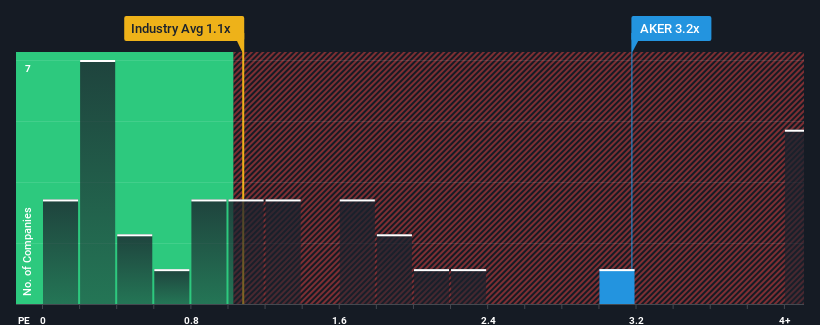

Aker ASA's (OB:AKER) price-to-sales (or "P/S") ratio of 3.2x may look like a poor investment opportunity when you consider close to half the companies in the Industrials industry in Norway have P/S ratios below 1.1x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Aker

How Has Aker Performed Recently?

For example, consider that Aker's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Aker's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Aker?

The only time you'd be truly comfortable seeing a P/S as steep as Aker's is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 45%. Still, the latest three year period has seen an excellent 231% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 5.3% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Aker is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What We Can Learn From Aker's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that Aker can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Aker (1 is concerning!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:AKER

Aker

Operates as an industrial investment company in Norway, Europa, North America, South America, and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives