In a week marked by volatility, global markets have experienced mixed performances, with U.S. stocks largely declining due to AI competition concerns and tariff risks, while European indices reached record highs following strong earnings reports and an ECB rate cut. Amid these fluctuating conditions, dividend stocks can offer stability and income potential to investors' portfolios by providing regular payouts even when market sentiment is uncertain.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 3.81% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.32% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.47% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 3.96% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.96% | ★★★★★★ |

Click here to see the full list of 1974 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Sukoon Insurance PJSC (DFM:SUKOON)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sukoon Insurance PJSC offers insurance solutions to individuals and businesses in the United Arab Emirates, with a market cap of AED1.71 billion.

Operations: Sukoon Insurance PJSC's revenue segments include AED167.96 million from Life Insurance and AED4.36 billion from Non-Life Insurance.

Dividend Yield: 5.4%

Sukoon Insurance PJSC's dividends are well-covered by earnings and cash flows, with a payout ratio of 37.8% and a cash payout ratio of 15.1%. Despite this coverage, the dividend track record is unstable and has been volatile over the past decade. The company's price-to-earnings ratio of 6.4x suggests good value relative to the AE market average of 13.2x, though its dividend yield is lower than top-tier payers in the region.

- Click here to discover the nuances of Sukoon Insurance PJSC with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Sukoon Insurance PJSC's current price could be inflated.

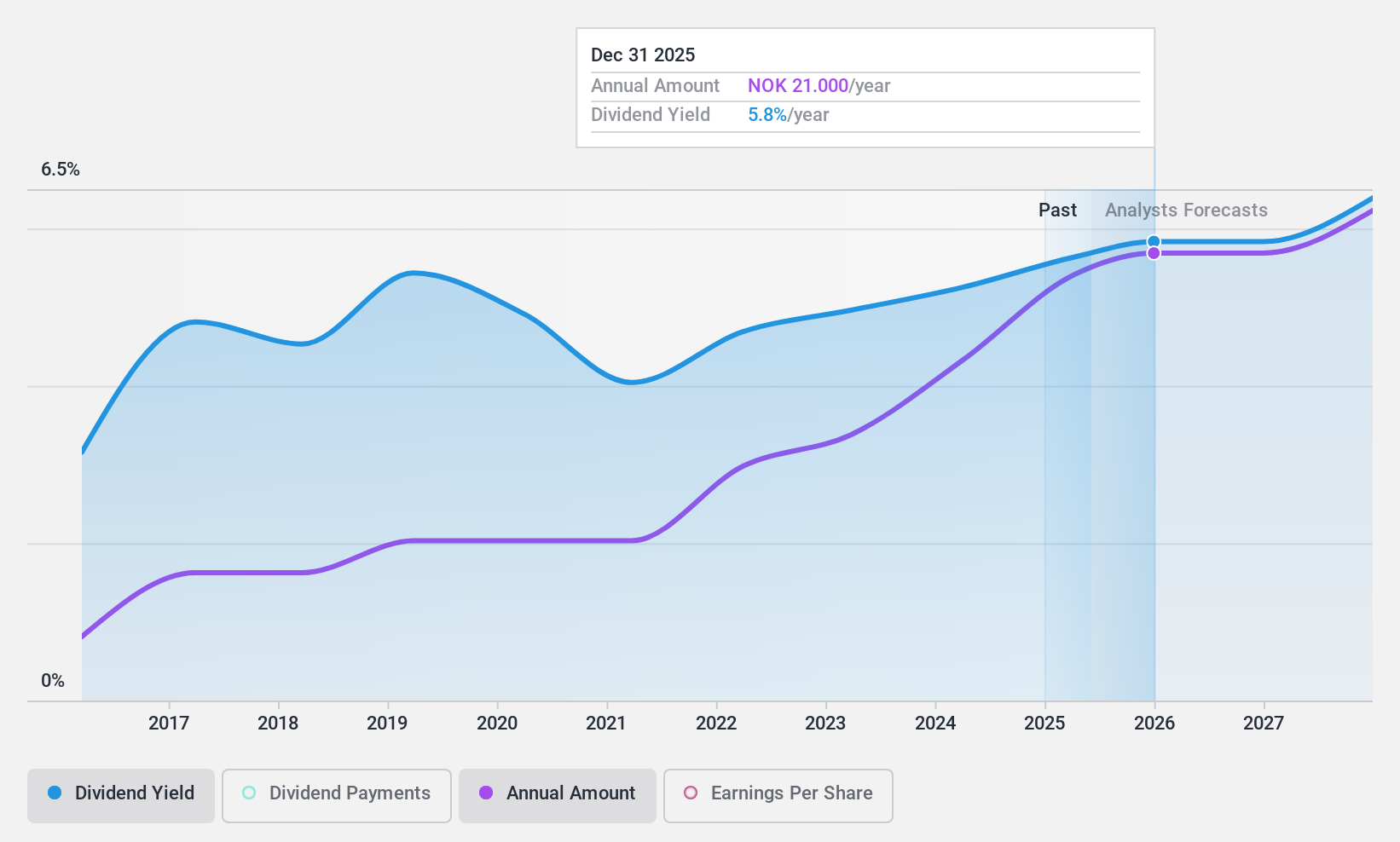

Jæren Sparebank (OB:JAREN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jæren Sparebank provides a range of financial products and services to individuals and businesses in Norway, with a market capitalization of NOK1.72 billion.

Operations: Jæren Sparebank's revenue is primarily derived from the Retail Market, which contributes NOK266.70 million, and the Corporate Market, which adds NOK166.69 million.

Dividend Yield: 4.4%

Jæren Sparebank's dividends are adequately covered by earnings, with a current payout ratio of 58.9% and forecasted coverage of 64.6% in three years. Despite past volatility in dividend payments, they have grown over the last decade. The bank's recent earnings report showed an increase in net income to NOK 62.96 million for Q3 2024, up from NOK 53.53 million a year earlier, indicating robust financial health supporting its dividend strategy.

- Delve into the full analysis dividend report here for a deeper understanding of Jæren Sparebank.

- Our valuation report here indicates Jæren Sparebank may be overvalued.

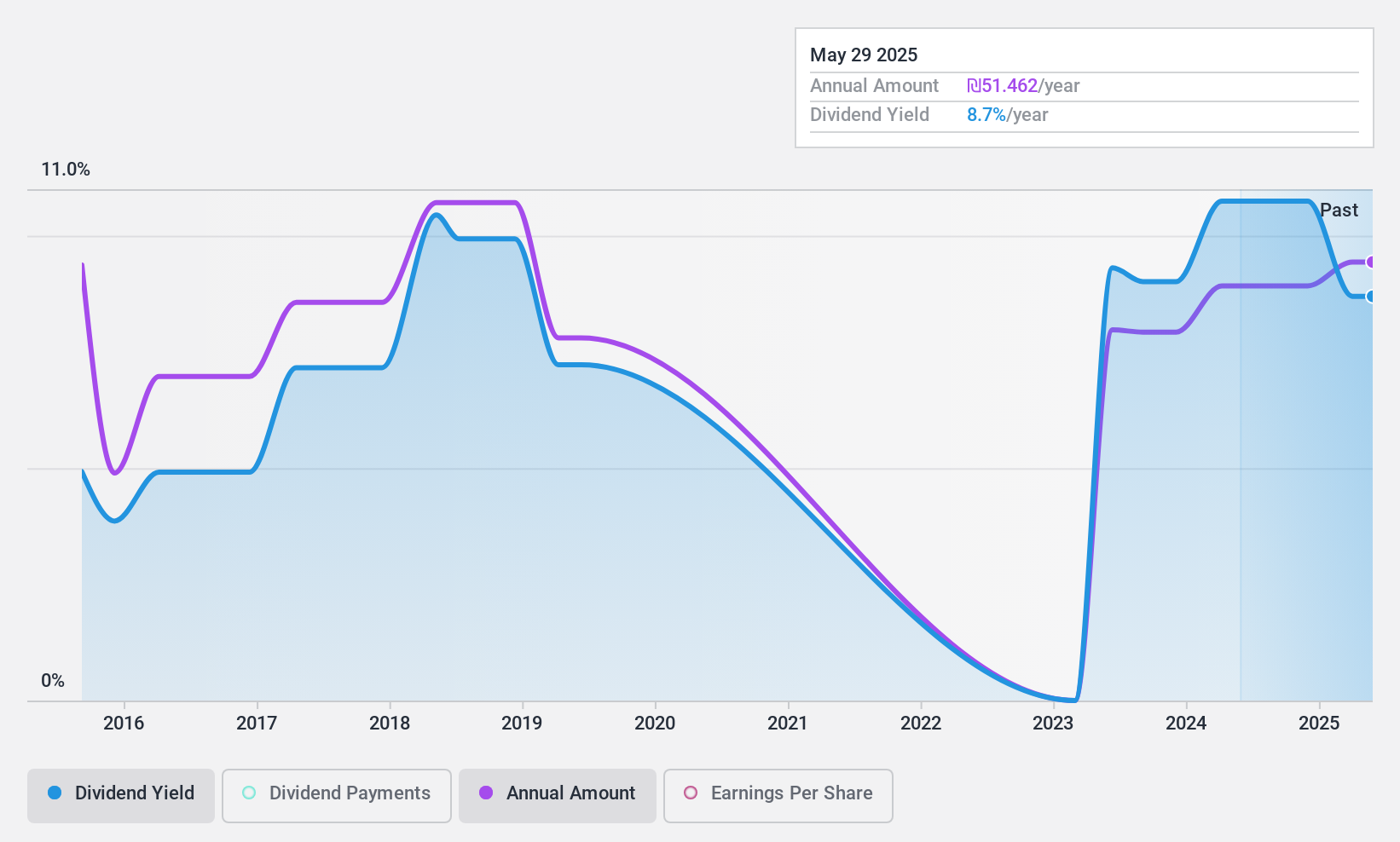

Delek Group (TASE:DLEKG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Delek Group Ltd. is an energy company involved in the exploration, development, production, and marketing of oil and gas both in Israel and internationally, with a market cap of ₪9.88 billion.

Operations: Delek Group Ltd. generates revenue from its operations in the development and production of oil and gas assets in the North Sea, amounting to ₪6.45 billion, and from oil and gas exploration and production in Israel and its surroundings, totaling ₪3.74 billion.

Dividend Yield: 9%

Delek Group's dividend yield of 9.02% ranks in the top 25% of IL market payers, with payments well-covered by cash flows (24.7% cash payout ratio) despite an 85.4% earnings payout ratio. However, dividends have been volatile over the past decade, reflecting some instability. Recent Q3 results showed a decline in net income to ILS 403 million from ILS 547 million year-over-year, which may impact future dividend sustainability given its high debt levels and volatile history.

- Dive into the specifics of Delek Group here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Delek Group shares in the market.

Turning Ideas Into Actions

- Take a closer look at our Top Dividend Stocks list of 1974 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:JAREN

Jæren Sparebank

Engages in providing various financial products and services to individuals and businesses in Norway.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives