DNB Bank (OB:DNB) Profit Margin Reaches 50.6%, Reinforcing Bullish Narratives on Strong Core Performance

Reviewed by Simply Wall St

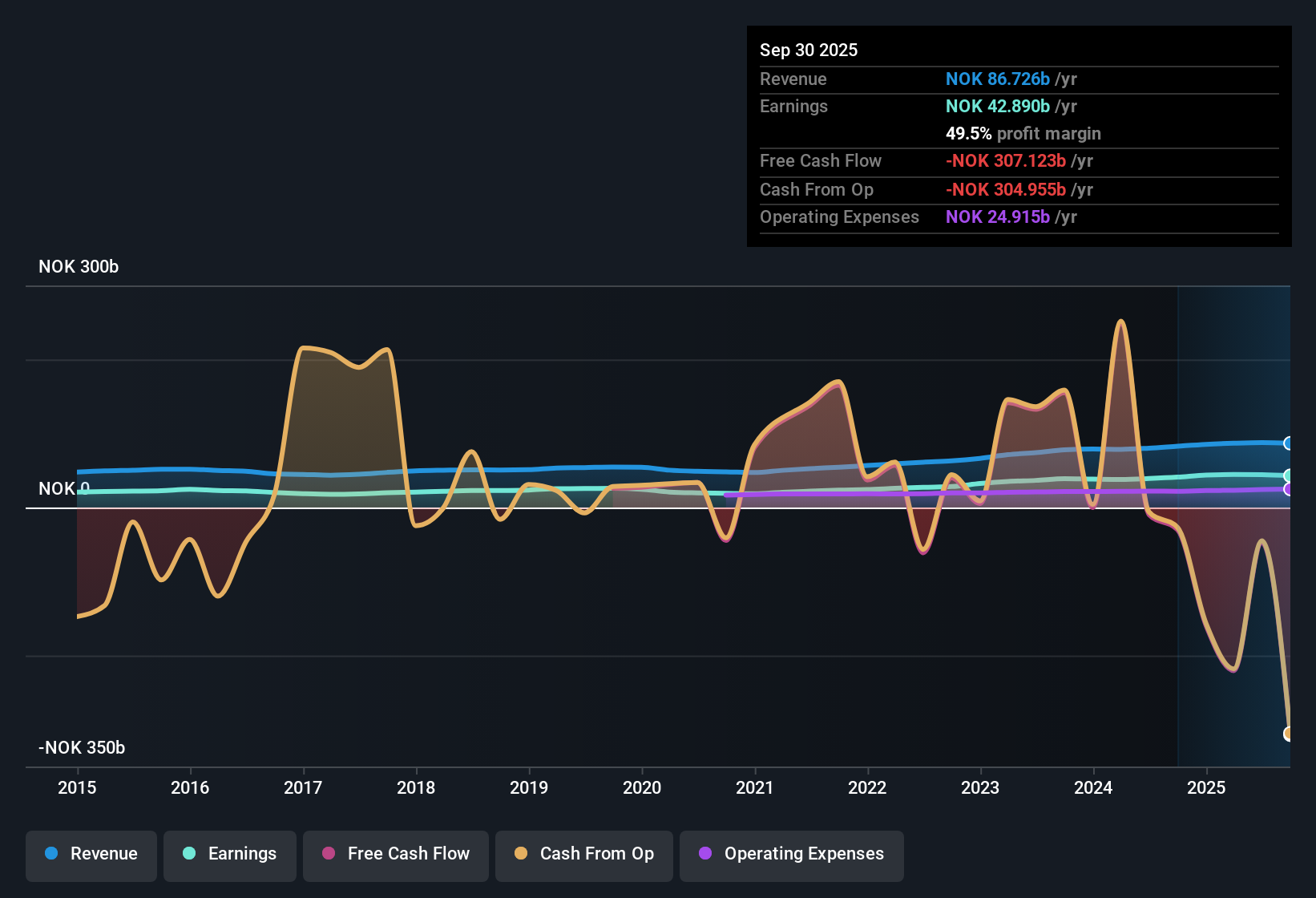

DNB Bank (OB:DNB) delivered a net profit margin of 50.6% for the period, up from 48.8% last year, and reported earnings growth of 13.3% year over year. Over the past five years, the bank has achieved an average annual earnings growth of 18.6%, while its shares are currently trading at NOK259.6, reflecting a significant discount to the estimated fair value of NOK473.83 and to peers based on valuation multiples.

See our full analysis for DNB Bank.The real test is how these headline numbers stack up against the market’s broader narrative for DNB. Some long-held beliefs may be reinforced, while others are open for debate.

See what the community is saying about DNB Bank

Margins Set to Shrink by 11 Percentage Points

- Analysts expect DNB's profit margins to retreat from 50.6% today to 39.1% by 2028, a sharp contraction that points to a less profitable period ahead even as the bank maintains robust core operations.

- Consensus narrative notes that this margin pressure stems from a combination of new ESG regulations, increased compliance costs, and intensified competition from digital-first banks.

- These factors could challenge DNB's ability to sustain its recent earnings pace as fintech entrants compete for market share and regulatory costs accumulate. Both developments may impact efficiency gains.

- Still, strong asset quality and diversified loan growth provide some offsetting resilience, suggesting that while headwinds are real, DNB may weather them better than peers that lack this foundation.

- Click through for a full breakdown of how analysts weigh the risks and strengths shaping DNB's profit outlook. 📊 Read the full DNB Bank Consensus Narrative.

Fee and Commission Income: 9% Growth Targeted

- DNB guides to 9% annual growth in fee and commission income, spotlighting investment banking and asset management as key drivers of this positive recurring revenue trend.

- Consensus narrative highlights that despite this strong target, some analysts caution that macro uncertainty and tariff risks may make it difficult to sustain recent momentum, especially as new entrants pressure fee-generating segments.

- On the upside, steady market share gains in real estate brokerage and resilient defined contribution inflows suggest DNB's diversified approach is insulating these segments. This remains a bullish talking point.

- However, critics point to the risk that rising competition could slow fee growth faster than management expects, emphasizing the need for ongoing vigilance.

Trading at a 45% Discount to DCF Fair Value

- At NOK259.6 per share, DNB trades at a 45% discount to its DCF fair value estimate of NOK473.83 and below peer multiples. Analysts' price target of NOK277.4 suggests only modest upside from current levels.

- Consensus narrative underlines that the market appears to be pricing in both near-term earnings headwinds and longer-term structural challenges, yet the large DCF fair value gap hints at the potential for valuation rerating should profitability hold up.

- The low price-to-earnings ratio of 8.6x versus the industry average of 10.9x provides further context for investors weighing whether DNB represents a classic value opportunity or a genuine risk discount.

- While slower forecast revenue growth (1.3% annually) weighs on sentiment, the magnitude of the current valuation gap sparks debate about whether expectations are too bearish given DNB's capital strength and diversified business model.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for DNB Bank on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the numbers paint a different picture? Bring your own perspective to life and craft your narrative. Get started in under three minutes. Do it your way

A great starting point for your DNB Bank research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

DNB Bank faces forecast margin compression, slowing revenue growth, and stiff competition. These factors could pressure profitability in the years ahead.

If you want more reliable expansion and less turbulence, use our stable growth stocks screener (2096 results) to target companies delivering consistent, steady growth regardless of headwinds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:DNB

DNB Bank

Provides financial services to individuals and businesses in Norway and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives