- Norway

- /

- Construction

- /

- OB:CADLR

Cadeler (OB:CADLR) Lands €500 Million Offshore Wind Contracts Pending Approval—Is Revenue Stability Within Reach?

Reviewed by Sasha Jovanovic

- Cadeler announced in the past week that it has signed two firm contracts worth approximately €500 million to carry out full-scope transportation and installation of wind turbines and foundations for a new offshore wind farm, with work scheduled from 2029 to 2030 using both A-class and O-class vessels.

- This marks Cadeler's third comprehensive foundation transportation and installation project, highlighting its growing reputation as a complete service provider in the offshore wind sector, although both contracts remain subject to the client's final investment decision and may be cancelled with a termination fee.

- We'll explore how these large-scale contract wins, pending client approval, affect Cadeler's perceived revenue stability and backlog strength in its investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Cadeler Investment Narrative Recap

To invest in Cadeler, you need to believe in the company’s ability to secure and execute multi-year offshore wind contracts as sector complexity rises, supporting long-term revenue visibility and utilization. While the recently signed EUR 500 million contracts enhance perceived backlog strength and revenue stability, they do not materially shift the most important short-term catalyst, final investment decisions on existing pipeline projects, or mitigate the biggest risk, which remains project delays or cancellations, potentially resulting in unsustainable reliance on one-off termination fees.

Among recent news, the July 2025 contract termination notice from Ørsted stands out, since it directly touches on the risk of project discontinuations and compensatory fees. This announcement places the spotlight back on contract execution, project pipeline stability, and reinforces why finalized client commitments, not just contract signings, are essential to backing Cadeler’s investment outlook.

However, investors should be aware that even as new wins are publicized, if project delays or interruptions become frequent ...

Read the full narrative on Cadeler (it's free!)

Cadeler's outlook anticipates €1.0 billion in revenue and €406.3 million in earnings by 2028. This assumes a 30.6% annual revenue growth rate and a €173.7 million earnings increase from the current earnings of €232.6 million.

Uncover how Cadeler's forecasts yield a NOK83.62 fair value, a 93% upside to its current price.

Exploring Other Perspectives

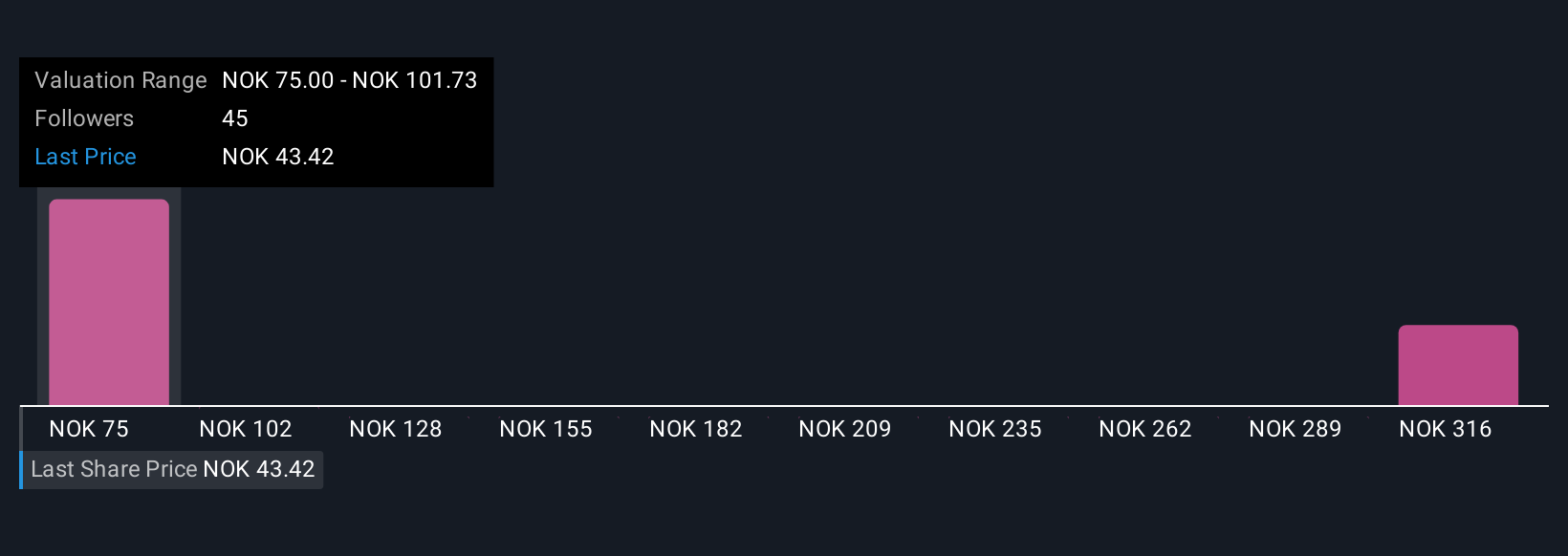

Seven members of the Simply Wall St Community have set Cadeler fair values ranging widely from NOK75 to NOK191.87. With project delays flagged as a critical risk, differing viewpoints highlight the importance of examining both execution risk and sector opportunity before deciding your next move.

Explore 7 other fair value estimates on Cadeler - why the stock might be worth just NOK75.00!

Build Your Own Cadeler Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cadeler research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cadeler research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cadeler's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:CADLR

Cadeler

Engages in offshore wind farm installation, operations, and maintenance services in Denmark.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives