Undiscovered Gems And 2 Other Small Cap Stocks With Strong Potential

Reviewed by Simply Wall St

As global markets react to the uncertainties surrounding the incoming Trump administration and shifting economic policies, small-cap indices like the S&P 600 have shown mixed performance amid sector-specific volatility. In this dynamic environment, identifying promising small-cap stocks requires a keen focus on companies with robust fundamentals and potential for growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Primadaya Plastisindo | 12.52% | 18.29% | 26.12% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Tethys Petroleum | NA | 29.98% | 44.48% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

RCS MediaGroup (BIT:RCS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: RCS MediaGroup S.p.A. is an international multimedia publishing company based in Italy with a market capitalization of €356.68 million.

Operations: RCS MediaGroup generates revenue primarily from Italy Newspapers (€371 million), Advertising and Sport (€286.10 million), and Unidad Editorial (€220.60 million). The company also earns from Magazines Italy, contributing €65.20 million, while Corporate and Other Activities add €80.80 million to its revenue streams.

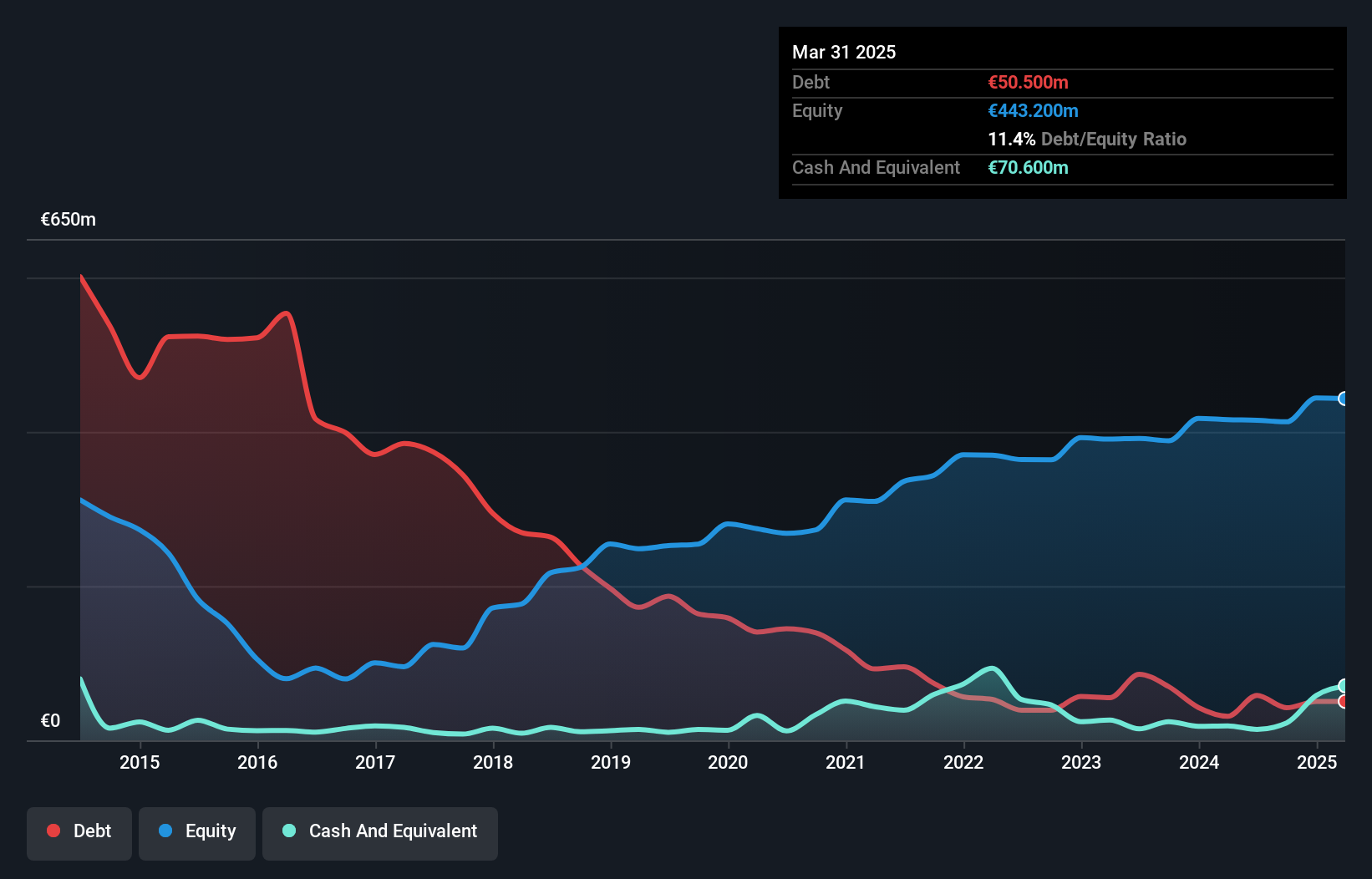

RCS MediaGroup, a dynamic player in the media sector, is trading at a notable 62.8% below its estimated fair value, suggesting potential undervaluation. With high-quality earnings and an impressive net debt to equity ratio of 4.8%, the company seems financially robust. Over five years, RCS has successfully reduced its debt to equity from 64.5% to 10.2%. Despite sales dipping slightly from €249.5 million to €242.7 million for the nine months ending September 2024, net income rose to €32.1 million from €27.8 million last year, highlighting operational efficiency and resilience amidst industry challenges.

- Get an in-depth perspective on RCS MediaGroup's performance by reading our health report here.

Gain insights into RCS MediaGroup's historical performance by reviewing our past performance report.

Sparebanken Møre (OB:MORG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sparebanken Møre, with a market cap of NOK4.44 billion, offers banking services to both retail and corporate customers in Norway through its subsidiaries.

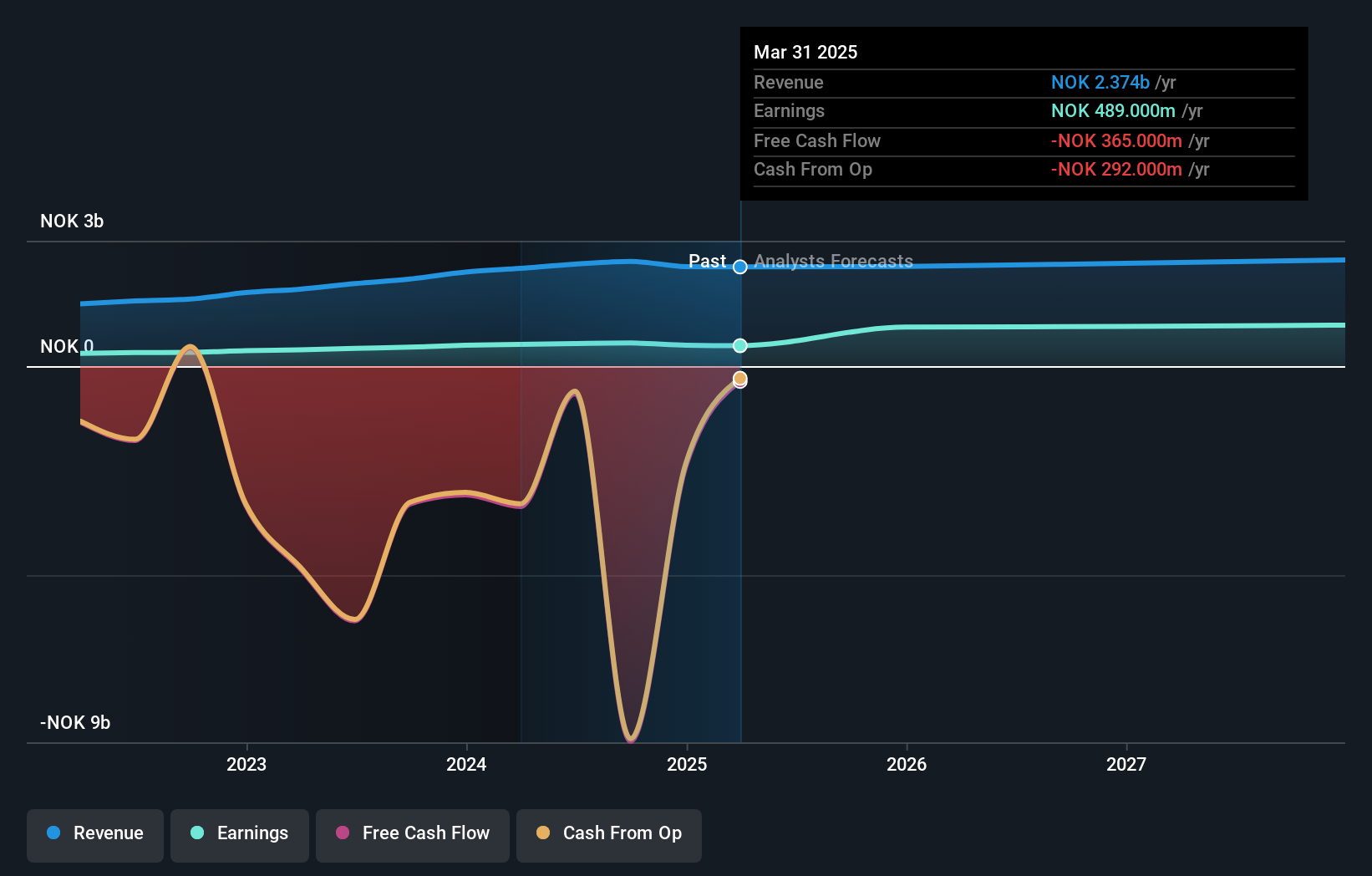

Operations: Sparebanken Møre generates revenue primarily from its retail and corporate banking segments, contributing NOK1.06 billion and NOK1.00 billion respectively. The real estate brokerage segment adds NOK43 million to the total revenue.

Sparebanken Møre, a notable player with total assets of NOK106.9B and equity of NOK8.8B, is trading at 36.5% below its estimated fair value, offering potential for investors seeking undervalued opportunities. With earnings growth of 22.3% over the past year surpassing the industry average of 20.5%, it demonstrates robust performance supported by low-risk funding sources—50% from customer deposits—and an appropriate bad loan allowance at 0.5%. Recent changes in company bylaws and strong quarterly earnings reinforce its promising outlook, with net income rising to NOK280 million from NOK253 million year-over-year.

Walaa Cooperative Insurance (SASE:8060)

Simply Wall St Value Rating: ★★★★★☆

Overview: Walaa Cooperative Insurance Company offers cooperative insurance and reinsurance products and services in the Kingdom of Saudi Arabia, with a market capitalization of SAR 1.87 billion.

Operations: The primary revenue streams for Walaa Cooperative Insurance come from vehicle and medical insurance, generating SAR 776.39 million and SAR 645.48 million, respectively. The company also earns from property, engineering, energy, and protection & saving segments. Additionally, investment activities contribute with realized and unrealized gains measured at FVTPL totaling SAR 87.08 million.

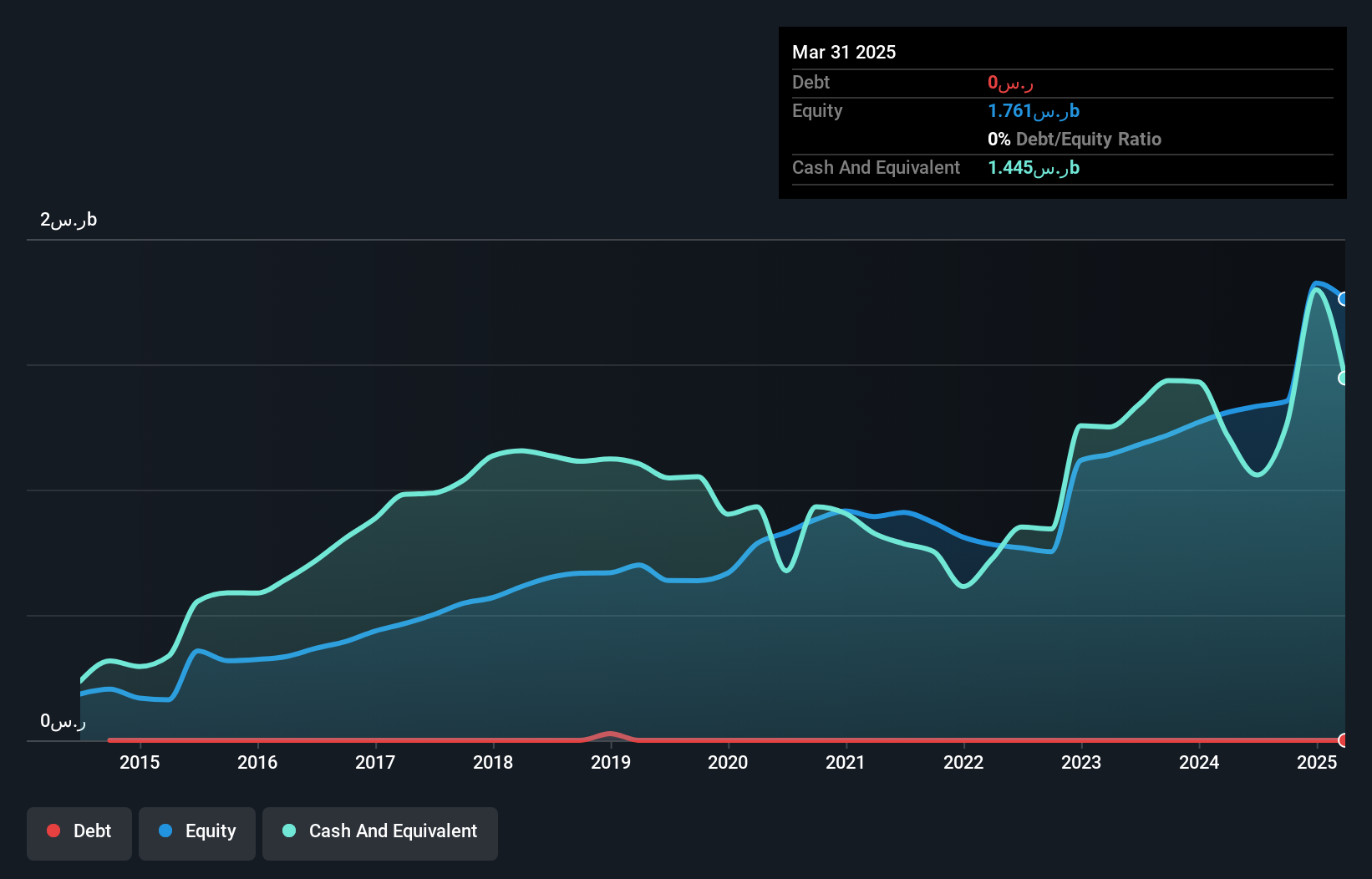

Walaa Cooperative Insurance, a smaller player in the insurance sector, reported a net income of SAR 20.1 million for Q3 2024, down from SAR 39.78 million the previous year. Basic earnings per share from continuing operations fell to SAR 0.24 compared to SAR 0.47 last year. Despite this dip in quarterly performance, Walaa boasts a debt-free balance sheet and a favorable price-to-earnings ratio of 14.4x against the SA market's average of 24.3x, suggesting it might be undervalued relative to peers. The company’s earnings have grown by an impressive 42% over the past year, outpacing industry averages significantly.

- Delve into the full analysis health report here for a deeper understanding of Walaa Cooperative Insurance.

Gain insights into Walaa Cooperative Insurance's past trends and performance with our Past report.

Turning Ideas Into Actions

- Embark on your investment journey to our 4644 Undiscovered Gems With Strong Fundamentals selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:MORG

Sparebanken Møre

Provides banking services for retail and corporate customers in Norway.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives