The European market has shown resilience with the pan-European STOXX Europe 600 Index rising by 1.18%, buoyed by easing trade tensions and optimism over potential U.S. interest rate cuts, which have bolstered investor sentiment across major indices like France's CAC 40 and Germany's DAX. In this environment of cautious optimism, identifying promising stocks involves looking for companies that can leverage these favorable macroeconomic conditions to drive growth and innovation within their sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

FRoSTA (DB:NLM)

Simply Wall St Value Rating: ★★★★★★

Overview: FRoSTA Aktiengesellschaft, along with its subsidiaries, specializes in the development, production, and marketing of frozen food products across Germany, Poland, Austria, Italy, and Eastern Europe with a market capitalization of €708.51 million.

Operations: FRoSTA generates its revenue primarily from the sale of frozen food products in various European markets. The company's cost structure includes expenses related to production and marketing activities. Its net profit margin has shown variability, reflecting changes in operational efficiency and market conditions.

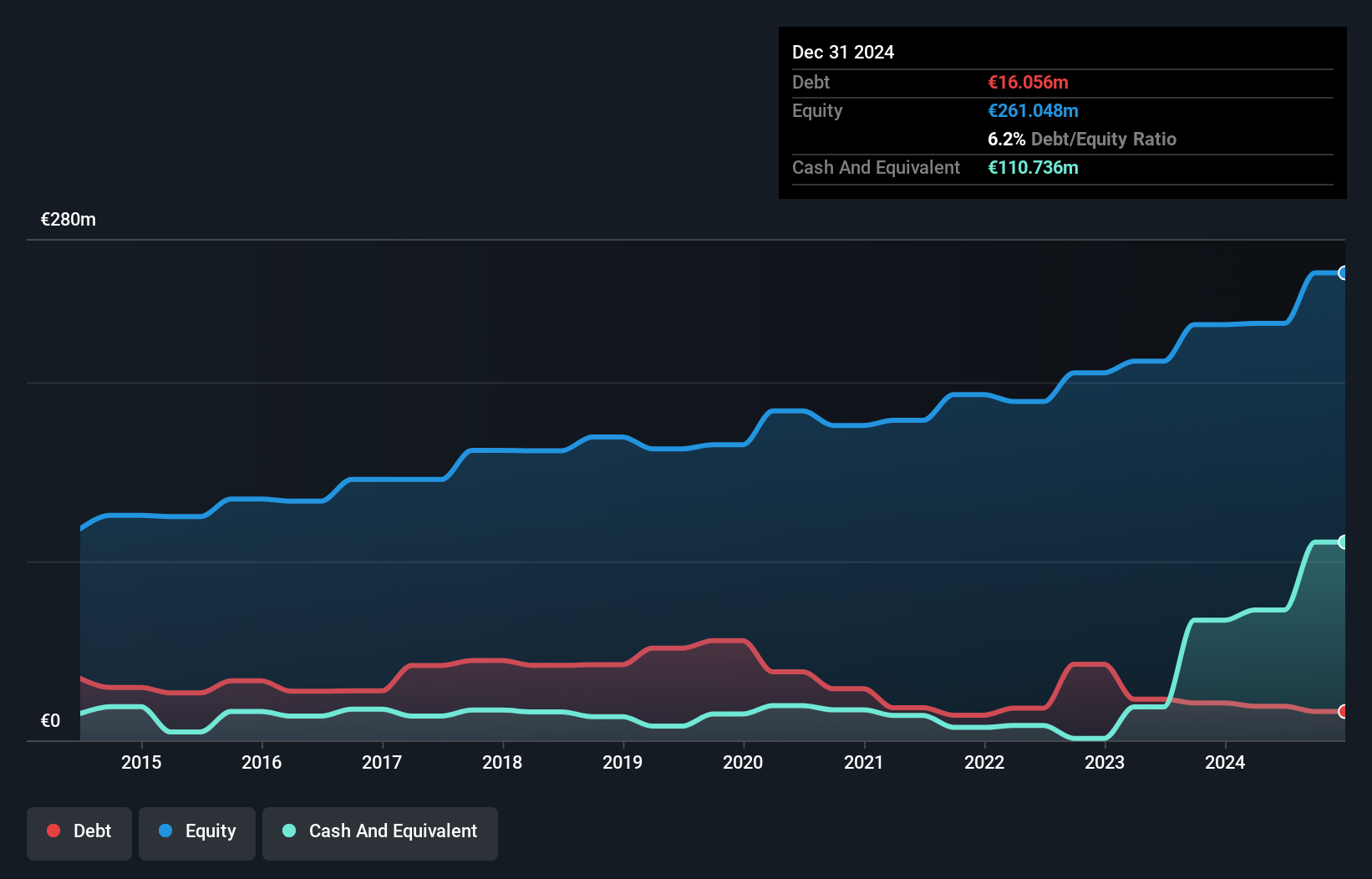

FRoSTA, a European player in the food sector, has shown promising performance with its recent half-year earnings. Sales reached €329.89 million, up from €315.94 million last year, while revenue climbed to €348.48 million compared to the previous €319.81 million. Net income also improved to €17.74 million from last year's €15.5 million, reflecting solid growth in a challenging industry environment where FRoSTA's earnings growth of 29% outpaced the industry's -17%. The company's strong financial footing is evident as it trades at nearly 60% below estimated fair value and maintains high-quality past earnings despite market pressures.

Nedap (ENXTAM:NEDAP)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nedap N.V., along with its subsidiaries, focuses on developing and manufacturing electronic equipment and software across various regions including the Netherlands, Germany, the rest of Europe, North America, and internationally, with a market capitalization of €587.04 million.

Operations: Nedap generates revenue primarily from its Scientific & Technical Instruments segment, amounting to €262.42 million. The company's market capitalization stands at €587.04 million.

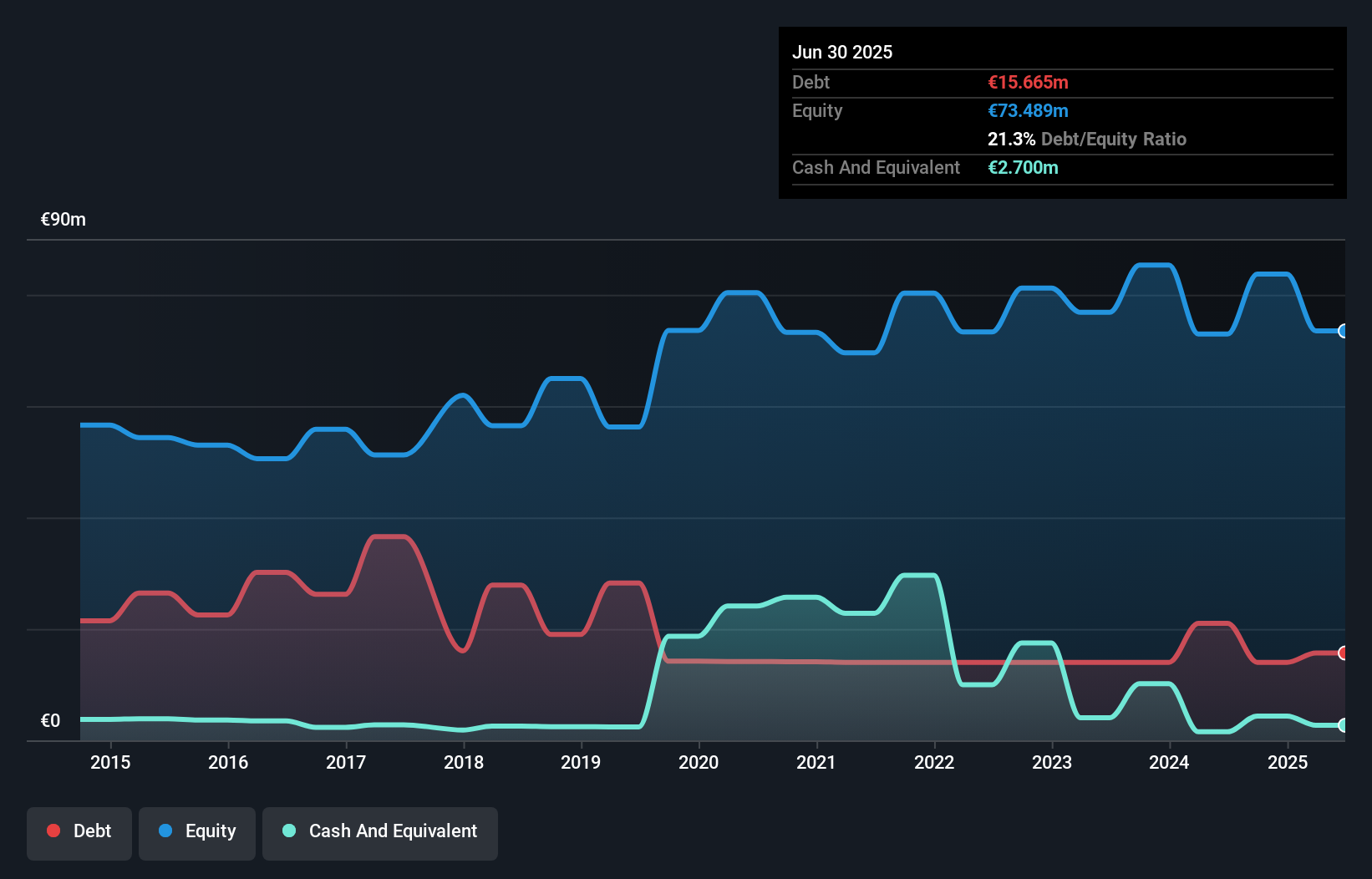

Nedap, a promising player in the electronics industry, has shown impressive growth with earnings up 23% over the past year, outpacing its industry peers. The company's debt to equity ratio increased from 17.6% to 21.3% over five years, yet remains satisfactory under 40%. Trading at a notable discount of 32.7% below fair value estimates, Nedap's financials are bolstered by high-quality earnings and strong EBIT coverage of interest payments at 34.7 times. Recent results highlight sales rising to €134.88 million from €124.06 million and net income climbing to €10.91 million compared to last year's €8.16 million, reflecting robust performance amidst market challenges.

- Click to explore a detailed breakdown of our findings in Nedap's health report.

Understand Nedap's track record by examining our Past report.

Creades (OM:CRED A)

Simply Wall St Value Rating: ★★★★★★

Overview: Creades AB is a private equity and venture capital investment firm that focuses on early, mid, and late-stage ventures as well as emerging growth, middle market, growth capital, and buyout investments with a market cap of approximately SEK10.69 billion.

Operations: Creades generates revenue primarily from its investments in online retailers, amounting to SEK1.36 billion.

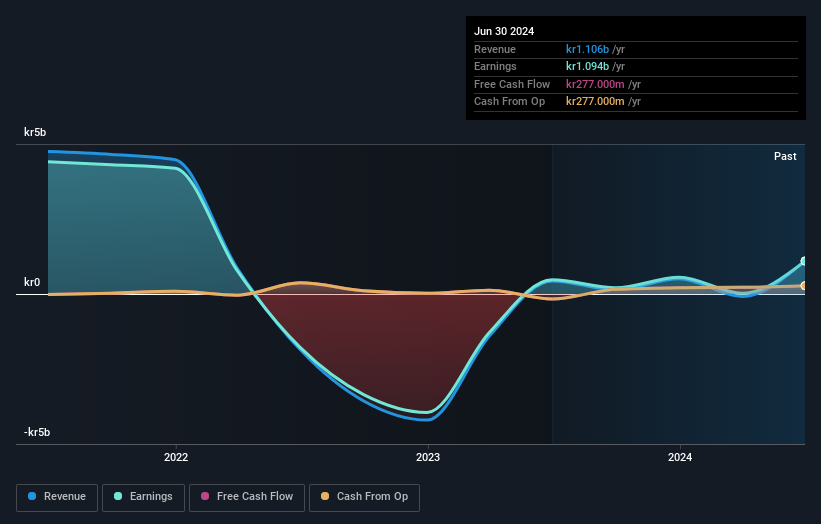

Creades, a nimble player in the financial sector, showcases a compelling profile with its debt-free status and an attractive price-to-earnings ratio of 8.6x, notably lower than the Swedish market's 23.4x. Over the past year, earnings surged by 14.3%, outpacing the broader Diversified Financial industry which saw -25.1%. Despite a challenging five-year period with earnings decreasing by 25.5% annually, recent performance indicates resilience as six-month net income reached SEK 780 million from SEK 732 million previously. The company's high-quality earnings and positive free cash flow position it well for future opportunities in its niche market space.

- Dive into the specifics of Creades here with our thorough health report.

Assess Creades' past performance with our detailed historical performance reports.

Taking Advantage

- Get an in-depth perspective on all 333 European Undiscovered Gems With Strong Fundamentals by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:NLM

FRoSTA

Develops, produces, and markets frozen food products in Germany, Poland, Austria, Italy, and Eastern Europe.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives