SpareBank 1 BV (OB:SBVG) Has Gifted Shareholders With A Fantastic 210% Total Return On Their Investment

When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. One great example is SpareBank 1 BV (OB:SBVG) which saw its share price drive 123% higher over five years. Also pleasing for shareholders was the 13% gain in the last three months. But this move may well have been assisted by the reasonably buoyant market (up 10% in 90 days).

View our latest analysis for SpareBank 1 BV

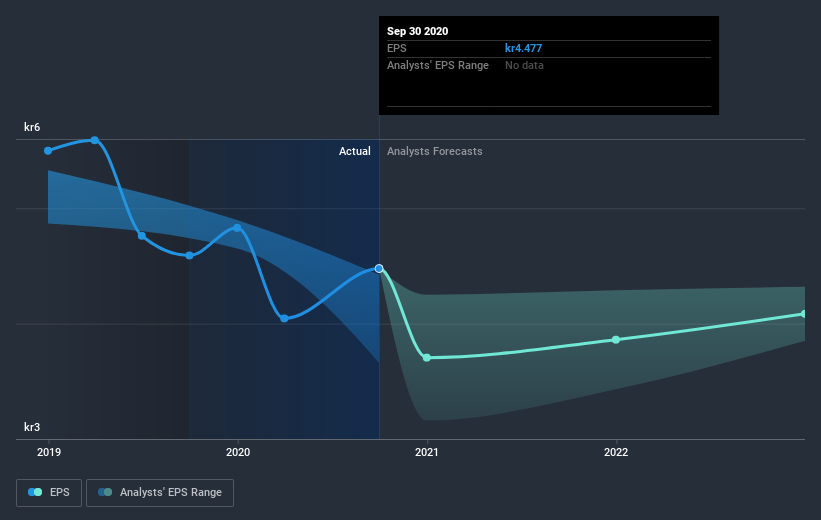

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last half decade, SpareBank 1 BV became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on SpareBank 1 BV's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, SpareBank 1 BV's TSR for the last 5 years was 210%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that SpareBank 1 BV shareholders have received a total shareholder return of 11% over one year. And that does include the dividend. However, the TSR over five years, coming in at 25% per year, is even more impressive. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for SpareBank 1 BV you should know about.

But note: SpareBank 1 BV may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

If you decide to trade SpareBank 1 BV, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:SOON

SpareBank 1 Sørøst-Norge

Provides various banking products and services for private and corporate customers in Norway.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives