Stock Analysis

- Netherlands

- /

- Capital Markets

- /

- ENXTAM:VLK

Euronext Amsterdam Showcases 3 Dividend Stocks With Yields Up To 9.9%

Reviewed by Simply Wall St

As global markets respond to fluctuating inflation and interest rates, the Netherlands market remains a point of interest for investors looking for yield opportunities. Amid these conditions, dividend stocks listed on Euronext Amsterdam are attracting attention due to their potential to offer stable returns in a volatile environment.

Top 5 Dividend Stocks In The Netherlands

| Name | Dividend Yield | Dividend Rating |

| Acomo (ENXTAM:ACOMO) | 6.56% | ★★★★★☆ |

| ABN AMRO Bank (ENXTAM:ABN) | 9.53% | ★★★★☆☆ |

| Van Lanschot Kempen (ENXTAM:VLK) | 9.94% | ★★★★☆☆ |

| Signify (ENXTAM:LIGHT) | 6.32% | ★★★★☆☆ |

| Randstad (ENXTAM:RAND) | 5.11% | ★★★★☆☆ |

| Koninklijke KPN (ENXTAM:KPN) | 4.09% | ★★★★☆☆ |

| Koninklijke Heijmans (ENXTAM:HEIJM) | 3.72% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

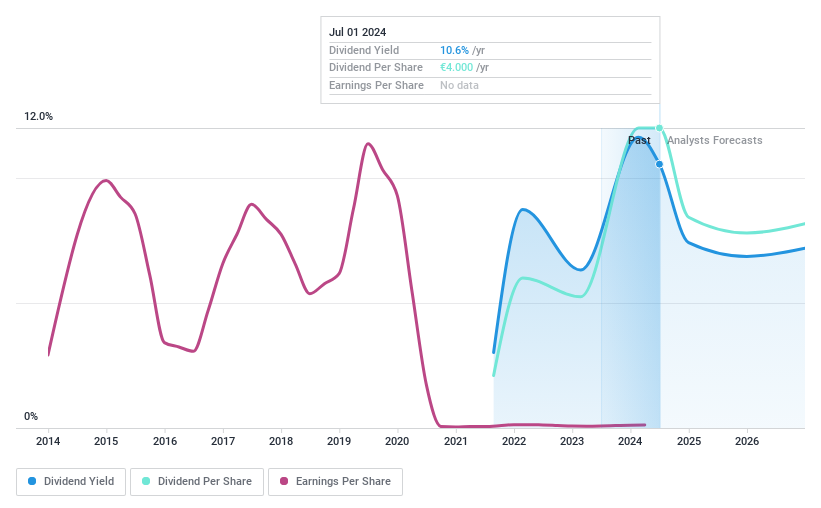

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. operates in property development, construction, and infrastructure sectors primarily in the Netherlands and abroad, with a market capitalization of approximately €642.48 million.

Operations: Koninklijke Heijmans N.V. generates revenue through its Real Estate, Van Wanrooij, Infrastructure Works, and Construction & Technology segments, with respective earnings of €411.79 million, €124.76 million, €800.03 million, and €1.08 billion.

Dividend Yield: 3.7%

Koninklijke Heijmans has demonstrated a capacity to increase its dividends over the last decade, though the growth has been marred by volatility, with significant annual drops exceeding 20%. Currently, its Price-To-Earnings ratio at 10.8x sits below the Dutch market average of 16.3x, indicating potential value. Dividends are supported by earnings and cash flows with payout ratios of 37.1% and 59% respectively. However, its dividend yield of 3.72% is lower than the top quartile in the Dutch market at 5.45%.

- Take a closer look at Koninklijke Heijmans' potential here in our dividend report.

- According our valuation report, there's an indication that Koninklijke Heijmans' share price might be on the expensive side.

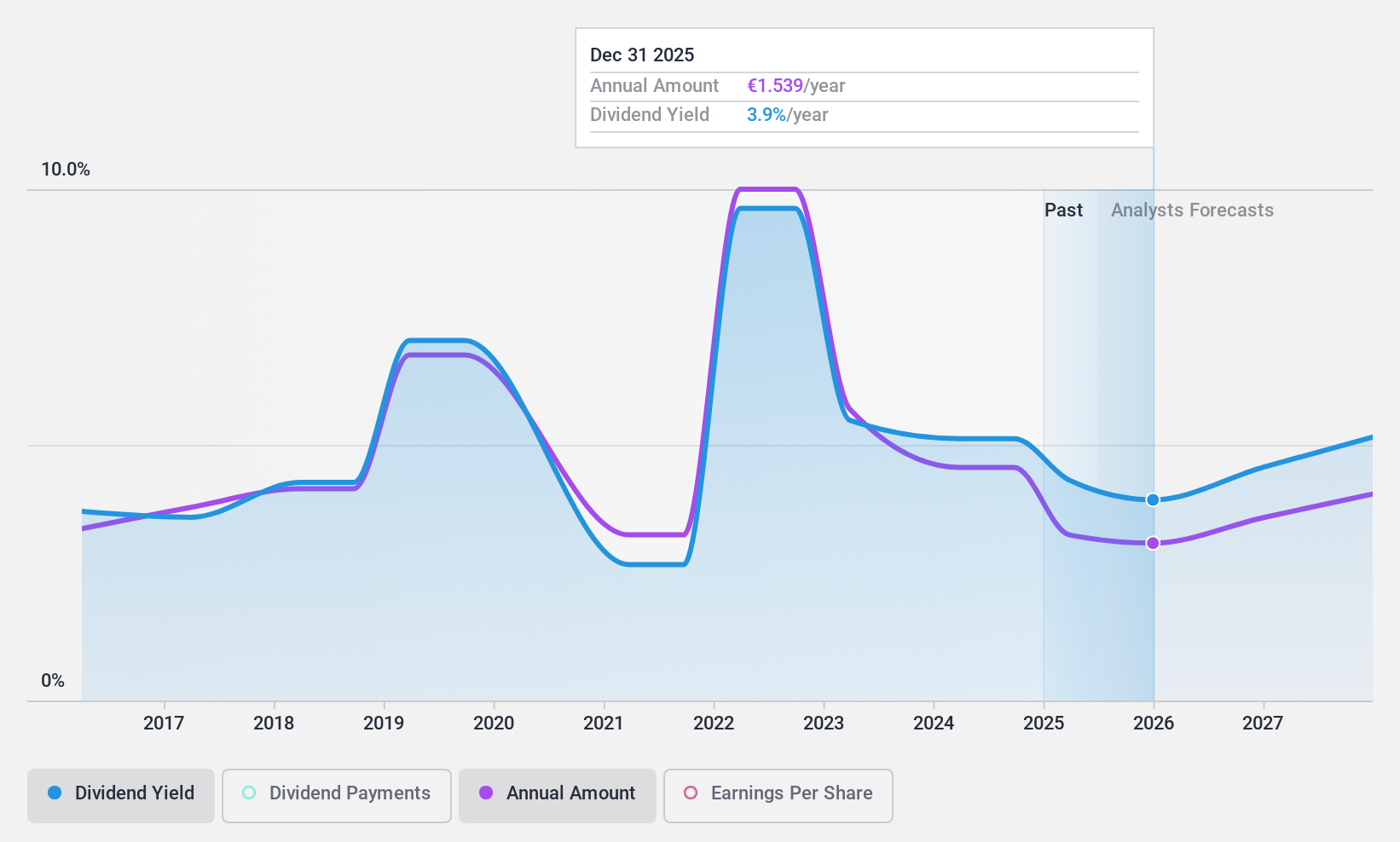

Randstad (ENXTAM:RAND)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Randstad N.V. specializes in offering a range of work and human resources services, with a market capitalization of approximately €7.90 billion.

Operations: Randstad N.V. generates its revenue from a variety of work and HR services, but specific segment details are not provided in the text.

Dividend Yield: 5.1%

Randstad's recent earnings decline, with Q1 2024 sales dropping to €5.94 billion from €6.52 billion year-over-year and net income falling to €88 million from €154 million, reflects challenges despite a stable dividend history. The firm maintains a sustainable dividend, supported by a 73.4% earnings payout ratio and a 45.9% cash flow payout ratio, yet its yield of 5.11% trails the Dutch market's top quartile at 5.45%. Additionally, Randstad has repurchased shares worth €316.66 million since early 2023, signaling confidence in its valuation, which is currently deemed below fair value by 50.1%.

- Get an in-depth perspective on Randstad's performance by reading our dividend report here.

- The analysis detailed in our Randstad valuation report hints at an deflated share price compared to its estimated value.

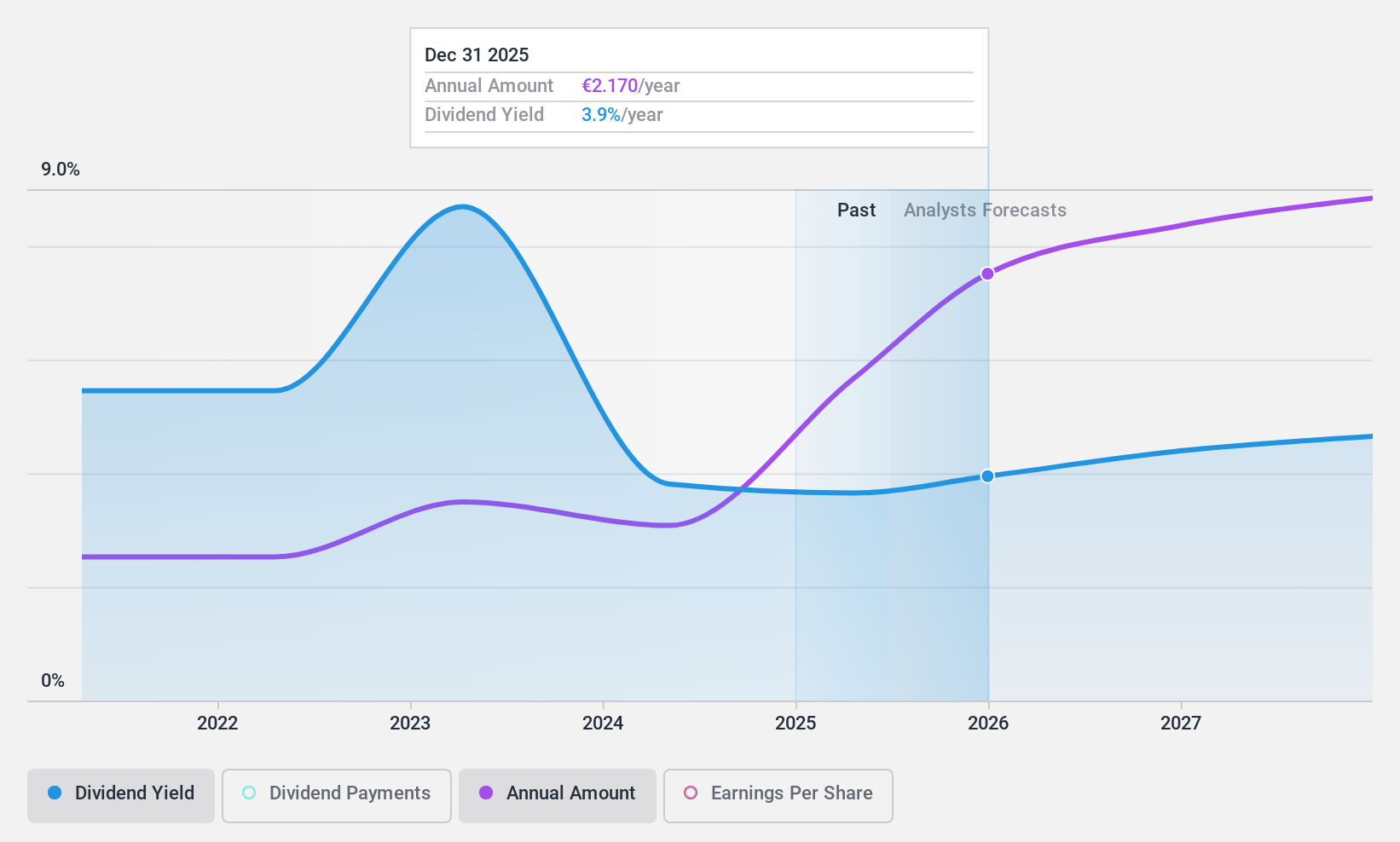

Van Lanschot Kempen (ENXTAM:VLK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Van Lanschot Kempen NV is a financial services provider operating both in the Netherlands and internationally, with a market capitalization of approximately €1.70 billion.

Operations: Van Lanschot Kempen NV generates revenue primarily through its Investment Banking Clients and Wholesale & Institutional Clients segments, contributing €41 million and €83.10 million respectively.

Dividend Yield: 9.9%

Van Lanschot Kempen, with a dividend yield of 9.94%, stands above the Dutch market average of 5.45%. Its dividends are currently 70.9% covered by earnings, projected to rise to 84.6% in three years, indicating a sustainable payout despite a short history of less than ten years in dividend distribution. Recent share buybacks totaling €22.66 million affirm financial strength, yet the firm's price-to-earnings ratio at 13x remains below the sector average of 16.3x, suggesting good value relative to peers.

- Click here and access our complete dividend analysis report to understand the dynamics of Van Lanschot Kempen.

- The valuation report we've compiled suggests that Van Lanschot Kempen's current price could be quite moderate.

Summing It All Up

- Explore the 7 names from our Top Euronext Amsterdam Dividend Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Van Lanschot Kempen is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:VLK

Van Lanschot Kempen

Provides various financial services in the Netherlands and internationally.

Solid track record with excellent balance sheet and pays a dividend.