- France

- /

- Aerospace & Defense

- /

- ENXTPA:FGA

European Market's Hidden Value: 3 Stocks Trading Below Estimated Worth

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index experienced a modest rise, bolstered by the reopening of the U.S. federal government, cooling sentiment on artificial intelligence tempered broader market gains. In this environment, identifying stocks trading below their estimated worth can offer potential opportunities for investors seeking value amidst fluctuating economic conditions and investor sentiment.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| YIT Oyj (HLSE:YIT) | €3.03 | €5.98 | 49.4% |

| Stille (OM:STIL) | SEK170.50 | SEK334.56 | 49% |

| STEICO (XTRA:ST5) | €20.30 | €40.07 | 49.3% |

| Roche Bobois (ENXTPA:RBO) | €35.00 | €69.61 | 49.7% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.44 | €4.88 | 50% |

| NEUCA (WSE:NEU) | PLN785.00 | PLN1553.92 | 49.5% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.394 | €0.78 | 49.6% |

| eDreams ODIGEO (BME:EDR) | €7.29 | €14.42 | 49.4% |

| Bonesupport Holding (OM:BONEX) | SEK202.00 | SEK396.20 | 49% |

| Absolent Air Care Group (OM:ABSO) | SEK200.00 | SEK398.95 | 49.9% |

Let's explore several standout options from the results in the screener.

Figeac Aero Société Anonyme (ENXTPA:FGA)

Overview: Figeac Aero Société Anonyme manufactures, supplies, and sells equipment and sub-assemblers for the aeronautics sector in France, with a market cap of €531.40 million.

Operations: The company's revenue is primarily derived from Aerostructures & Aeroengines, which accounts for €398.56 million, and Diversification Activities, contributing €33.74 million.

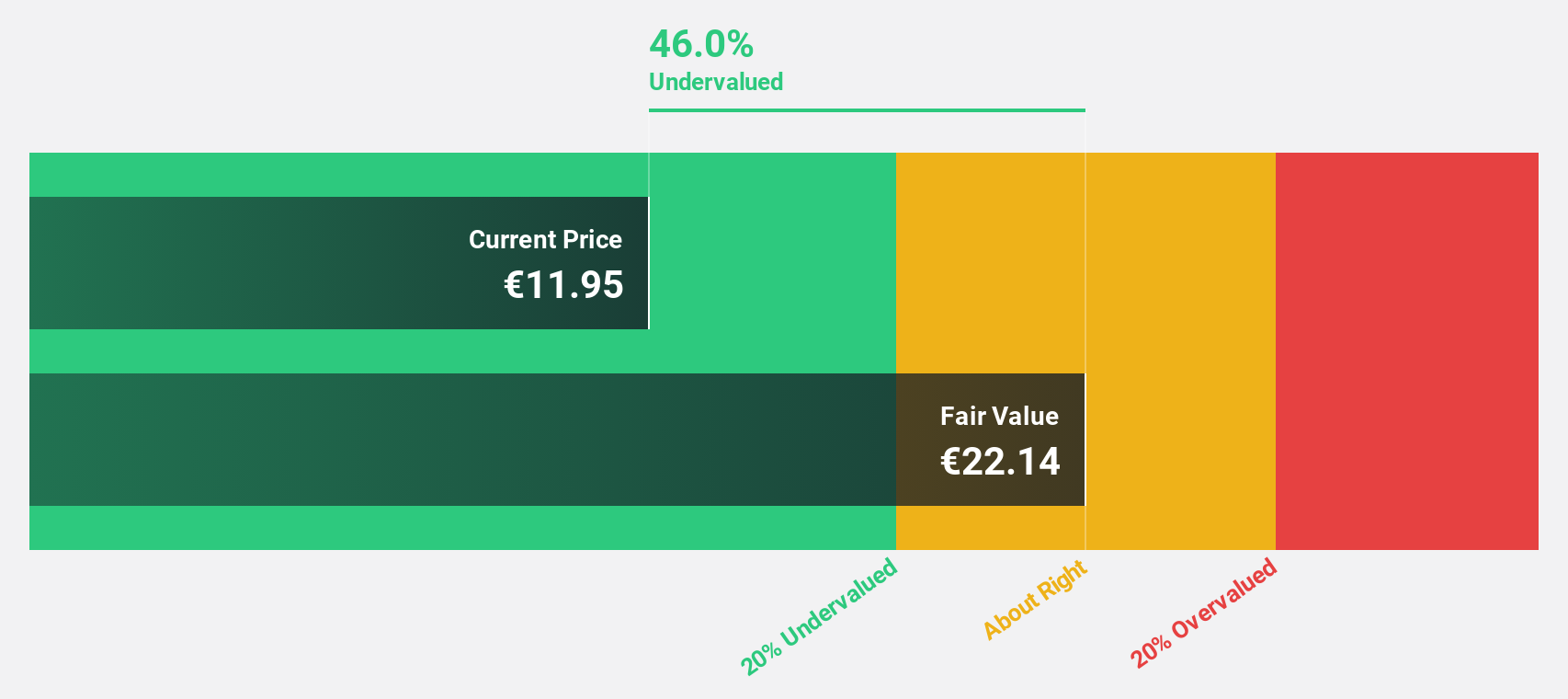

Estimated Discount To Fair Value: 46.1%

Figeac Aero Société Anonyme appears undervalued based on cash flows, trading at €12.05, significantly below its estimated fair value of €22.35. The company has recently become profitable and forecasts suggest earnings growth of 59.8% annually, outpacing the French market's 12.2%. Recent contracts with Bombardier and Safran secure additional revenue streams without requiring new capital investments, bolstering financial stability despite interest payments not being well covered by earnings.

- The analysis detailed in our Figeac Aero Société Anonyme growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Figeac Aero Société Anonyme.

Sparebanken Norge (OB:SBNOR)

Overview: Sparebanken Vest is a financial services company offering banking and financing services in Vestland and Rogaland, Norway, with a market cap of NOK18.99 billion.

Operations: The company's revenue is primarily derived from its Banking Operations, with NOK3.86 billion from the Retail Market, NOK2.74 billion from the Corporate Market, and NOK425 million from Bulder Bank, along with NOK465 million generated through Real Estate activities.

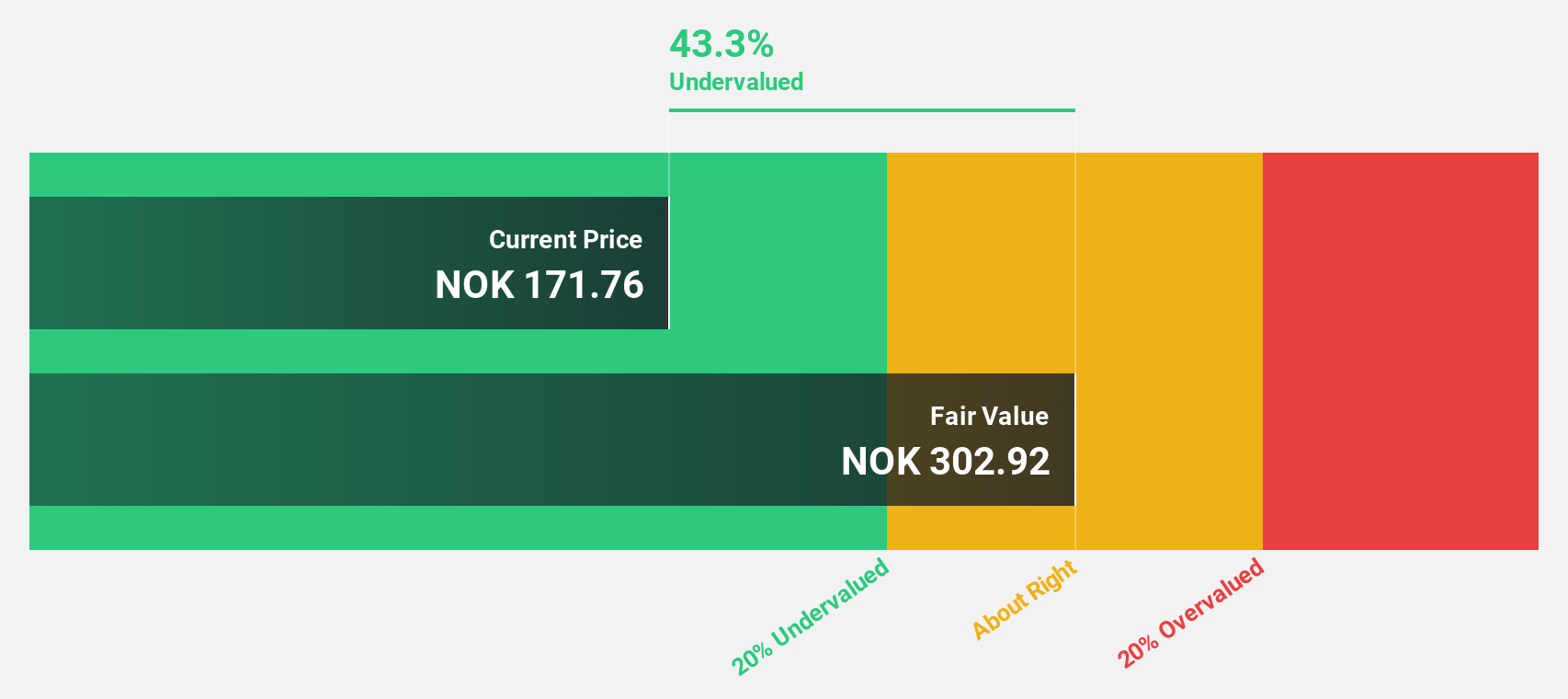

Estimated Discount To Fair Value: 42.7%

Sparebanken Norge is trading at NOK 173.18, significantly below its estimated fair value of NOK 302.46, highlighting its potential undervaluation based on cash flows. Recent earnings growth of 26.7% and forecasted annual profit growth of 30.9% surpass the Norwegian market's average, suggesting strong future performance despite reliance on higher-risk external borrowing for funding. The bank's recent inclusion in the Euronext 150 Index and issuance of bonds totaling NOK 2.7 billion further underscore its strategic financial positioning.

- Our growth report here indicates Sparebanken Norge may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Sparebanken Norge's balance sheet health report.

Shoper (WSE:SHO)

Overview: Shoper S.A. offers software as a service solutions for e-commerce in Poland and has a market cap of PLN1.47 billion.

Operations: Shoper S.A. generates revenue through its software as a service solutions tailored for the e-commerce sector in Poland.

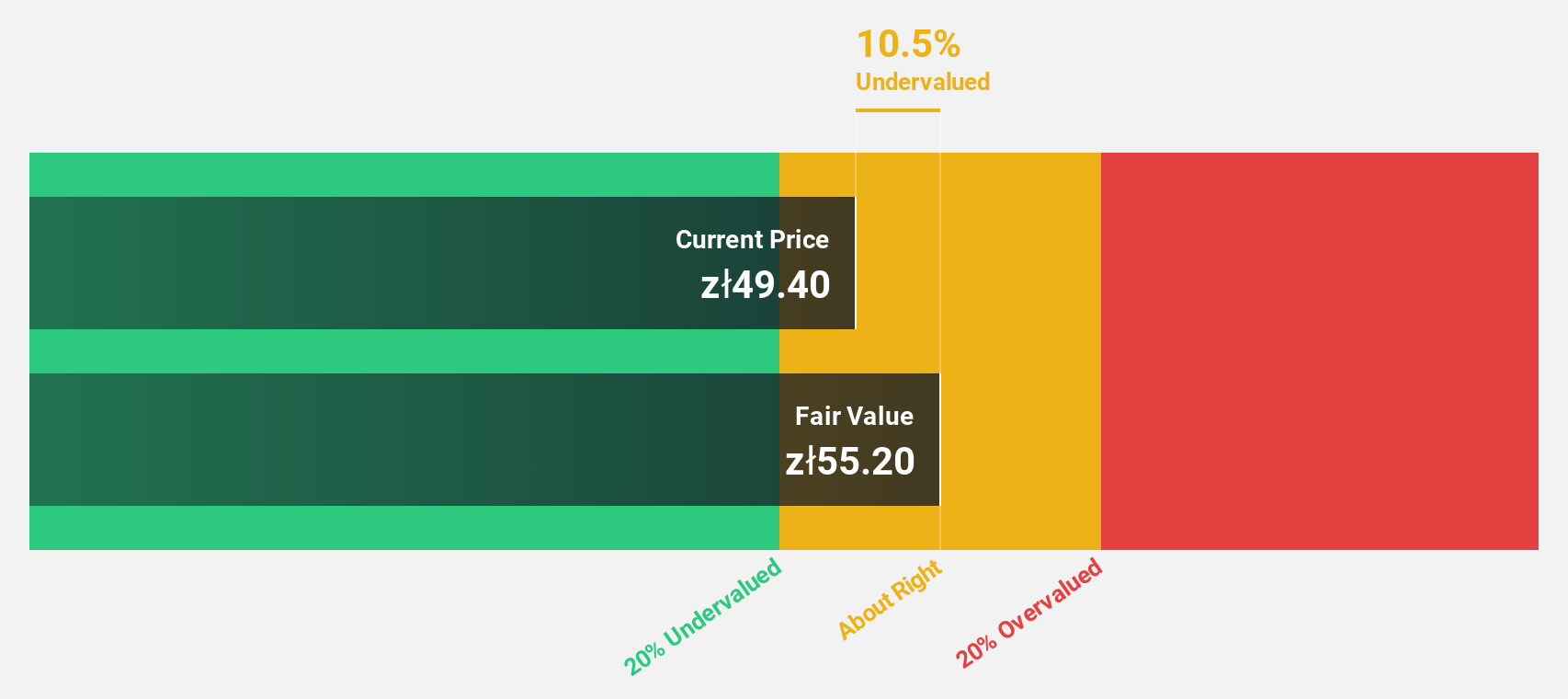

Estimated Discount To Fair Value: 13.7%

Shoper S.A. is trading at PLN 52.20, slightly below its fair value estimate of PLN 60.45, reflecting some undervaluation based on cash flows. The company reported a revenue increase to PLN 158.31 million for the nine months ended September 2025, with net income rising to PLN 29.52 million from the previous year. Forecasts indicate significant earnings growth of over 22% annually, outpacing Polish market averages and enhancing its investment appeal despite moderate revenue growth projections.

- In light of our recent growth report, it seems possible that Shoper's financial performance will exceed current levels.

- Dive into the specifics of Shoper here with our thorough financial health report.

Taking Advantage

- Access the full spectrum of 198 Undervalued European Stocks Based On Cash Flows by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:FGA

Figeac Aero Société Anonyme

Manufactures, supplies, and sells equipment and sub-assemblers for aeronautics sector in France.

High growth potential and good value.

Market Insights

Community Narratives