Assessing SpareBank 1 Sør-Norge (OB:SB1NO): Is the Recent Stock Performance Reflected in Its Valuation?

Reviewed by Simply Wall St

SpareBank 1 Sør-Norge (OB:SB1NO) has caught the eye of many investors lately, largely due to its striking run this year. Even without a headline-making event or breaking news to spark its recent moves, any shift in this bank's stock is enough to make you wonder whether something significant is brewing beneath the surface. It's the kind of pause that naturally leads investors to ask if today’s market activity is an early signal or simply market noise.

Looking back, the share price has experienced a healthy rise over the past year, booking around 40% growth and showing an even stronger performance over the past five years. However, momentum has cooled somewhat lately, with minor dips over the past month and past three months. Annual revenue and net income are up modestly as well, which supports a steadily improving fundamental story, even if there has not been a single recent trigger propelling the shares higher.

So, where does this leave us? Is SpareBank 1 Sør-Norge gearing up for another leap, or is the current price starting to reflect all the future growth the market expects?

Most Popular Narrative: 7.9% Undervalued

The prevailing narrative views SpareBank 1 Sør-Norge as undervalued, highlighting future-focused drivers and strategic transformation expected to deliver additional upside.

*Technical integration, digital investment, and geographic diversification are expected to lower costs, reduce risks, and expand both the customer base and revenue streams. Emphasis on sustainable finance, efficient capital deployment, and shareholder return initiatives positions the bank for long-term growth and market leadership.*

Want to know what’s fueling this bullish view? The real story is not just about strong past performance or stable growth trends. Analysts base their fair value on bold assumptions about future earnings, revenue expansion, and profitability levels that are rarely seen outside rapid-growth sectors. Unlock the full narrative to see which financial levers must deliver for these optimistic projections to become reality.

Result: Fair Value of $188.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying competition and heavy reliance on the real estate market could quickly challenge the optimistic outlook for SpareBank 1 Sør-Norge’s future growth.

Find out about the key risks to this SpareBank 1 Sør-Norge narrative.Another View: Market Pricing Challenges the Optimism

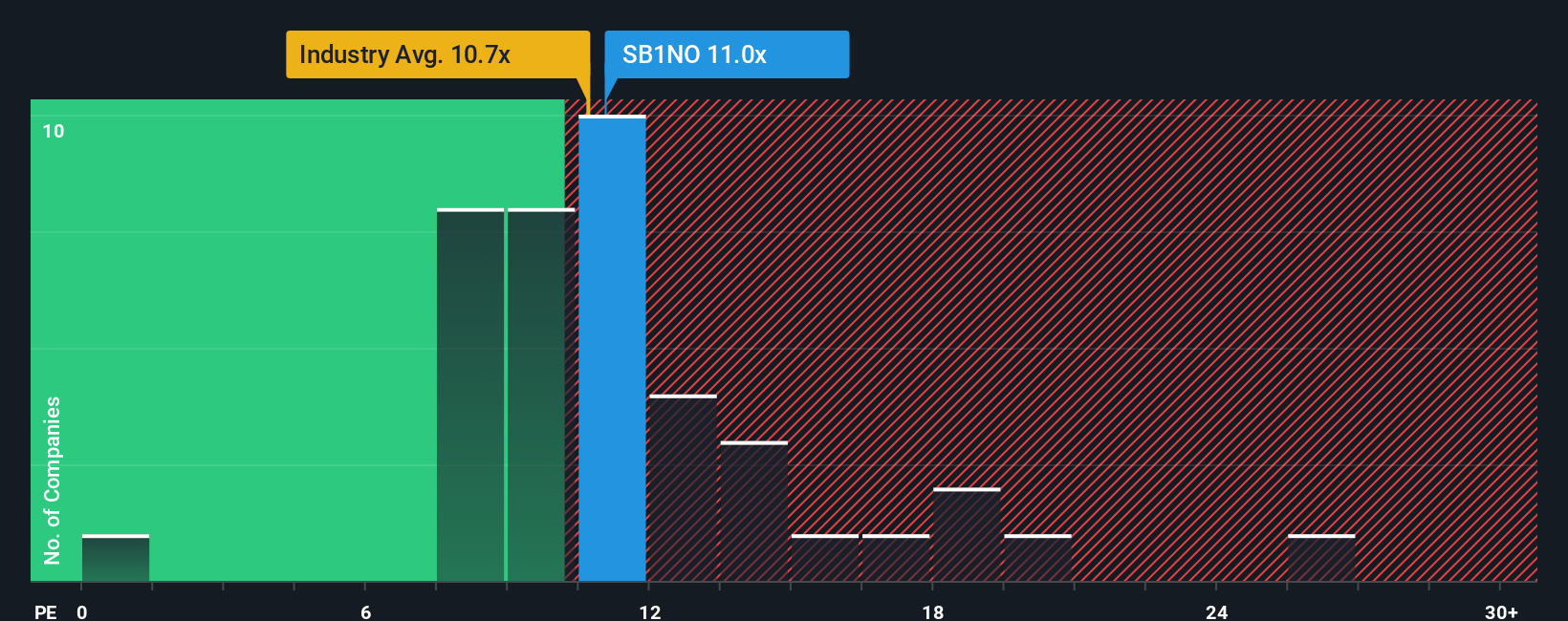

While the main analysis sees SpareBank 1 Sør-Norge as undervalued, a look at its valuation relative to others in the same industry paints a different picture. This suggests investors might already be paying a premium. Could the strong growth justify this?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding SpareBank 1 Sør-Norge to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own SpareBank 1 Sør-Norge Narrative

If you see things differently or feel more comfortable reaching your own conclusions, you can craft a personalized perspective in just a few minutes by using Do it your way.

A great starting point for your SpareBank 1 Sør-Norge research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Staying ahead in the market means focusing on opportunity, not just one stock. Don’t let the best prospects slip away; target winning themes with our latest screeners.

- Uncover tomorrow’s giants by tapping into undervalued stocks based on cash flows, featuring quality companies that are trading below their true worth.

- Spot the surge in medical innovation as you back your portfolio with healthcare AI stocks, where healthcare and artificial intelligence fuel sector breakthroughs.

- Accelerate your returns by chasing dividend stocks with yields > 3% and secure income streams from stocks boasting yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About OB:SB1NO

SpareBank 1 Sør-Norge

Provides various financial products and services for personal and corporate customers in Norway.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives