- Romania

- /

- Capital Markets

- /

- BVB:EVER

Unearthing Europe's Undiscovered Stock Gems This October 2025

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index reaches record levels, driven by a rally in technology stocks and expectations for lower U.S. borrowing costs, the European market is buzzing with optimism. In this environment of rising indices and contained inflation risks, investors are on the lookout for lesser-known small-cap opportunities that may offer unique growth potential amid broader market gains.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Dekpol | 64.28% | 9.75% | 13.77% | ★★★★★☆ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Dn Agrar Group | 63.27% | 15.46% | 33.00% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Evergent Investments (BVB:EVER)

Simply Wall St Value Rating: ★★★★★☆

Overview: Evergent Investments SA is a publicly owned investment manager with a market capitalization of RON1.94 billion.

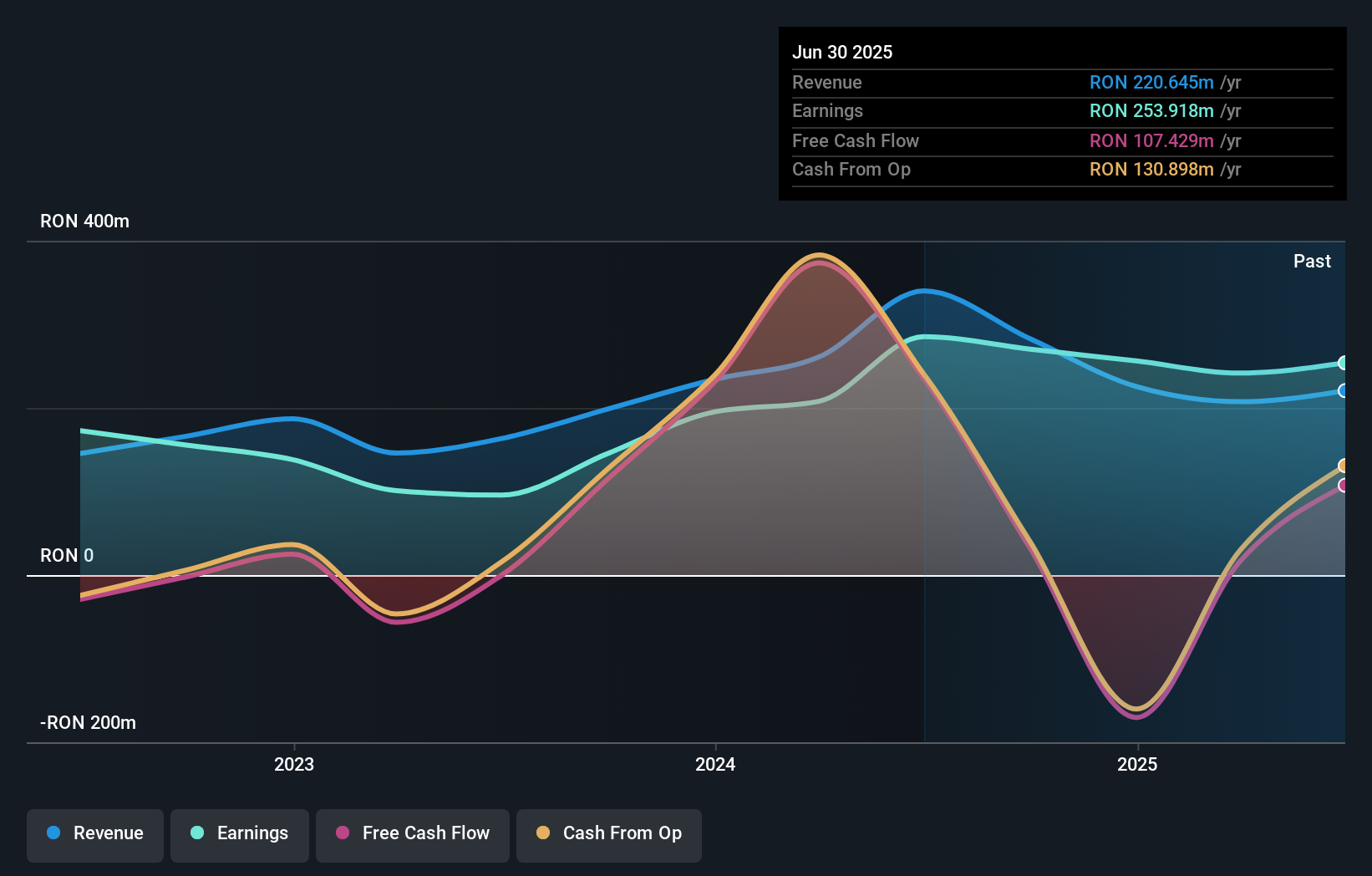

Operations: Evergent's primary revenue stream is from Financial Investment Services, generating RON190.94 million, followed by the Manufacture of Agricultural Machinery and Equipment at RON19.96 million. The company also earns from Cultivation of Fruit-Bearing Trees (Blueberries) with revenues of RON5.98 million and Real Estate Development (Apartments) contributing RON0.79 million.

Evergent Investments, a promising player in the European market, showcases a robust financial profile despite some challenges. With a debt-to-equity ratio rising from 0.6% to 3.8% over five years, it remains well-positioned with interest payments covered 12.3 times by EBIT. The company boasts high-quality earnings and maintains more cash than its total debt, reflecting sound financial health. Its price-to-earnings ratio of 7.6x is notably below the regional market average of 15.5x, suggesting potential undervaluation opportunities for investors seeking value plays in this segment of the capital markets industry.

- Delve into the full analysis health report here for a deeper understanding of Evergent Investments.

Evaluate Evergent Investments' historical performance by accessing our past performance report.

AF Gruppen (OB:AFG)

Simply Wall St Value Rating: ★★★★☆☆

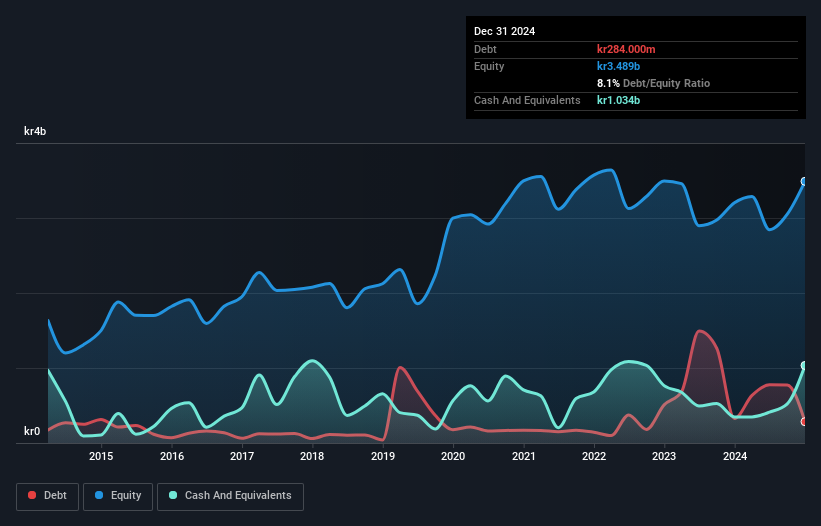

Overview: AF Gruppen ASA is a contracting and industrial company offering civil engineering, construction, energy and environment, property, and offshore services in Norway and Sweden with a market capitalization of approximately NOK18.59 billion.

Operations: AF Gruppen generates revenue primarily from its civil engineering (NOK10.38 billion) and construction (NOK8.89 billion) segments, with significant contributions also from Sweden (NOK4.82 billion) and Betonmast (NOK4.35 billion). The company has a notable presence in the energy and environment sector, contributing NOK1.49 billion to its total revenue stream, while offshore services add NOK1.04 billion.

AF Gruppen, a notable player in the construction sector, has shown impressive financial performance with earnings surging by 179% over the past year, outperforming the industry average. Despite an increase in its debt-to-equity ratio from 5.5 to 7.4 over five years, it holds more cash than total debt and covers interest payments comfortably at 41 times EBIT. Recent contracts like a NOK 500 million carbon capture facility and NOK 100 million school rehabilitation project highlight its growing order book. Additionally, AF Gruppen initiated a share repurchase program worth NOK 45 million to support its employee share scheme.

- Get an in-depth perspective on AF Gruppen's performance by reading our health report here.

Explore historical data to track AF Gruppen's performance over time in our Past section.

Cloetta (OM:CLA B)

Simply Wall St Value Rating: ★★★★★☆

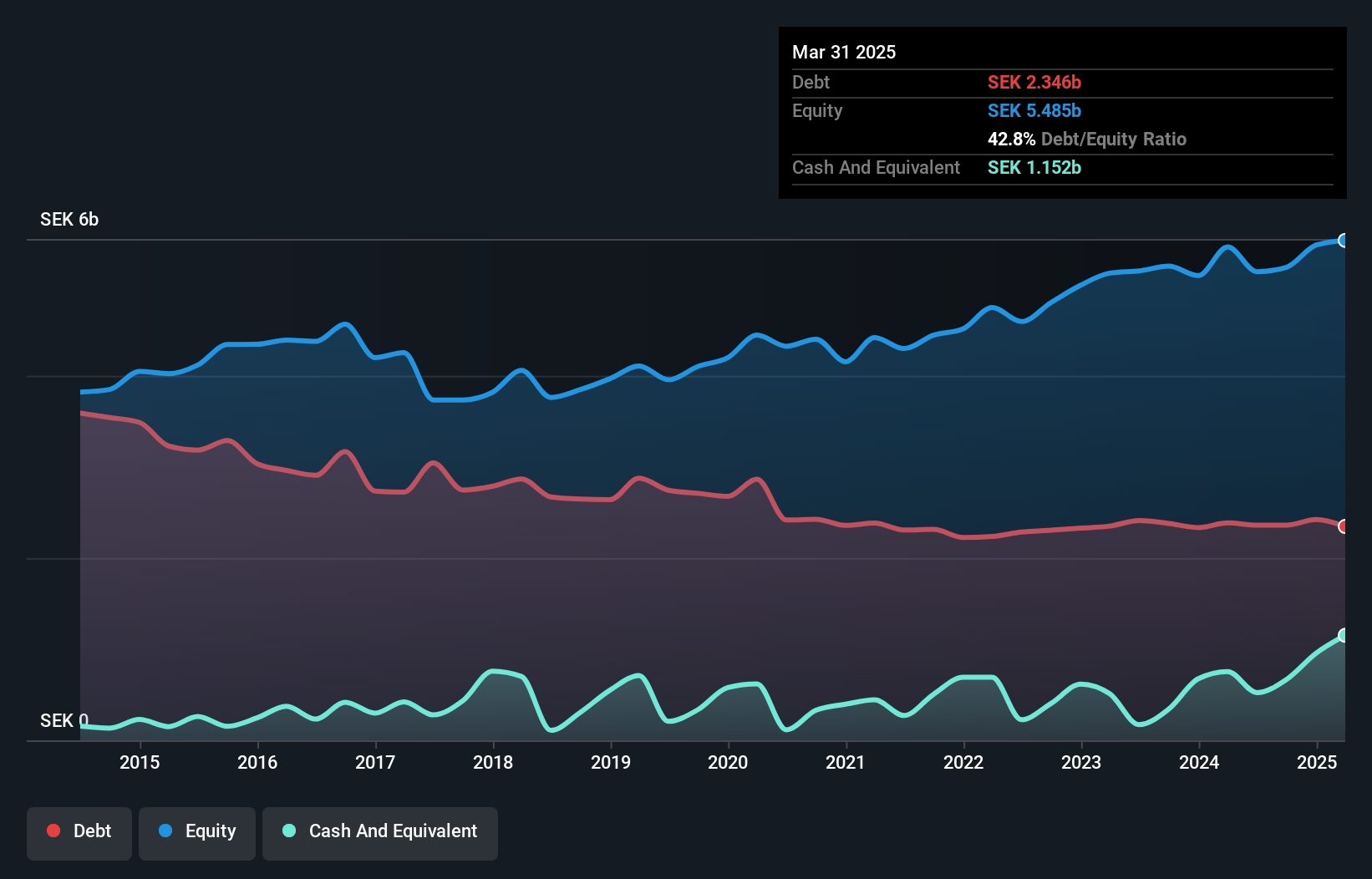

Overview: Cloetta AB (publ) is a confectionery company with a market capitalization of approximately SEK9.96 billion.

Operations: The company generates revenue from two primary segments: Pick & Mix, contributing SEK2.51 billion, and Packaged Branded Goods, adding SEK6.08 billion.

Cloetta, a notable player in the confectionery sector, appears to be trading at an attractive 50.2% below its estimated fair value. The company has demonstrated robust financial health with a debt to equity ratio reduction from 55.9% to 45.5% over five years and maintains satisfactory interest coverage of 6.4 times EBIT against its debt obligations. Recent earnings announcements revealed a net income increase from SEK 82 million to SEK 116 million for Q2, alongside improved basic earnings per share rising from SEK 0.29 to SEK 0.41 year-over-year, reflecting strong operational performance amidst strategic shifts and new financing agreements enhancing financial flexibility.

- Click here to discover the nuances of Cloetta with our detailed analytical health report.

Understand Cloetta's track record by examining our Past report.

Next Steps

- Discover the full array of 331 European Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evergent Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:EVER

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives