- Netherlands

- /

- Logistics

- /

- ENXTAM:PNL

Top Growth Companies With Insider Stakes December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious Federal Reserve commentary and political uncertainty, investors are keenly observing the impact of rate cuts and economic data on market indices. With U.S. stocks experiencing fluctuations amid these developments, attention turns to growth companies where high insider ownership can signal confidence in long-term potential. In such an environment, identifying stocks with strong insider stakes may offer insights into companies poised for resilience and growth despite broader market challenges.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

Here's a peek at a few of the choices from the screener.

PostNL (ENXTAM:PNL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PostNL N.V. offers postal and logistics services to businesses and consumers in the Netherlands, Europe, and internationally, with a market cap of €517.17 million.

Operations: The company's revenue segments include postal services and logistics solutions for businesses and consumers across the Netherlands, Europe, and international markets.

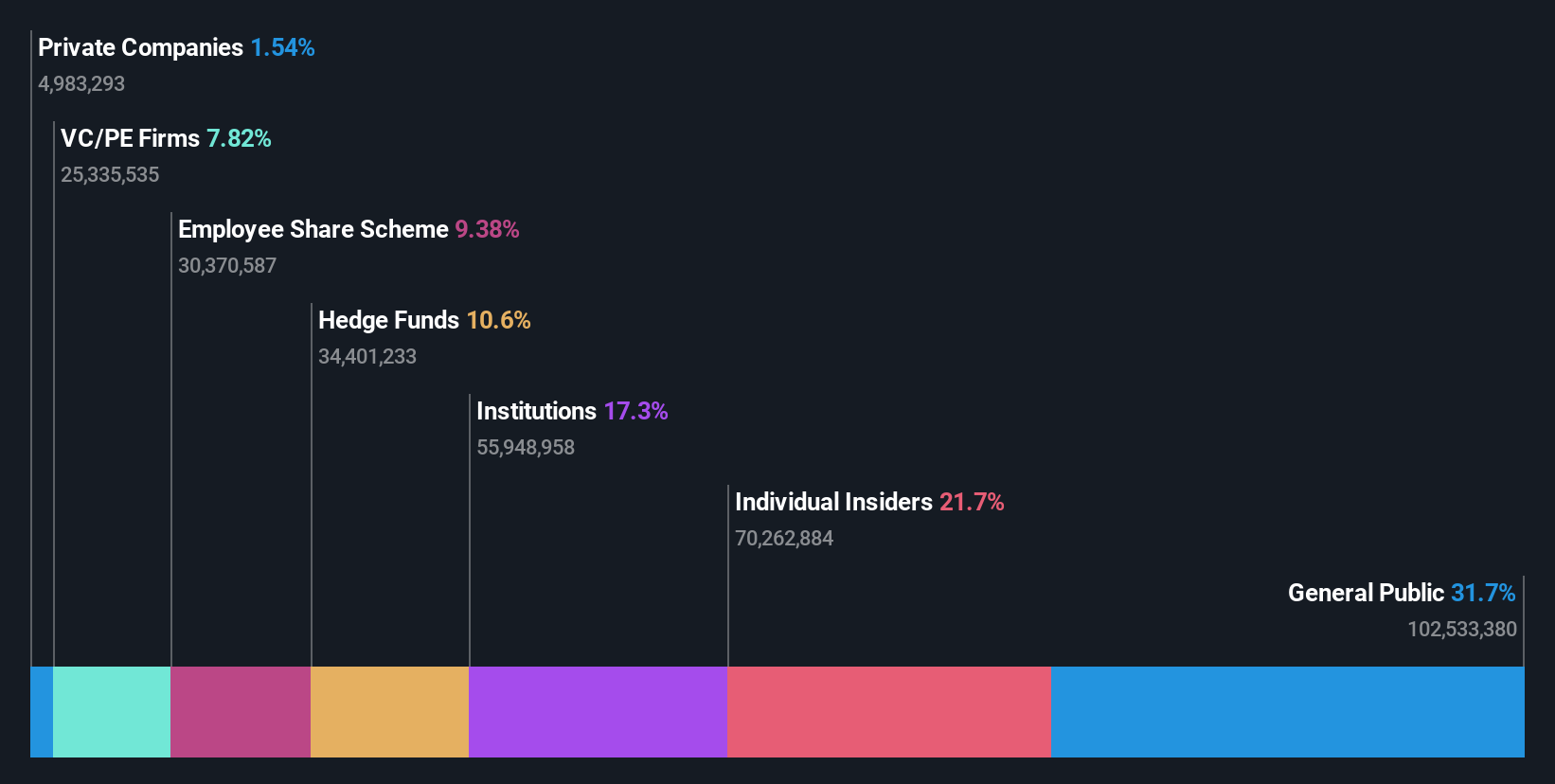

Insider Ownership: 35.6%

PostNL's earnings are expected to grow significantly at 58.08% annually, outpacing the Dutch market's growth rate of 15.7%. Despite this, revenue growth is forecasted at a modest 2.4%, trailing behind the market average of 8.8%. The company recently reported a net loss for Q3 and the first nine months of 2024, indicating challenges in achieving profitability despite becoming profitable earlier this year. Insider trading activity remains unreported over recent months.

- Navigate through the intricacies of PostNL with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, PostNL's share price might be too pessimistic.

Zylox-Tonbridge Medical Technology (SEHK:2190)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zylox-Tonbridge Medical Technology Co., Ltd. is a medical device company that offers neuro- and peripheral-vascular interventional devices in the People's Republic of China and internationally, with a market cap of HK$3.63 billion.

Operations: The company's revenue segment consists of CN¥663.61 million from the sales of neurovascular and peripheral-vascular interventional surgical devices.

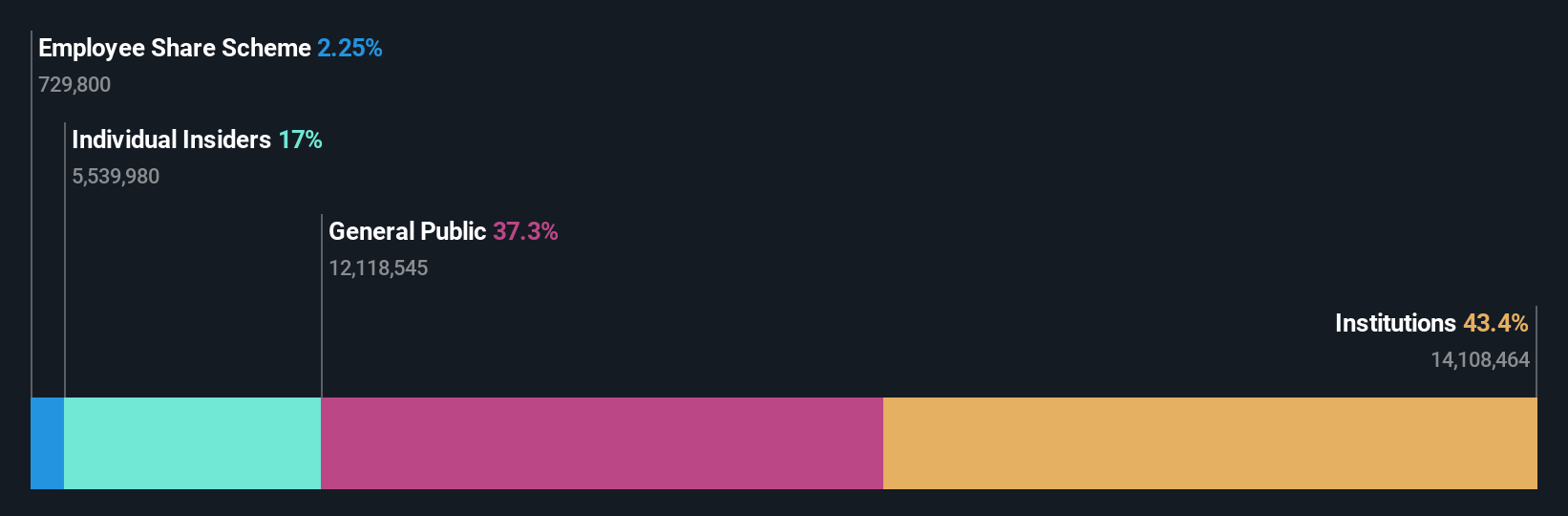

Insider Ownership: 19.4%

Zylox-Tonbridge Medical Technology is experiencing substantial growth, with revenue forecasted to increase by 34% annually, significantly outpacing the Hong Kong market's 7.8%. The company became profitable this year and expects earnings to grow at a robust 66.5% annually over the next three years. However, its Return on Equity is projected to remain low at 6.7%. A recent shareholders meeting addressed a Share Award Scheme and Loss Compensation Plan, indicating strategic financial adjustments ahead.

- Unlock comprehensive insights into our analysis of Zylox-Tonbridge Medical Technology stock in this growth report.

- According our valuation report, there's an indication that Zylox-Tonbridge Medical Technology's share price might be on the expensive side.

Tri Chemical Laboratories (TSE:4369)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tri Chemical Laboratories Inc. supplies chemical products for semiconductors, coating, optical fibers, solar cells, and compound semiconductors with a market cap of ¥87.77 billion.

Operations: The company's revenue is primarily derived from its High-Purity Chemical Compound Business for Manufacturing Semiconductors, generating ¥16.14 billion.

Insider Ownership: 17.4%

Tri Chemical Laboratories is set for strong growth, with revenue expected to rise by 22.8% annually, surpassing the Japanese market's 4.2%. Earnings are projected to grow significantly at 31.2% per year over the next three years, though Return on Equity might remain modest at 19.8%. The stock trades at a considerable discount of 52.6% below estimated fair value, and analysts predict an 80.8% price increase despite recent share price volatility.

- Delve into the full analysis future growth report here for a deeper understanding of Tri Chemical Laboratories.

- Our comprehensive valuation report raises the possibility that Tri Chemical Laboratories is priced lower than what may be justified by its financials.

Taking Advantage

- Click through to start exploring the rest of the 1509 Fast Growing Companies With High Insider Ownership now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:PNL

PostNL

Provides postal and logistics services to businesses and consumers in the Netherlands, rest of Europe, and internationally.

Reasonable growth potential with adequate balance sheet.