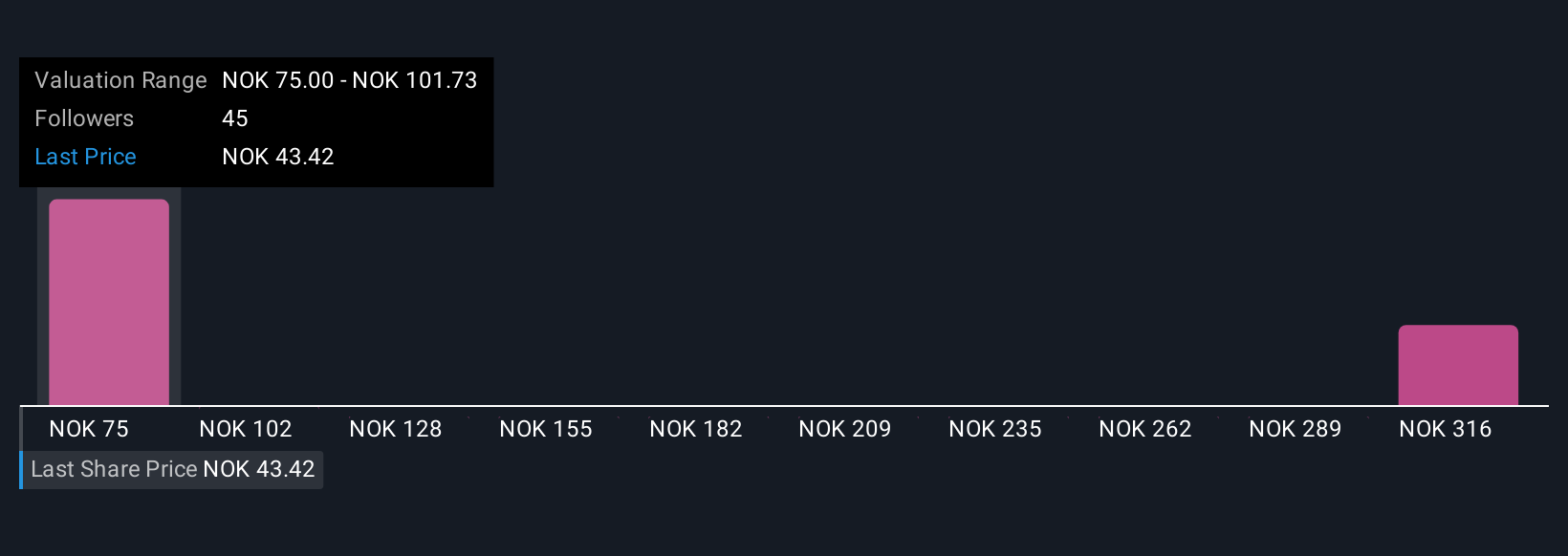

Simply Wall St Community members produced seven fair value estimates for Cadeler ranging from NOK75 to NOK348. Some see risk in Cadeler’s concentrated European exposure, which could bring further project delays affecting future revenue visibility. Explore these perspectives to see how your views compare.

Explore 7 other fair value estimates on Cadeler - why the stock might be worth just NOK75.00!

Build Your Own Cadeler Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cadeler research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cadeler research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cadeler's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:CADLR

Cadeler

Engages in offshore wind farm installation, operations, and maintenance services in Denmark.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives