- Norway

- /

- Industrials

- /

- OB:AKER

Aker (OB:AKER): Exploring Valuation After Impressive Share Price Gains in 2024

Reviewed by Kshitija Bhandaru

Aker (OB:AKER) shares have quietly been gaining momentum in recent months, climbing 17% over the past 3 months and 36% so far this year. The stock’s recent performance has attracted attention and is encouraging investors to revisit its potential valuation.

See our latest analysis for Aker.

Momentum seems to be building for Aker, with its share price return climbing steadily this year and the 1-year total shareholder return hitting 51.2%. This progress comes even as headlines remain quiet. This suggests investors are starting to see renewed growth potential and improved sentiment around the stock’s valuation and outlook.

If you're keeping an eye on companies capitalizing on shifting fundamentals, it's an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With shares up significantly, the key question now is whether Aker is trading below its intrinsic value or if optimistic expectations are already reflected in the price. This could potentially leave limited upside for new investors.

Price-to-Sales Ratio of 4.2x: Is it justified?

Aker is trading at a price-to-sales (P/S) ratio of 4.2x, which is well above both its peer group and the broader European Industrials industry. This signals a premium valuation relative to its revenue base. Given the last close price of NOK781.0 per share, the market appears to be placing a higher value on each unit of Aker’s sales compared to many of its competitors.

The price-to-sales ratio measures how much investors are willing to pay for every krone of the company's revenue. For an industrial company like Aker, this metric is often used when comparing firms with varying profitability or when earnings are influenced by one-off events. A high P/S ratio typically indicates optimism around future growth, margins, or operational resilience.

Currently, Aker's P/S ratio of 4.2x is significantly higher than the European Industrials industry average of 0.9x and the peer average of 2.9x. This steep premium may suggest elevated growth or profitability expectations, but it also means new investors risk paying too much if these expectations do not materialize.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales Ratio of 4.2x (OVERVALUED)

However, factors like disappointing revenue growth or an unexpected shift in market sentiment could quickly undermine the current optimism surrounding Aker’s valuation.

Find out about the key risks to this Aker narrative.

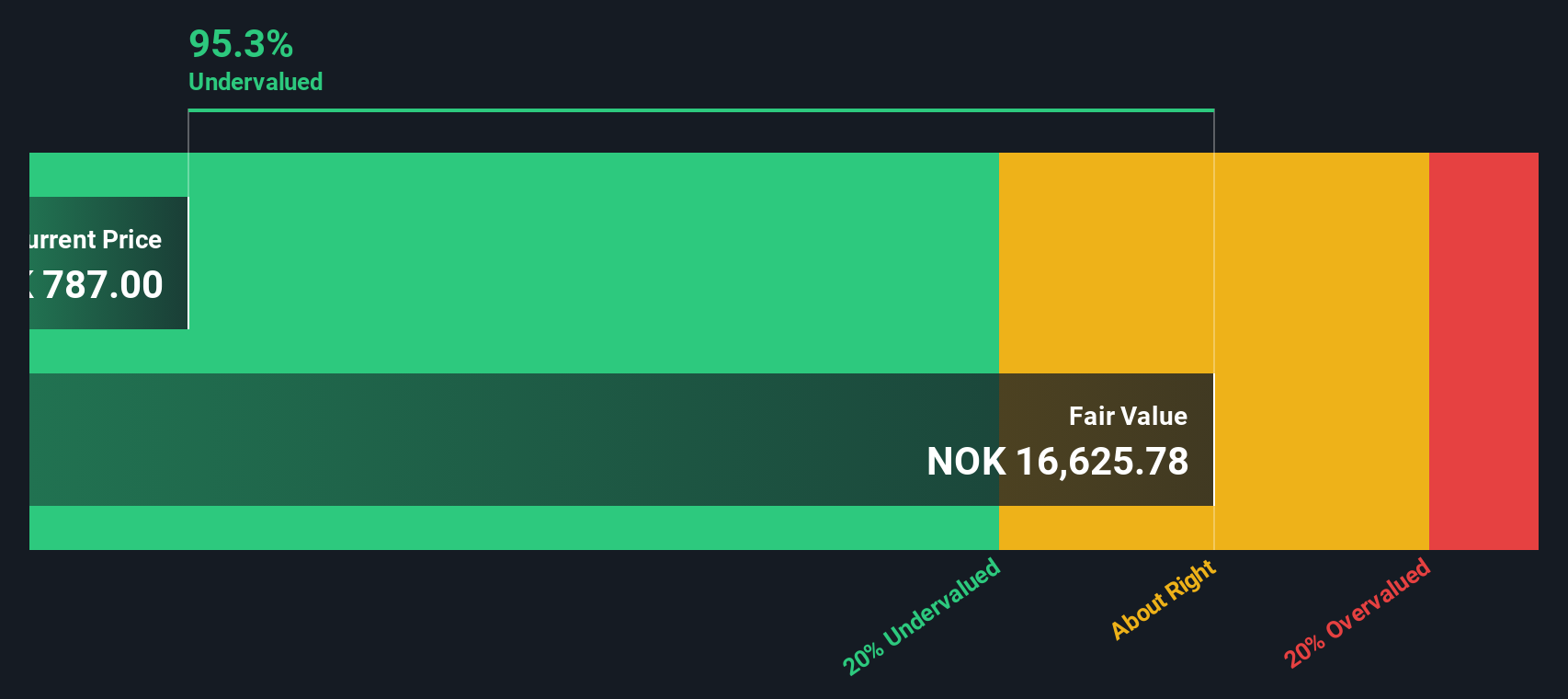

Another View: Discounted Cash Flow Signals Undervaluation

While the market assigns Aker a premium based on its price-to-sales ratio, our DCF model paints a contrasting picture. It estimates Aker’s fair value at NOK16,507.8 per share, which is far above the current price. This suggests a major disconnect between market sentiment and underlying cash flow potential. Could the DCF be highlighting a hidden opportunity, or is the market’s caution justified?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aker for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aker Narrative

Keep in mind, if you see the story differently or want to dive into your own analysis, you can build your personal view in just a few minutes with Do it your way.

A great starting point for your Aker research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Staying ahead in today's market means seeking out tomorrow’s winners before everybody else does. Don’t let the best opportunities pass you by. Put your next move in motion now.

- Boost your portfolio’s yield when you check out these 19 dividend stocks with yields > 3% with payouts exceeding 3% for smart, steady income potential.

- Tap into the power of artificial intelligence with these 24 AI penny stocks and position your investments at the forefront of digital innovation.

- Capture growth by seizing these 908 undervalued stocks based on cash flows packed with strong cash flows and overlooked value opportunities others might be missing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AKER

Aker

Operates as an industrial investment company in Norway, Europa, North America, South America, and internationally.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives