Today we'll take a closer look at Totens Sparebank (OB:TOTG) from a dividend investor's perspective. Owning a strong dividend company and reinvesting the dividends is widely seen as an attractive way of growing your wealth. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

In this case, Totensrebank likely looks attractive to investors, given its 6.4% dividend yield and a payment history of over ten years. It would not be a surprise to discover that many investors buy it for the dividends. Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Explore this interactive chart for our latest analysis on Totensrebank!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Looking at the data, we can see that 50% of Totensrebank's profits were paid out as dividends in the last 12 months. This is a fairly normal payout ratio among most businesses. It allows a higher dividend to be paid to shareholders, but does limit the capital retained in the business - which could be good or bad.

We update our data on Totensrebank every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

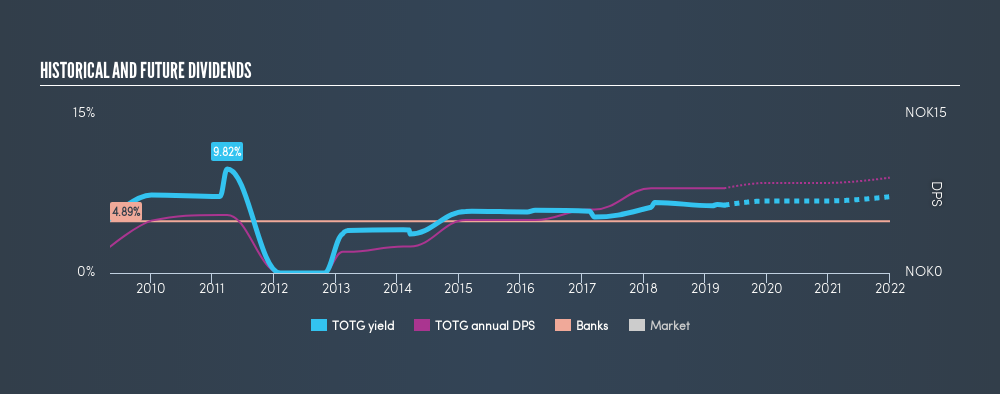

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. Totensrebank has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. The dividend has been stable over the past 10 years, which is great. We think this could suggest some resilience to the business and its dividends. During the past ten-year period, the first annual payment was øre2.47 in 2009, compared to øre8.00 last year. Dividends per share have grown at approximately 12% per year over this time.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. Totensrebank has grown its earnings per share at 9.9% per annum over the past five years. The rate at which earnings have grown is quite decent, and by paying out more than half of its earnings as dividends, the company is striking a reasonable balance between reinvestment and returns to shareholders.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. First, we think Totensrebank has an acceptable payout ratio. Second, earnings growth has been mediocre, but at least the dividends have been relatively stable. Totensrebank might not be a bad business, but it doesn't show all of the characteristics we look for in a dividend stock.

See if management have put their money where their mouth is, by checking insider shareholdings in Totensrebank stock.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OB:TOTG

Totens Sparebank

Provides various banking and financial products and services in Norway.

Established dividend payer with moderate growth potential.

Market Insights

Community Narratives