- Norway

- /

- Auto Components

- /

- OB:KOA

European Penny Stocks To Watch In April 2025

Reviewed by Simply Wall St

The European market has recently experienced significant volatility due to higher-than-expected U.S. trade tariffs, leading to sharp declines across major stock indexes such as the STOXX Europe 600 and Germany’s DAX. Amidst this uncertainty, investors may find opportunities in lesser-known corners of the market like penny stocks, which often represent smaller or newer companies with potential for growth at lower price points. While the term 'penny stock' might seem outdated, these investments can still offer substantial upside when supported by strong financials and solid fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK1.99 | SEK1.9B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.50 | SEK231.11M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.55 | SEK266.2M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.94 | SEK239.71M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.45 | PLN116.93M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.50 | €52.73M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.982 | €32.88M | ✅ 3 ⚠️ 3 View Analysis > |

| Arcure (ENXTPA:ALCUR) | €4.16 | €24.09M | ✅ 3 ⚠️ 3 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €1.04 | €83.78M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.05 | €283.03M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 427 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

Catenon (BME:COM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Catenon, S.A. is a technology-based company that offers recruitment services both in Spain and internationally, with a market cap of €11.59 million.

Operations: Catenon, S.A. does not report specific revenue segments.

Market Cap: €11.59M

Catenon, S.A., with a market cap of €11.59 million, has demonstrated financial resilience despite its status as a penny stock. The company's short-term assets of €4.0 million comfortably exceed both its long-term liabilities (€472.9K) and short-term liabilities (€2.1M), highlighting strong liquidity management. Recent earnings reports show Catenon has become profitable, reporting net income of €0.148 million for 2024 compared to a loss the previous year, though sales declined to €0.315 million from €0.521 million in 2023. Despite high share price volatility and low Return on Equity at 4.8%, debt levels have improved significantly over five years, reflecting prudent financial strategies amidst market challenges.

- Unlock comprehensive insights into our analysis of Catenon stock in this financial health report.

- Understand Catenon's track record by examining our performance history report.

Aelis Farma (ENXTPA:AELIS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aelis Farma SA is a clinical-stage biotechnology company dedicated to discovering and developing drug candidates for central nervous system disorders, with a market cap of €17.29 million.

Operations: The company generates revenue from the research and development of pharmaceutical products, amounting to €5.56 million.

Market Cap: €17.29M

Aelis Farma, with a market cap of €17.29 million, remains unprofitable but showcases financial stability through its short-term assets of €18.8 million exceeding both long-term (€4.2M) and short-term liabilities (€6.3M). The company's recent Phase 2B trial results for AEF0117 in cannabis use disorder are promising, potentially paving the way for future partnerships and development opportunities. Despite high share price volatility and negative Return on Equity (-74.98%), Aelis maintains a sufficient cash runway beyond one year without significant shareholder dilution, supported by reduced debt levels over five years from 209.2% to 51.1%.

- Take a closer look at Aelis Farma's potential here in our financial health report.

- Assess Aelis Farma's future earnings estimates with our detailed growth reports.

Kongsberg Automotive (OB:KOA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kongsberg Automotive ASA develops, manufactures, and sells products to the automotive industry worldwide with a market cap of NOK1.27 billion.

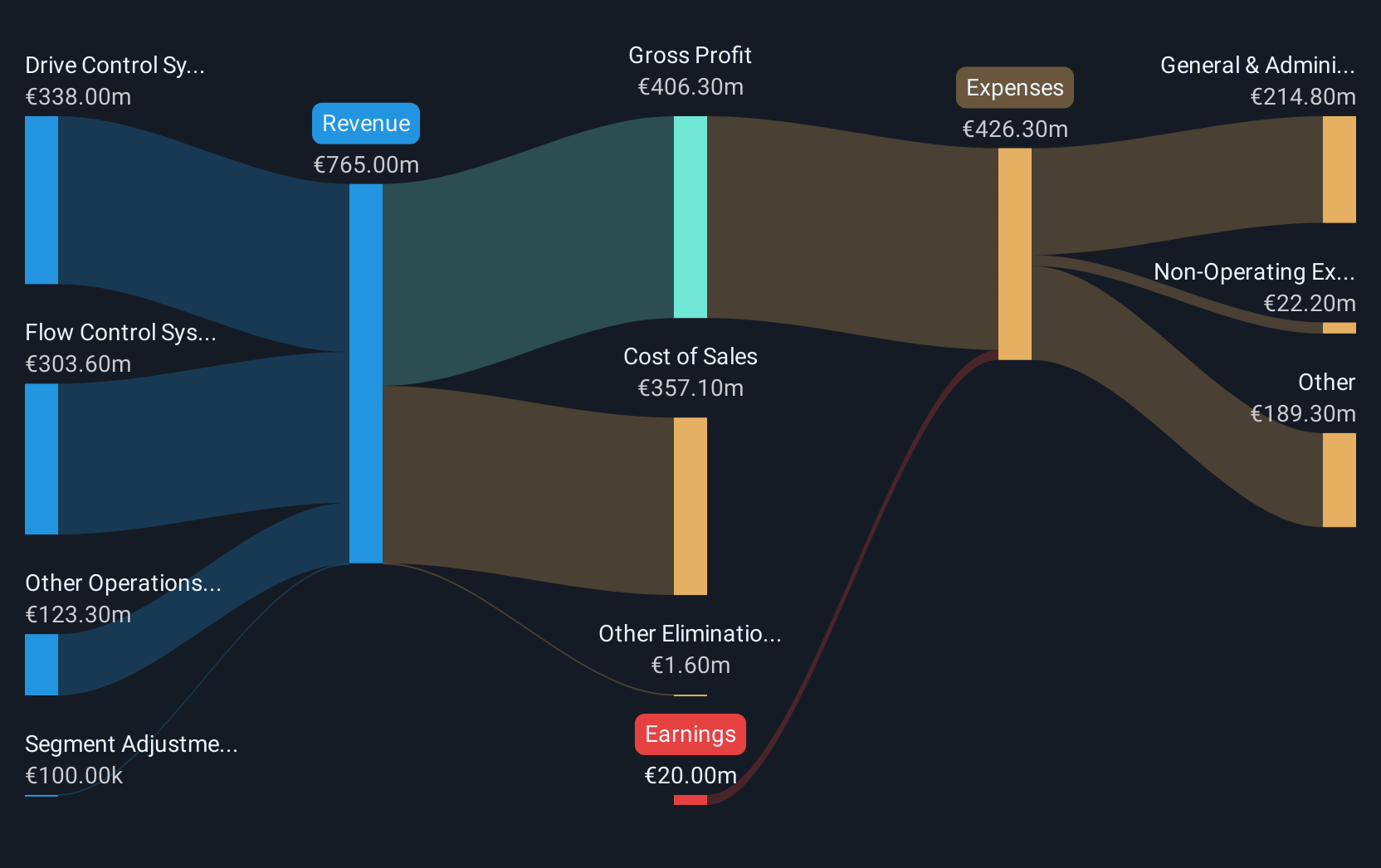

Operations: The company's revenue is primarily derived from its Drive Control Systems segment at €351.20 million and Flow Control Systems segment at €307.30 million, with additional contributions from Other Operations totaling €129.60 million.

Market Cap: NOK1.27B

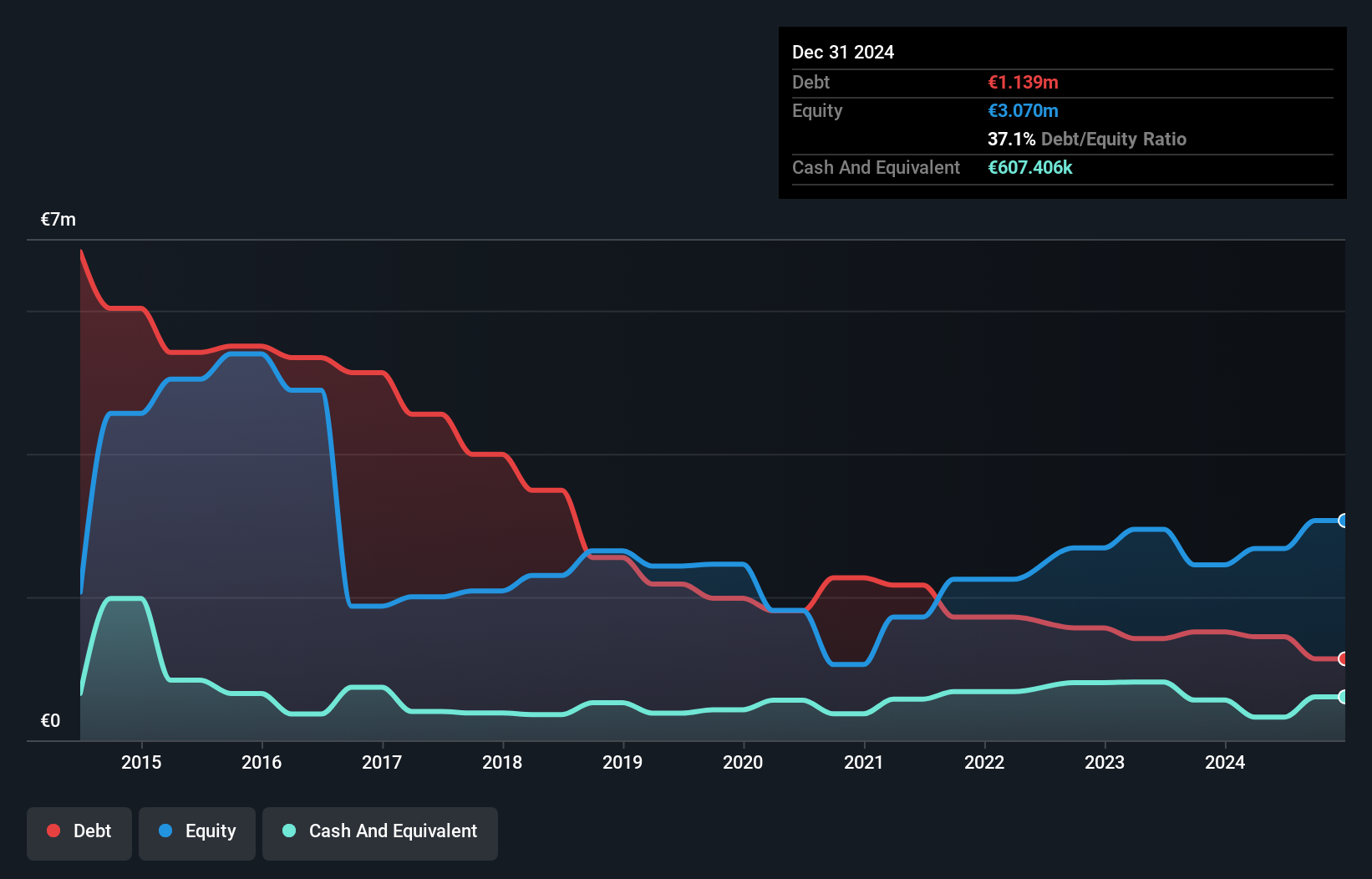

Kongsberg Automotive, with a market cap of NOK1.27 billion, is navigating challenges as it remains unprofitable despite generating €788.2 million in revenue for 2024. The company has a stable cash position, boasting a runway exceeding three years due to positive free cash flow and manageable debt levels with a net debt to equity ratio of 23.7%. Recent leadership changes include the appointment of Trond Fiskum as CEO and Erik Magelssen as CFO, both bringing extensive experience aimed at strategic growth and efficiency improvements. A significant contract extension worth over €58 million further strengthens its revenue outlook.

- Get an in-depth perspective on Kongsberg Automotive's performance by reading our balance sheet health report here.

- Explore historical data to track Kongsberg Automotive's performance over time in our past results report.

Turning Ideas Into Actions

- Investigate our full lineup of 427 European Penny Stocks right here.

- Seeking Other Investments? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kongsberg Automotive might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:KOA

Kongsberg Automotive

Develops, manufactures, and sells products to the automotive industry worldwide.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives