Stock Analysis

- Netherlands

- /

- Hospitality

- /

- ENXTAM:BFIT

Discovering Basic-Fit And Two More Top Growth Stocks With Insider Ownership On Euronext Amsterdam

Reviewed by Simply Wall St

As global markets experience mixed reactions to economic data, with particular attention on inflation and interest rates, the Euronext Amsterdam remains a focal point for investors looking for growth opportunities. In this context, companies like Basic-Fit that boast high insider ownership might signal strong confidence from those closest to the business, potentially aligning their interests with external shareholders especially in uncertain times.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

| Name | Insider Ownership | Earnings Growth |

| BenevolentAI (ENXTAM:BAI) | 27.8% | 62.8% |

| Ebusco Holding (ENXTAM:EBUS) | 33.2% | 114.0% |

| Envipco Holding (ENXTAM:ENVI) | 31.1% | 68.9% |

| MotorK (ENXTAM:MTRK) | 35.8% | 105.8% |

| Basic-Fit (ENXTAM:BFIT) | 12% | 64.8% |

| PostNL (ENXTAM:PNL) | 35.8% | 23.9% |

Here we highlight a subset of our preferred stocks from the screener.

Basic-Fit (ENXTAM:BFIT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Basic-Fit N.V. operates a chain of fitness clubs across Europe, with a market capitalization of approximately €1.45 billion.

Operations: The company generates its revenue primarily from fitness club operations in the Benelux region (€479.04 million) and in France, Spain, and Germany (€568.21 million).

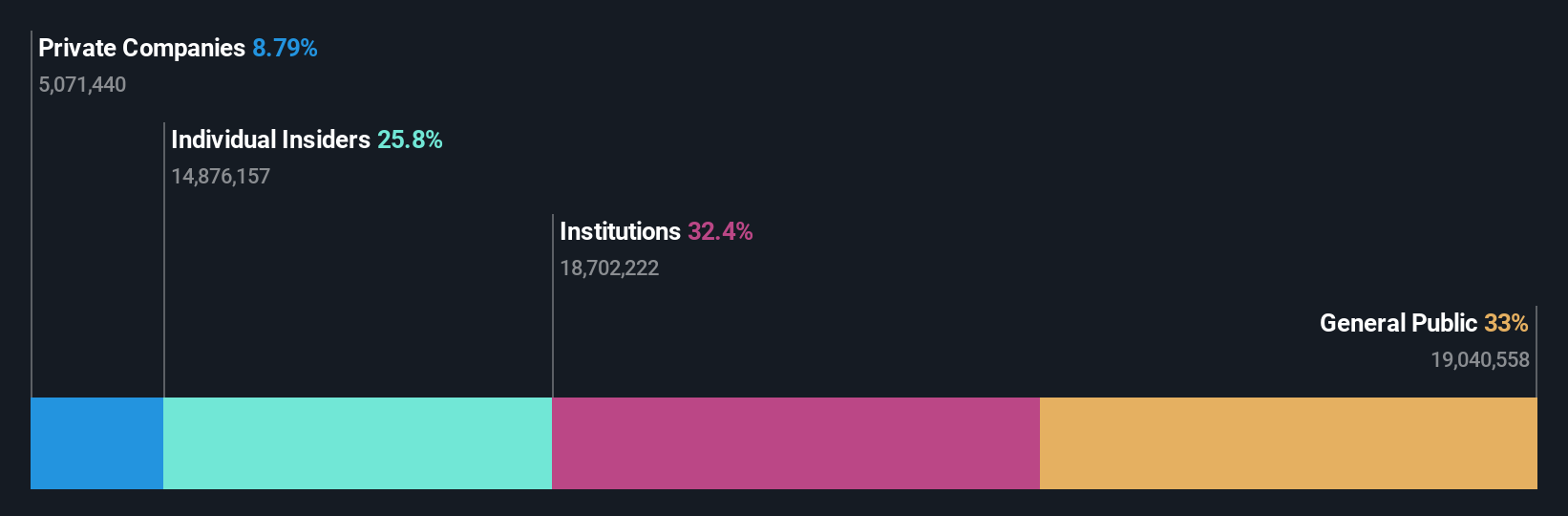

Insider Ownership: 12%

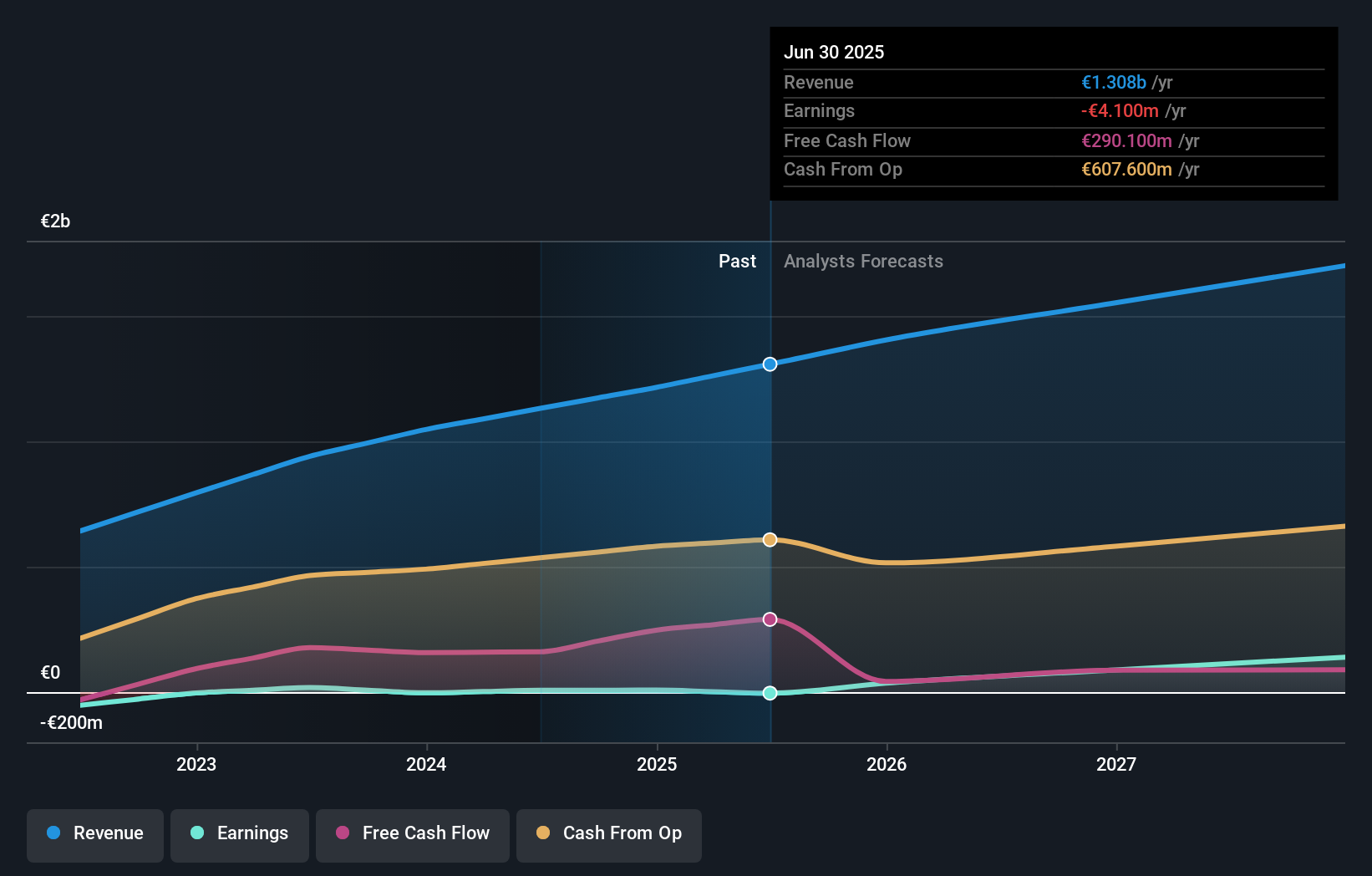

Basic-Fit, a notable growth company in the Netherlands with high insider ownership, shows promising prospects. Despite not having substantial insider buying recently, no significant shares have been sold by insiders either. Analysts predict a 50.8% potential rise in stock price, and earnings are expected to grow by 64.81% annually. Furthermore, Basic-Fit's revenue growth at 14.9% per year outpaces the Dutch market's 9.9%, with profitability anticipated within three years and a strong forecast Return on Equity of 26.7%.

- Navigate through the intricacies of Basic-Fit with our comprehensive analyst estimates report here.

- The analysis detailed in our Basic-Fit valuation report hints at an inflated share price compared to its estimated value.

Envipco Holding (ENXTAM:ENVI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Envipco Holding N.V. operates in the sector of reverse vending machines, providing solutions for collecting and processing used beverage containers mainly in the Netherlands, North America, and other parts of Europe, with a market capitalization of approximately €334.60 million.

Operations: The company generates its revenue by designing, selling, leasing, and servicing reverse vending machines primarily across the Netherlands, North America, and other European regions.

Insider Ownership: 31.1%

Envipco Holding N.V., a growth-oriented company in the Netherlands with high insider ownership, recently turned profitable with first-quarter sales jumping to €27.44 million from €10.41 million year-over-year and net income reaching €0.147 million after a previous loss of €2.57 million. Despite some shareholder dilution last year, insider activity has been positive with more shares bought than sold in recent months. Envipco's earnings are expected to surge by 68.9% annually, significantly outpacing the Dutch market's forecasted 18% growth, while its revenue growth also exceeds market expectations at 33.3% per year.

- Delve into the full analysis future growth report here for a deeper understanding of Envipco Holding.

- Upon reviewing our latest valuation report, Envipco Holding's share price might be too optimistic.

PostNL (ENXTAM:PNL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PostNL N.V. offers postal and logistics services across the Netherlands, Europe, and globally, with a market capitalization of approximately €0.62 billion.

Operations: The company's revenue is generated primarily through two segments: Packages, which brought in €2.25 billion, and Mail in the Netherlands, contributing €1.35 billion.

Insider Ownership: 35.8%

PostNL, while trading at a significant discount to its estimated fair value, faces challenges with a high debt level and unstable dividend history. Its earnings are projected to grow by 23.9% annually, outstripping the Dutch market's 18% growth rate. However, revenue growth lags behind at 3.3% per year compared to the market's 9.9%. Recent activities include issuing €298.67 million in sustainability-linked bonds and providing an earnings guidance with expected normalized EBIT between €80 million and €110 million for 2024.

- Take a closer look at PostNL's potential here in our earnings growth report.

- Our valuation report unveils the possibility PostNL's shares may be trading at a discount.

Summing It All Up

- Gain an insight into the universe of 6 Fast Growing Euronext Amsterdam Companies With High Insider Ownership by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Basic-Fit is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:BFIT

High growth potential with imperfect balance sheet.