- Norway

- /

- Industrials

- /

- OB:AKER

The Bull Case For Aker (OB:AKER) Could Change Following Joint Venture Launch in Sovereign AI Infrastructure

Reviewed by Sasha Jovanovic

- Aker and Nscale Global Holdings recently completed the closing of their 50/50 joint venture in Narvik, Northern Norway, launching "Aker Nscale" to provide secure, scalable, and energy-efficient infrastructure geared for sovereign AI workloads across Europe.

- This collaboration signals Aker’s accelerated entry into the AI infrastructure space, underscored by Kristian Røkke’s appointment as CEO and a broad operational presence in Norway.

- We'll examine how Aker's push into sovereign AI infrastructure reshapes its investment narrative and future European market positioning.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Aker's Investment Narrative?

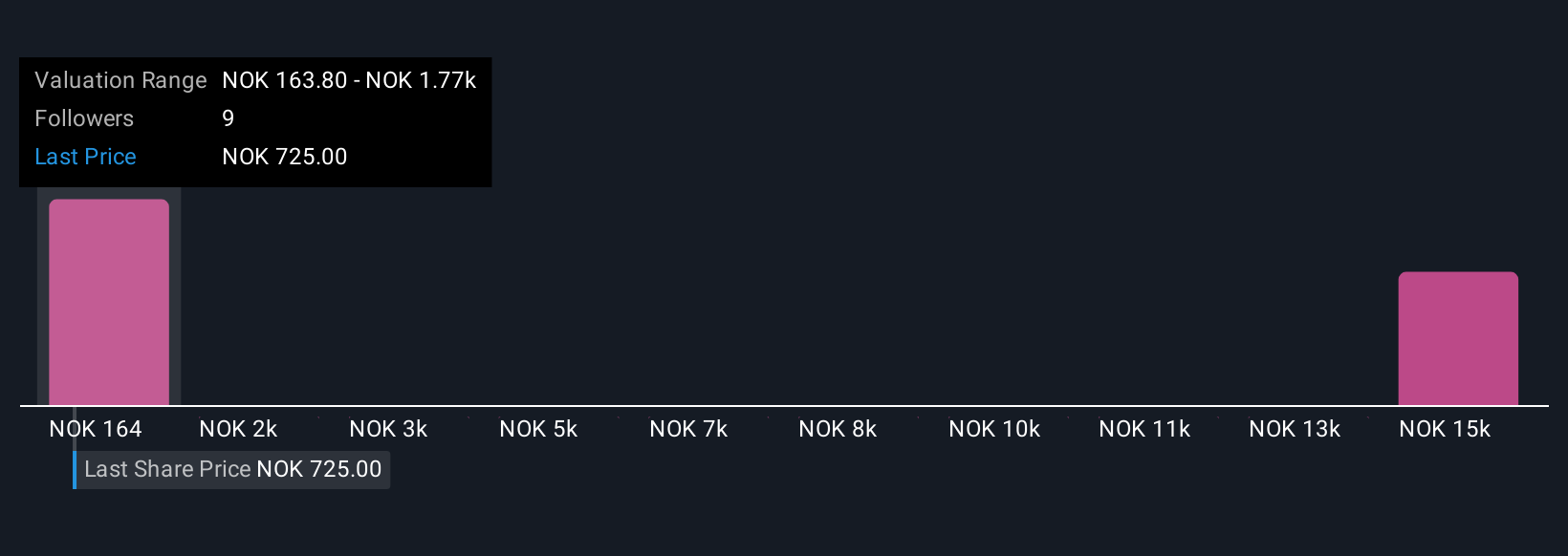

For shareholders in Aker, belief in the company hinges on its ambition to reinvent itself with a clear tilt toward AI infrastructure and digitalization. The recent Aker Nscale joint venture, especially given the scale of its contract with Microsoft and the appointment of Kristian Røkke as CEO, brings a potentially material new catalyst for the business. Previously, key risks revolved around inconsistent profitability, board turnover, and earnings distorted by significant one-off items. This new move could shift attention toward execution risk in scaling AI infrastructure, integrating new operations, and meeting expectations on shareholder returns, especially as dividends remain uncomfortably uncovered by earnings. Meanwhile, although the company is trading at a steep discount to some analyst price targets, questions around board independence and short-term financial health remain top of mind for many investors assessing Aker’s outlook after this news.

But don’t overlook board independence and ongoing profit volatility, these are issues every investor should consider.

Exploring Other Perspectives

Explore 4 other fair value estimates on Aker - why the stock might be a potential multi-bagger!

Build Your Own Aker Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aker research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Aker research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aker's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AKER

Aker

Operates as an industrial investment company in Norway, Europa, North America, South America, and internationally.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives