- Denmark

- /

- Construction

- /

- CPSE:MTHH

Undiscovered European Gems with Strong Potential for November 2025

Reviewed by Simply Wall St

As European markets experience a wave of optimism following the reopening of the U.S. federal government, with the STOXX Europe 600 Index rising by 1.77%, investor sentiment remains cautious due to cooling enthusiasm around artificial intelligence. In this environment, identifying stocks that demonstrate resilience and adaptability in response to shifting market dynamics can be key for investors seeking opportunities amid fluctuating economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| KABE Group AB (publ.) | 3.82% | 6.17% | 5.42% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Dn Agrar Group | 63.27% | 15.46% | 33.00% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

MT Højgaard Holding (CPSE:MTHH)

Simply Wall St Value Rating: ★★★★★★

Overview: MT Højgaard Holding A/S provides construction, civil engineering, and infrastructure services to private and public clients both in Denmark and internationally, with a market cap of DKK3.60 billion.

Operations: MT Højgaard Holding generates revenue through construction, civil engineering, and infrastructure services for both private and public sectors. The company's financial performance is influenced by its ability to manage project costs effectively.

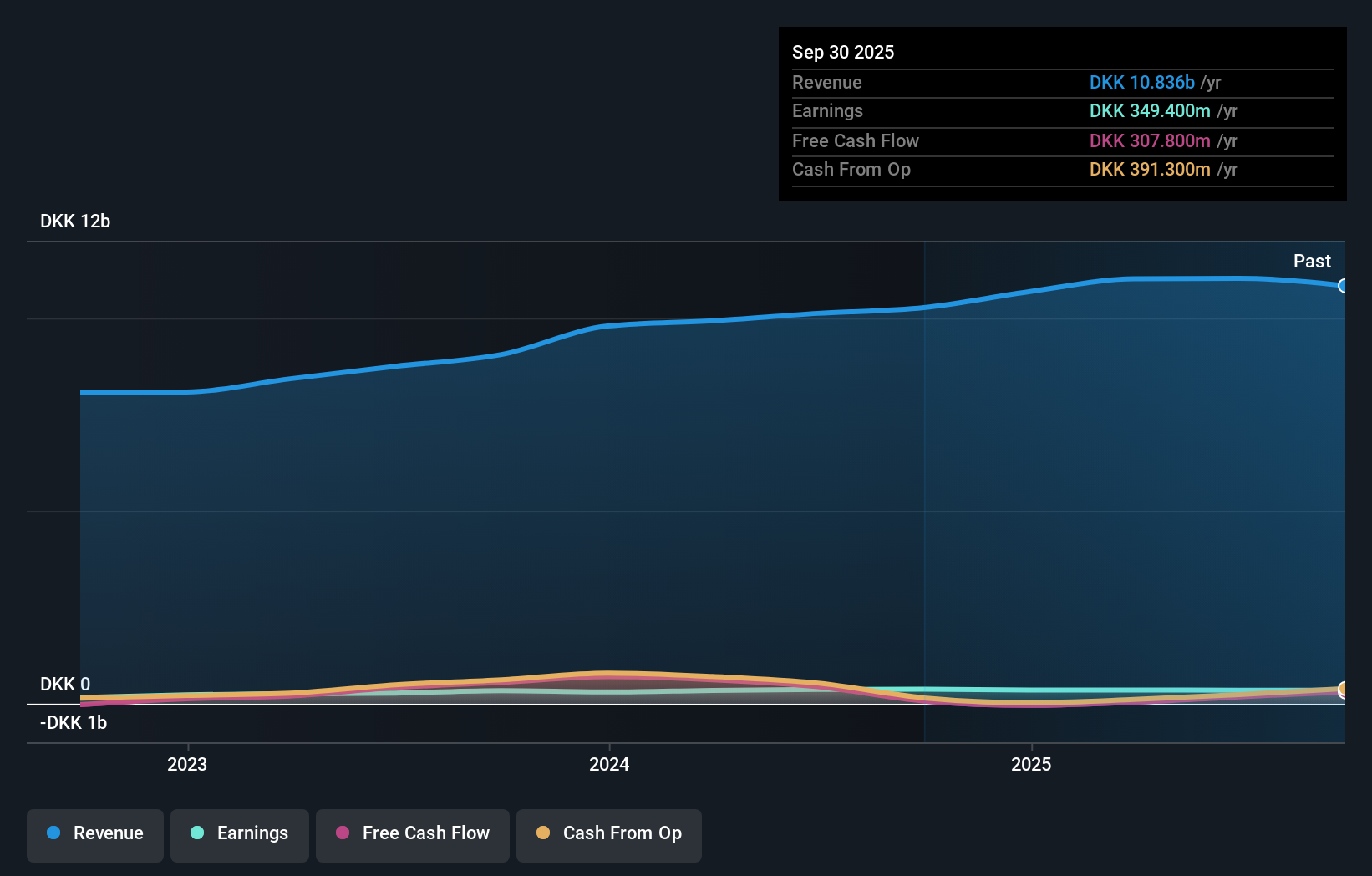

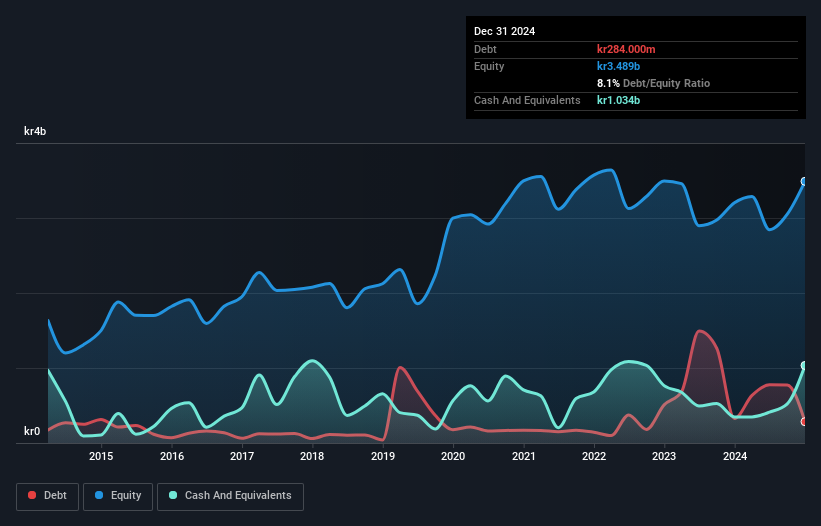

MT Højgaard Holding, a notable player in the construction sector, has demonstrated financial resilience with its debt to equity ratio dropping from 80.1% to 2.6% over five years. Despite a negative earnings growth of -6.9% last year compared to the industry average of 5.9%, it maintains high-quality earnings and free cash flow positivity. The company reported net income for Q3 at DKK 70 million, up from DKK 59 million the previous year, with sales reaching DKK 2,397 million despite a slight dip from last year's figures. Its price-to-earnings ratio stands attractively at 10x against the Danish market's average of 14x.

- Delve into the full analysis health report here for a deeper understanding of MT Højgaard Holding.

Evaluate MT Højgaard Holding's historical performance by accessing our past performance report.

AF Gruppen (OB:AFG)

Simply Wall St Value Rating: ★★★★★☆

Overview: AF Gruppen ASA is a contracting and industrial company offering civil engineering, construction, energy and environment, and property and offshore services in Norway and Sweden with a market cap of NOK19.75 billion.

Operations: AF Gruppen generates revenue primarily from its civil engineering, construction, energy and environment, and property and offshore services in Norway and Sweden. The company's net profit margin shows fluctuations with varying trends over different periods.

AF Gruppen, a notable player in the construction industry, has shown impressive financial performance with earnings growing by 105% over the past year, outpacing the industry's 3.4%. The company's debt management is robust, reducing its debt to equity ratio from 5.3 to 2.8 over five years and maintaining more cash than total debt. Recent projects include a NOK 582 million contract for a wastewater treatment plant and a NOK 464 million contract for hospital construction. With well-covered interest payments at an EBIT coverage of 56x and positive free cash flow, AF Gruppen appears financially sound with strong growth prospects.

- Dive into the specifics of AF Gruppen here with our thorough health report.

Gain insights into AF Gruppen's past trends and performance with our Past report.

MLP (XTRA:MLP)

Simply Wall St Value Rating: ★★★★★☆

Overview: MLP SE, along with its subsidiaries, offers financial services to private, corporate, and institutional clients in Germany and has a market capitalization of approximately €703.57 million.

Operations: MLP SE generates revenue primarily from financial services provided to private, corporate, and institutional clients in Germany. The company has a market capitalization of approximately €703.57 million.

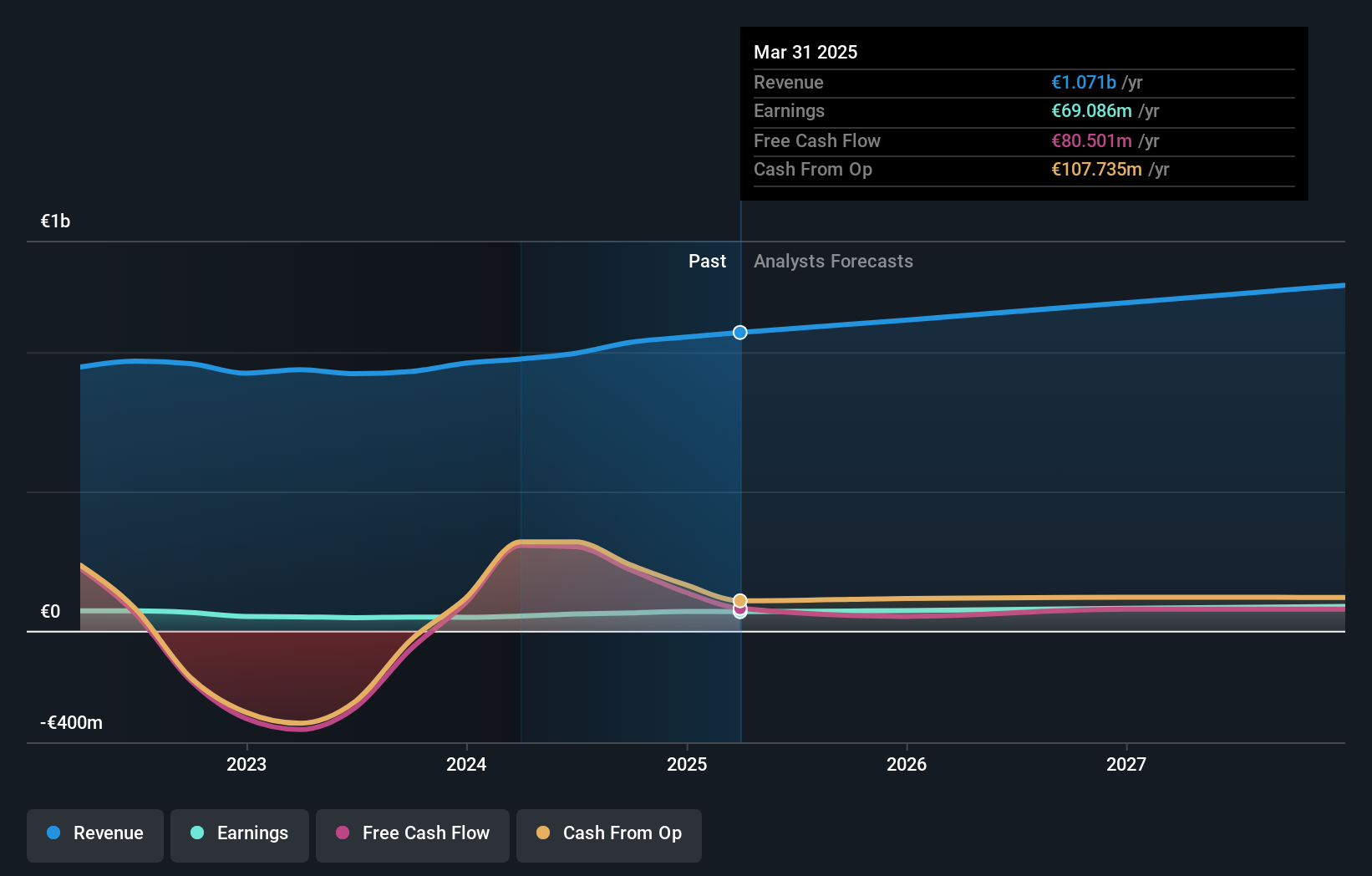

MLP, a financial services provider, is carving out its niche with strategic investments in AI and digital platforms. Despite recent challenges like capital market volatility and real estate risks, MLP's earnings have grown 4.8% annually over the past five years. The company reported Q3 2025 sales of €237.15M compared to €245.05M last year, while net income rose to €15.68M from €10.29M previously, showcasing resilience amidst industry pressures. Trading at 46% below estimated fair value and being debt-free adds to its appeal as an investment opportunity within the sector despite some potential headwinds in profit stability due to regulatory changes.

Next Steps

- Click through to start exploring the rest of the 319 European Undiscovered Gems With Strong Fundamentals now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:MTHH

MT Højgaard Holding

Engages in the provision of construction, civil engineering, and infrastructure services for private and public customers in Denmark and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives