Key Takeaways

- Strategic investments in artificial intelligence and digitalization enhance efficiency, expand offerings, and position MLP for sustainable revenue and earnings growth.

- Robust recurring revenues, a strong capital base, and an expanded client base underpin earnings stability and long-term financial flexibility.

- Revenue is threatened by capital market volatility, real estate risk, rising AI-driven costs, tighter regulations, and declining banking deposit income, challenging margin and profit stability.

Catalysts

About MLP- Provides financial services to private, corporate, and institutional clients in Germany.

- Strategic investments in artificial intelligence and digital platforms are expected to drive long-term cost efficiencies, enable process automation, and expand service offerings, which should gradually support higher net margins and improved earnings.

- Rapid growth in assets under management and managed non-life insurance premium volumes, supported by expanding recurring revenues (nearly 70% recurring), creates a strong foundation for sustainable, predictable revenue growth and earnings stability.

- Ongoing digitalization and innovative platforms (such as :pxtra and RVM SmartProtect) position MLP to capture growing corporate and SME demand for employee benefits and insurance solutions, expanding its client base and lifting future revenues.

- MLP's strong capital base and commitment to maintaining a regulatory core capital ratio well above minimum requirements enhance its financial flexibility to invest in growth areas and sustainably support earnings through economic cycles.

- Expansion of fee-based, long-term contracts across multiple business segments increases revenue visibility, improves cash flow predictability, and supports higher recurring income, all of which underpin the company's mid

- and long-term earnings targets.

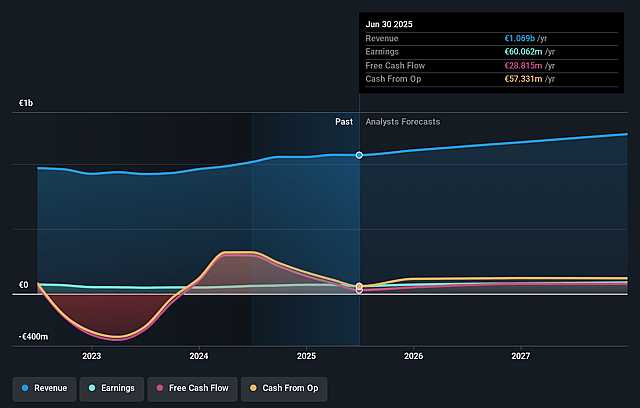

MLP Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MLP's revenue will grow by 5.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.6% today to 7.5% in 3 years time.

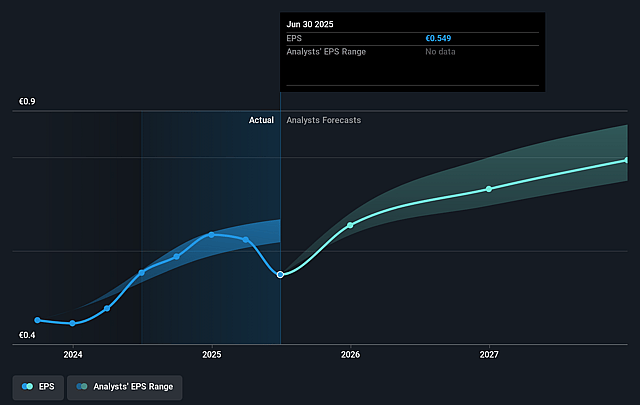

- Analysts expect earnings to reach €94.7 million (and earnings per share of €0.79) by about September 2028, up from €60.1 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €82 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.4x on those 2028 earnings, up from 12.7x today. This future PE is lower than the current PE for the GB Capital Markets industry at 16.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.84%, as per the Simply Wall St company report.

MLP Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Revenue growth in the Wealth competence field is vulnerable to capital market conditions and lower interest rates, as evidenced by weaker performance-based compensation and interest income; prolonged capital market volatility or persistently low rates may suppress future revenues and profits.

- The real estate development segment remains the largest ongoing risk, with management explicitly acknowledging high earnings volatility and uncertainty around returning to positive profit contribution, creating downside risk for group earnings and EBIT.

- Significant near-term and ongoing investments in artificial intelligence are elevating the cost base, particularly within IT and security; if projected efficiency gains and margin improvements from these investments do not materialize as expected, net margins and earnings could come under pressure.

- Active cost management is necessary amid increasing regulatory requirements and market uncertainties, as seen in elevated core capital ratio sensitivity to regulatory changes (CRR III) and continued extra costs within key segments like Financial Consulting, which could limit future margin expansion.

- Declines in interest income from banking deposits, in line with anticipated ECB rate cuts, risk reducing a stable source of profit, negatively impacting net interest income and overall earnings resilience if not offset by stronger growth in other business lines.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €11.267 for MLP based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €13.0, and the most bearish reporting a price target of just €9.8.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €1.3 billion, earnings will come to €94.7 million, and it would be trading on a PE ratio of 15.4x, assuming you use a discount rate of 5.8%.

- Given the current share price of €7.0, the analyst price target of €11.27 is 37.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.