- Italy

- /

- Construction

- /

- BIT:ICOP

European Market Insights: 3 Stocks That May Be Priced Below Their Estimated Worth

Reviewed by Simply Wall St

In recent weeks, the European markets have experienced tentative optimism driven by potential trade agreements with the U.S., alongside steady interest rates from the European Central Bank. Amid this backdrop, identifying undervalued stocks can be particularly appealing to investors looking for opportunities that may not yet be fully recognized by the market, especially when considering factors such as economic resilience and favorable trade developments.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sparebank 68° Nord (OB:SB68) | NOK180.00 | NOK350.66 | 48.7% |

| JOST Werke (XTRA:JST) | €52.00 | €102.79 | 49.4% |

| Hanza (OM:HANZA) | SEK109.00 | SEK214.06 | 49.1% |

| Green Oleo (BIT:GRN) | €0.805 | €1.58 | 49.1% |

| Echo Investment (WSE:ECH) | PLN5.42 | PLN10.70 | 49.3% |

| Cambi (OB:CAMBI) | NOK22.00 | NOK42.85 | 48.7% |

| ATON Green Storage (BIT:ATON) | €2.12 | €4.22 | 49.8% |

| Atea (OB:ATEA) | NOK141.60 | NOK282.62 | 49.9% |

| Aquila Part Prod Com (BVB:AQ) | RON1.44 | RON2.81 | 48.7% |

| Absolent Air Care Group (OM:ABSO) | SEK242.00 | SEK482.63 | 49.9% |

Let's explore several standout options from the results in the screener.

I.CO.P.. Società Benefit (BIT:ICOP)

Overview: I.CO.P. S.p.A. Società Benefit offers construction and special engineering services to both public and private clients in Italy and internationally, with a market cap of €450.75 million.

Operations: The company's revenue primarily comes from its heavy construction segment, which generated €110.92 million.

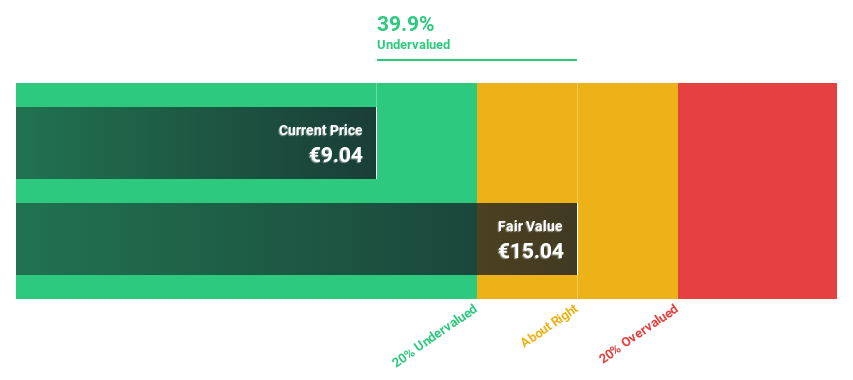

Estimated Discount To Fair Value: 42.8%

I.CO.P. Società Benefit is trading at €15, significantly below its estimated fair value of €26.22, presenting a potential undervaluation based on cash flows. Despite recent share price volatility, the company exhibits strong growth prospects with earnings expected to grow 32.1% annually over the next three years, outpacing both its revenue and the broader Italian market's growth rates. The firm's return on equity is also projected to be robust at 22.9% in three years.

- According our earnings growth report, there's an indication that I.CO.P.. Società Benefit might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of I.CO.P.. Società Benefit.

AF Gruppen (OB:AFG)

Overview: AF Gruppen ASA is a contracting and industrial company offering civil engineering, construction, energy and environment, and property and offshore services in Norway and Sweden with a market cap of NOK17.39 billion.

Operations: AF Gruppen ASA generates revenue from various segments including Plants (NOK9.91 billion), Sweden (NOK5 billion), Offshore (NOK1.05 billion), Property (NOK22 million), Betonmast (NOK4.41 billion), Construction (NOK8.79 billion), and Energy and Environment (NOK1.54 billion).

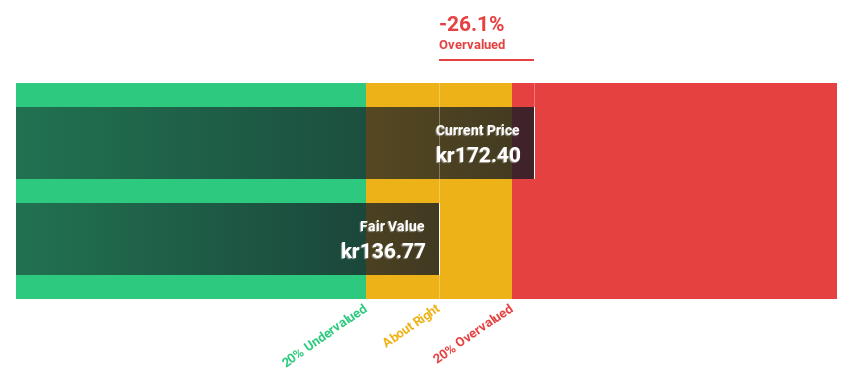

Estimated Discount To Fair Value: 17.6%

AF Gruppen is trading at NOK 159.2, below its estimated fair value of NOK 193.28, highlighting potential undervaluation based on cash flows. Revenue is forecast to grow at 3.4% annually, surpassing the Norwegian market's growth rate of 2.2%. Earnings are expected to increase by 17.1% per year, outpacing the market's growth of 10.9%. Recent contracts in Gothenburg and the North Sea bolster its project pipeline, potentially enhancing future cash flows and profitability.

- Our earnings growth report unveils the potential for significant increases in AF Gruppen's future results.

- Take a closer look at AF Gruppen's balance sheet health here in our report.

Vossloh (XTRA:VOS)

Overview: Vossloh AG specializes in providing rail infrastructure products and services both in Germany and internationally, with a market cap of €1.74 billion.

Operations: Vossloh AG generates revenue through its rail infrastructure products and services offered globally, with total revenue reported in millions of euros.

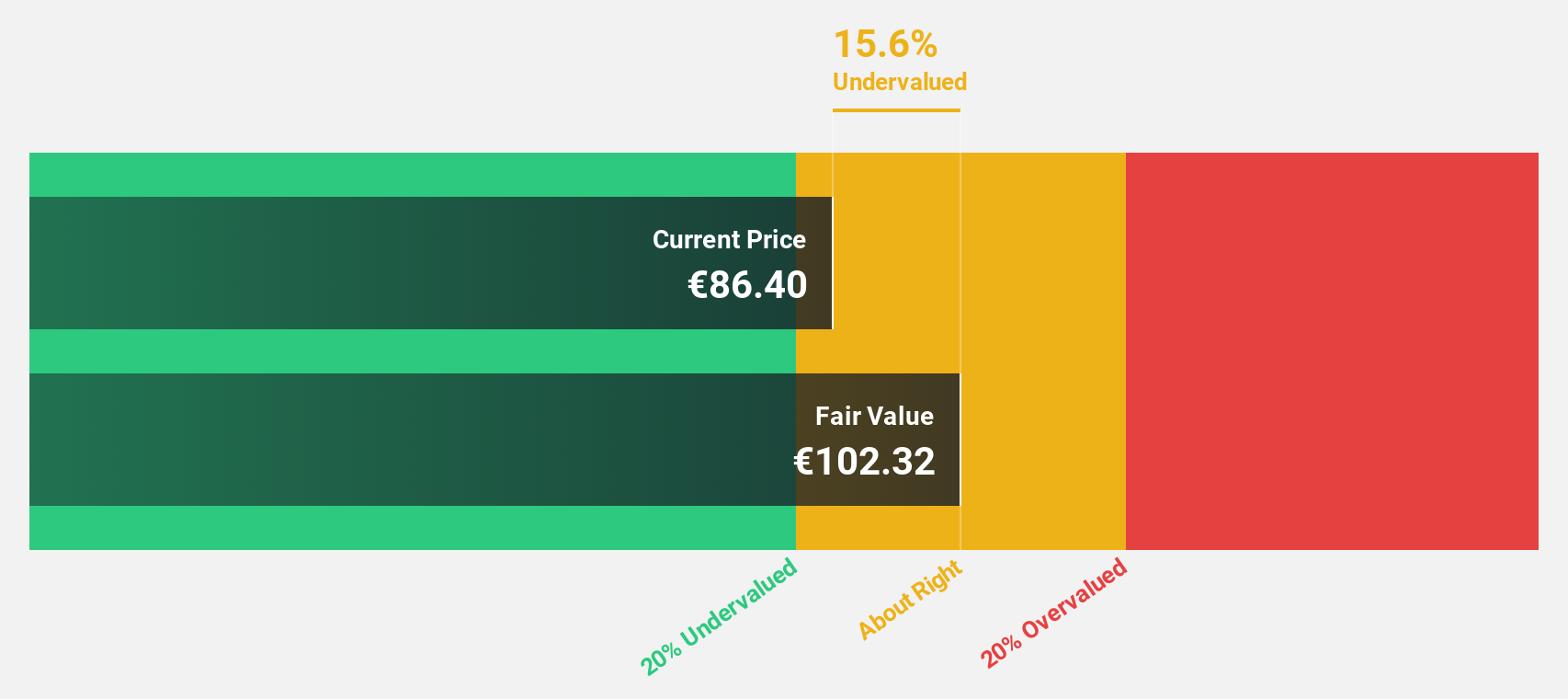

Estimated Discount To Fair Value: 10.6%

Vossloh is trading at €90.3, slightly below its estimated fair value of €100.99, suggesting undervaluation based on cash flows. Revenue is expected to grow annually by 8.4%, outpacing the German market's 6% growth rate, while earnings are projected to rise significantly at 21.7% per year over the next three years. Recent contracts in China and Algeria worth millions enhance its order book and could positively impact future cash flows despite recent profit declines.

- Insights from our recent growth report point to a promising forecast for Vossloh's business outlook.

- Get an in-depth perspective on Vossloh's balance sheet by reading our health report here.

Make It Happen

- Explore the 190 names from our Undervalued European Stocks Based On Cash Flows screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ICOP

I.CO.P.. Società Benefit

Engages in providing construction and special engineering services to public and private clients in Italy and internationally.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives