- Italy

- /

- Capital Markets

- /

- BIT:AZM

European Dividend Stocks To Watch In September 2025

Reviewed by Simply Wall St

As European markets show resilience with the pan-European STOXX Europe 600 Index rising by 1.03%, investors are closely monitoring the European Central Bank's steady rate policy and its slightly optimistic economic forecasts. In this context, dividend stocks stand out as potential opportunities for those seeking stable income, especially when considering companies with strong fundamentals and consistent payout histories amidst evolving economic conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.38% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.90% | ★★★★★☆ |

| Sulzer (SWX:SUN) | 3.00% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.44% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.55% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.90% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.34% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.72% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.59% | ★★★★★☆ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.76% | ★★★★★☆ |

Click here to see the full list of 223 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

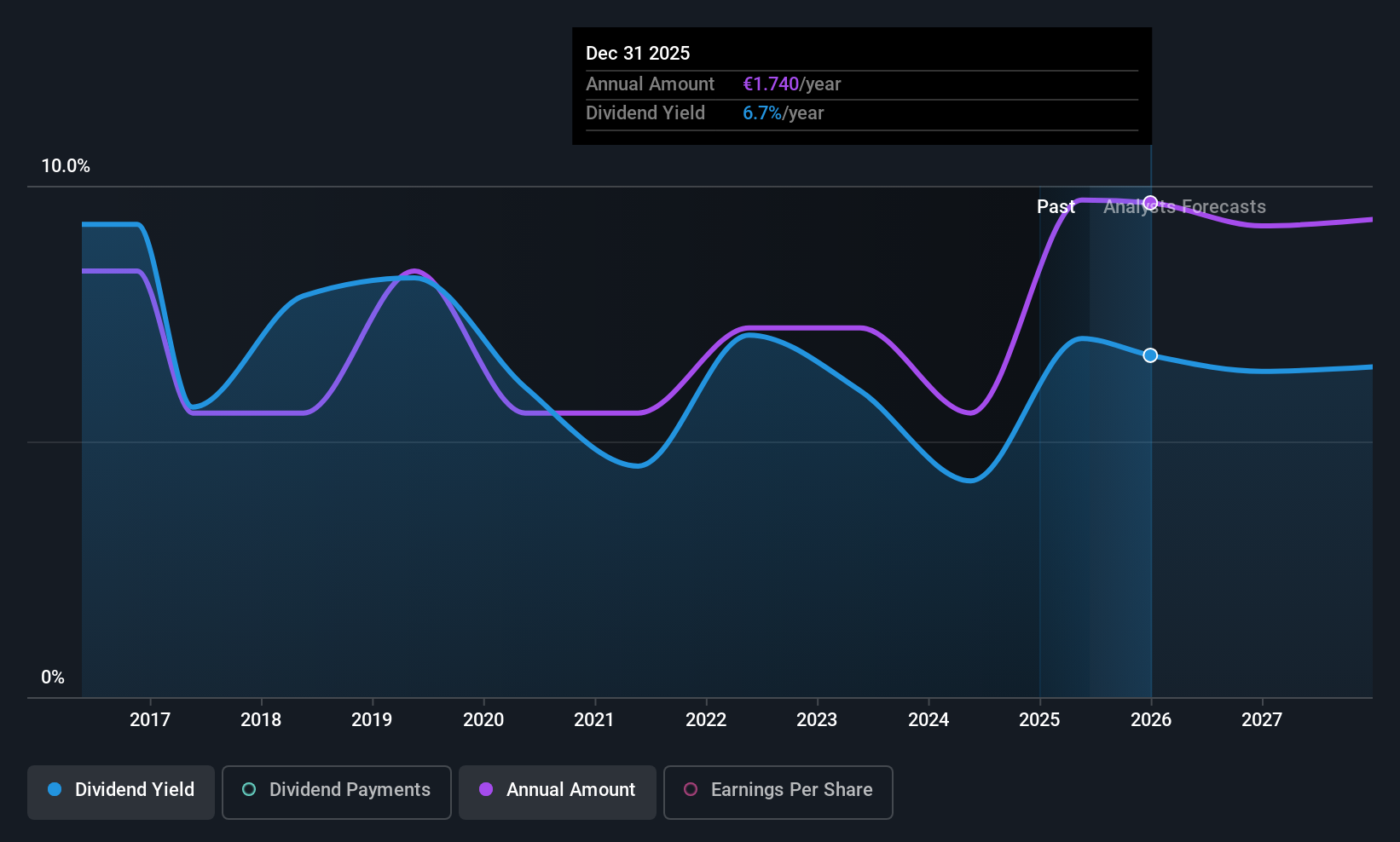

Azimut Holding (BIT:AZM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Azimut Holding S.p.A. operates in the asset management sector and has a market capitalization of €4.37 billion.

Operations: Azimut Holding S.p.A. generates its revenue primarily from the asset management segment, amounting to €1.43 billion.

Dividend Yield: 5.7%

Azimut Holding's dividend yield is among the top 25% in Italy, yet its payments have been volatile over the past decade. The dividend is not well covered by free cash flow, and high non-cash earnings raise sustainability concerns. Despite trading below estimated fair value and offering good relative value compared to peers, recent financials show a decline in net income. Leadership changes in Asia may impact future growth prospects for Azimut's fund business.

- Click to explore a detailed breakdown of our findings in Azimut Holding's dividend report.

- Our comprehensive valuation report raises the possibility that Azimut Holding is priced lower than what may be justified by its financials.

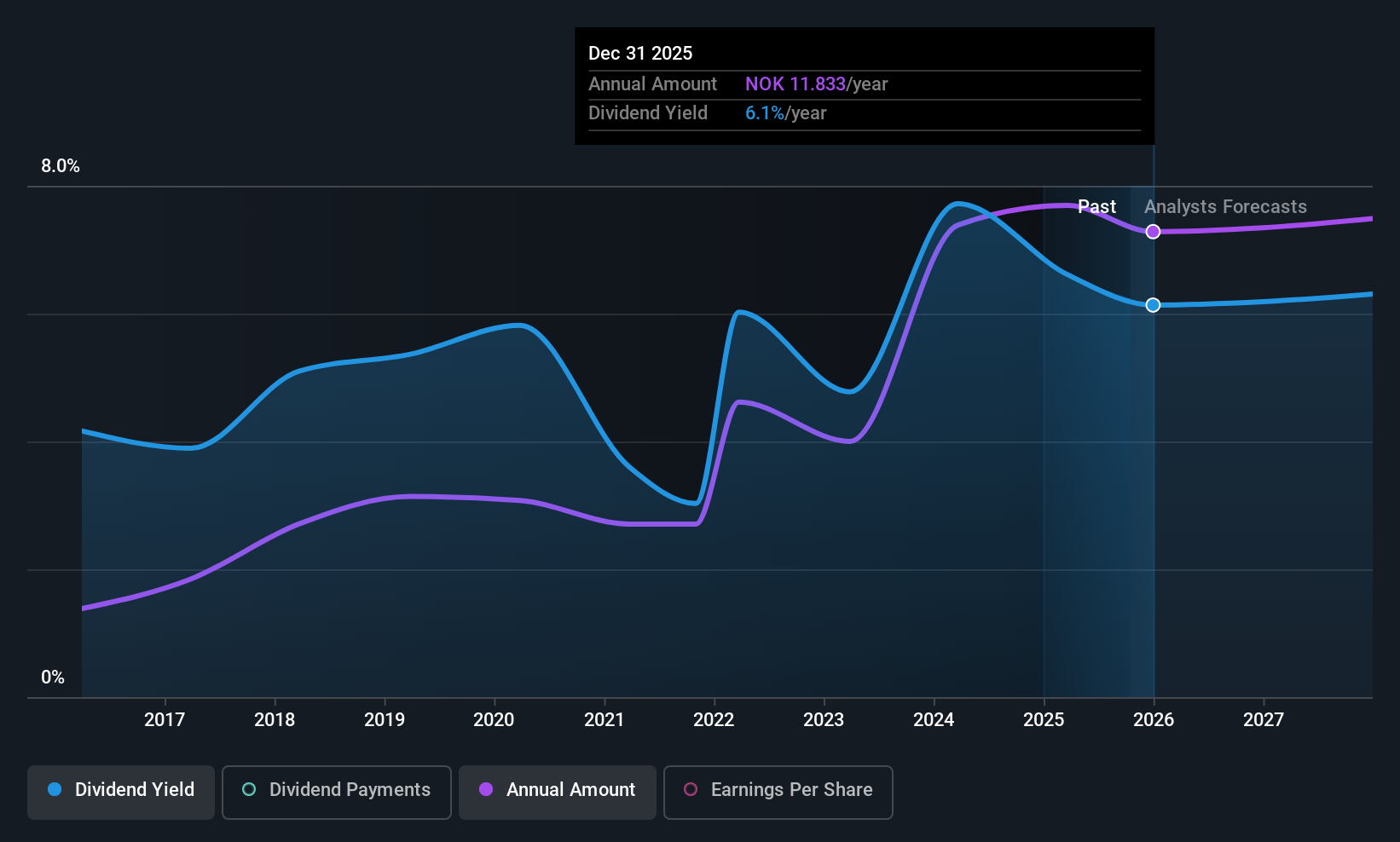

SpareBank 1 SMN (OB:MING)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SpareBank 1 SMN, along with its subsidiaries, offers a range of banking, accounting, and real estate products and services to both private individuals and companies in Norway and internationally, with a market cap of NOK27.92 billion.

Operations: SpareBank 1 SMN generates its revenue primarily from the Retail Market (NOK3.18 billion), Corporate Market (NOK1.97 billion), Eiendoms Megler 1 (NOK539 million), Sparebank 1 Finans Midt-Norge (NOK432 million), and Sparebank 1 Regnskapshuset SMN (NOK837 million).

Dividend Yield: 6.5%

SpareBank 1 SMN's dividends are well-covered by earnings, with a payout ratio of 61.7%, and are projected to remain sustainable in the coming years. The bank's recent earnings report showed growth in net income, reaching NOK 1.11 billion for Q2 2025. Although its dividend yield is lower than the top tier in Norway, it remains reliable and stable over the past decade. Trading at a good value compared to peers enhances its appeal as a dividend stock.

- Delve into the full analysis dividend report here for a deeper understanding of SpareBank 1 SMN.

- According our valuation report, there's an indication that SpareBank 1 SMN's share price might be on the cheaper side.

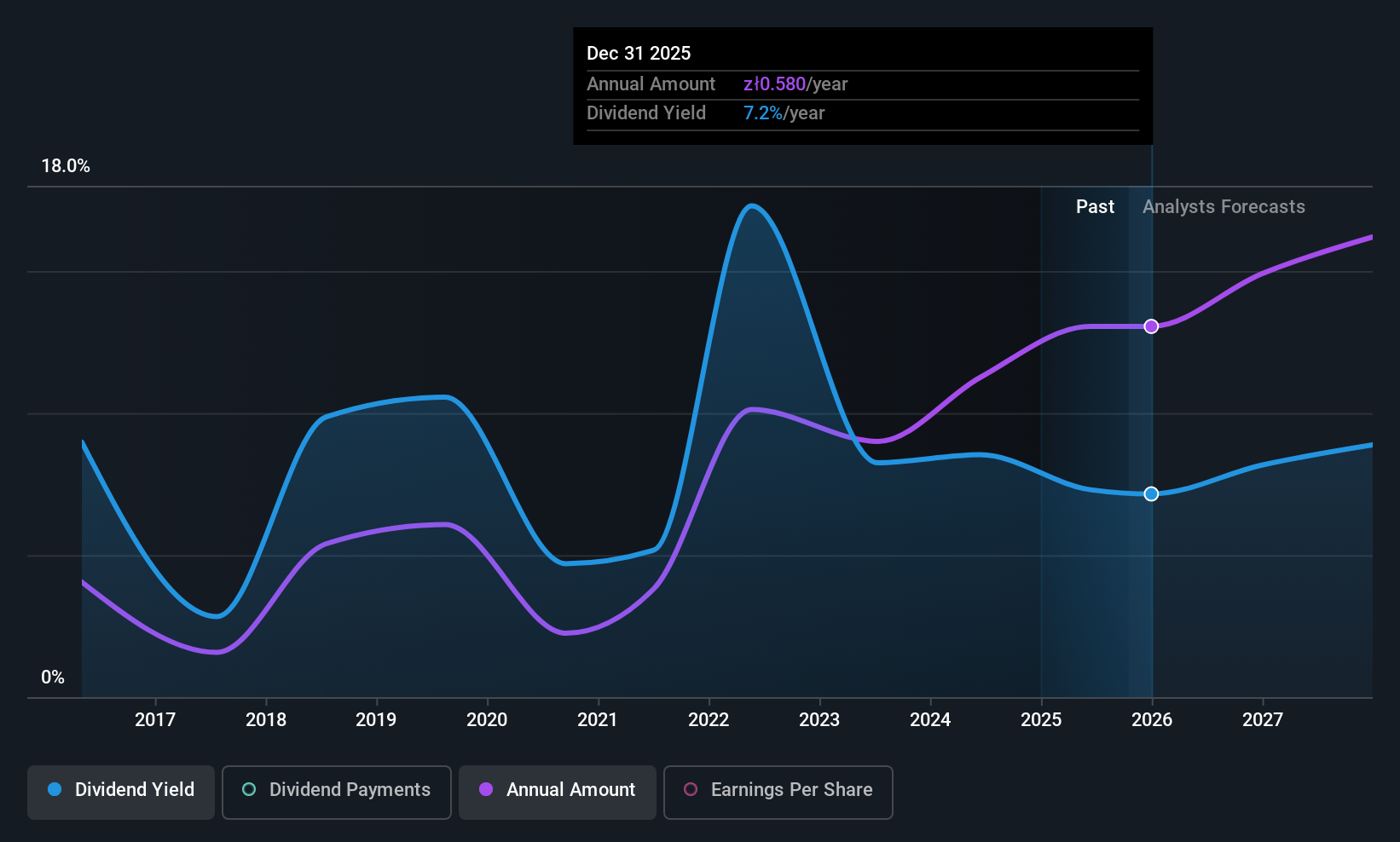

Develia (WSE:DVL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Develia S.A. operates in Poland through its subsidiaries by buying, developing, renting, managing, and selling real estate properties and has a market cap of PLN3.77 billion.

Operations: Develia S.A.'s revenue is derived from its activities in purchasing, developing, leasing, managing, and selling real estate properties within Poland.

Dividend Yield: 7.1%

Develia's recent earnings report shows robust growth, with net income rising to PLN 108.44 million for Q2 2025. Despite a volatile dividend history, current payouts are well-covered by earnings and cash flows, maintaining payout ratios of 65% and 68.2%, respectively. While its dividend yield is slightly below the top tier in Poland, Develia trades at a significant discount to estimated fair value, offering potential appeal for value-focused investors seeking dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Develia.

- The valuation report we've compiled suggests that Develia's current price could be quite moderate.

Make It Happen

- Take a closer look at our Top European Dividend Stocks list of 223 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:AZM

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives