If You Had Bought Komplett Bank (OB:KOMP) Stock A Year Ago, You'd Be Sitting On A 48% Loss, Today

The simplest way to benefit from a rising market is to buy an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. For example, the Komplett Bank ASA (OB:KOMP) share price is down 48% in the last year. That contrasts poorly with the market return of -5.5%. To make matters worse, the returns over three years have also been really disappointing (the share price is 43% lower than three years ago). Shareholders have had an even rougher run lately, with the share price down 25% in the last 90 days.

View our latest analysis for Komplett Bank

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Even though the Komplett Bank share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped. The divergence between the EPS and the share price is quite notable, during the year. But we might find some different metrics explain the share price movements better.

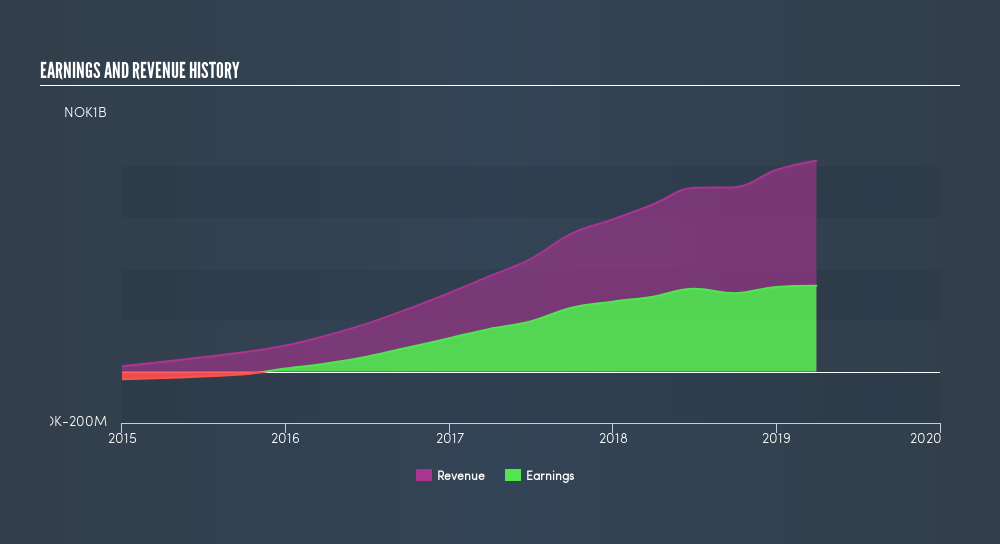

Komplett Bank's revenue is actually up 26% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for Komplett Bank in this interactive graph of future profit estimates.

A Different Perspective

Komplett Bank shareholders are down 48% for the year, falling short of the market return. The market shed around 5.5%, no doubt weighing on the stock price. Shareholders have lost 17% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Komplett Bank by clicking this link.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OB:MOBA

Morrow Bank

Provides unsecured financing to private individuals in Norway, Finland, Sweden, Netherlands, and Germany.

High growth potential with solid track record.

Market Insights

Community Narratives