Can You Imagine How Jaerenrebank's (OB:JAEREN) Shareholders Feel About The 58% Share Price Increase?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

One simple way to benefit from the stock market is to buy an index fund. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. For example, Jaeren Sparebank (OB:JAEREN) shareholders have seen the share price rise 58% over three years, well in excess of the market return (24%, not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 8.7%, including dividends.

Check out our latest analysis for Jaerenrebank

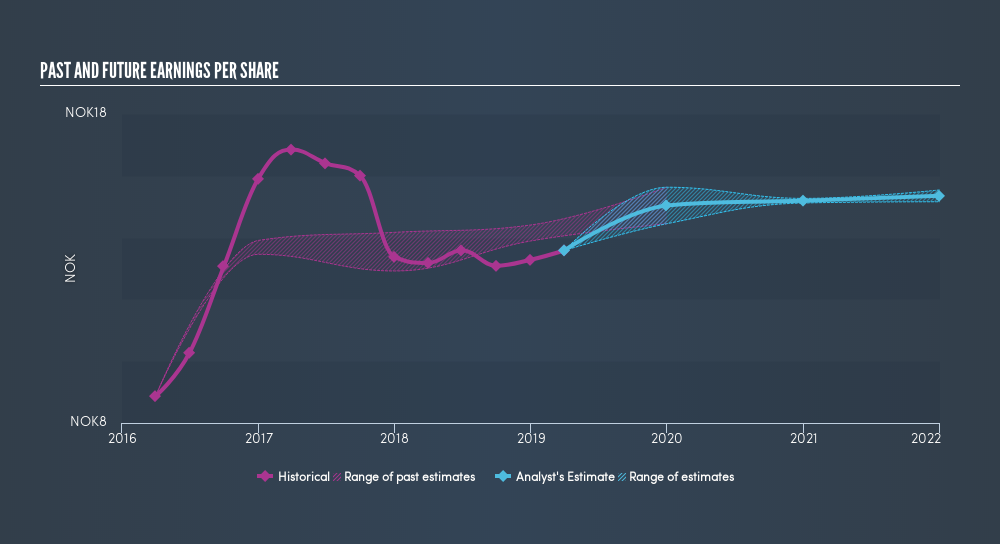

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Jaerenrebank was able to grow its EPS at 15% per year over three years, sending the share price higher. We don't think it is entirely coincidental that the EPS growth is reasonably close to the 16% average annual increase in the share price. This observation indicates that the market's attitude to the business hasn't changed all that much. Au contraire, the share price change has arguably mimicked the EPS growth.

It might be well worthwhile taking a look at our free report on Jaerenrebank's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Jaerenrebank's TSR for the last 3 years was 83%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Jaerenrebank rewarded shareholders with a total shareholder return of 8.7% over the last year. That's including the dividend. But the three year TSR of 22% per year is even better. Importantly, we haven't analysed Jaerenrebank's dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

But note: Jaerenrebank may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OB:JAREN

Jæren Sparebank

Engages in providing various financial products and services to individuals and businesses in Norway.

Proven track record average dividend payer.

Market Insights

Community Narratives